Not many people would turn down the chance of market-beating returns in their portfolios. But, besides knowing where to invest money to get good returns, it takes a lot of analysis to judge whether an investment will help you reach your targeted return.

| What does Alpha mean in finance? | Alpha (α) refers to an investment’s ‘active’ return performance against a specific benchmark |

| What is a good alpha? | A good alpha is a positive alpha as it means that the stock/fund has outperformed its benchmark |

| What is an alpha strategy? | An alpha strategy is an active investment strategy that focuses on investments that can potentially beat the market |

| How do professional portfolio managers calculate alpha? | They use a capital asset pricing model (CAPM) |

One measure often used to help people value an investment is an alpha, but how is it calculated, and what does it show?

What is alpha?

To answer the question of what is alpha, the first thing to understand is that alpha is a somewhat ill-defined concept – as is often the case when evaluating the performance of a fund or investment strategy.

Broadly speaking, alpha reflects an investment’s ‘active’ return against a benchmark. Active management is a strategy where a fund manager tries to outperform the wider market or the benchmark index it closely correlates with.

For example, imagine Fund A returns 5% over 12 months, outperforming the 4% growth of the benchmark. In this instance, you would describe alpha as 1%.

In reality, it’s more difficult to analyse the performance and authenticity of active return.

To generate alpha, a fund manager needs to have faith in their ability to time the market to buy and sell investments at their most profitable moments, and select the single securities they believe will outperform the market.

Alpha and financial theory

The use of alpha as a statistical measure derives from:

- Modern Portfolio Theory (MPT), which outlines the relationship between risk and return

- Capital Asset Pricing Model (CAPM), which first introduced the concepts of Alpha and Beta

Pioneered by Harry Markowitz, MPT suggests there’s an ‘efficient frontier’ of portfolios that offer the maximum expected return for a given level of risk.

When thinking about risk and how best to manage it in your portfolio, it’s useful to decide whether it can be described as systematic – also known as market or un-diversifiable risk – or unsystematic – also known as specific risk, which can be managed better through a process known as diversification.

How can you measure alpha?

Now that we know what is alpha, we need to know how when to measure and label an investment an alpha investment. An easy way to calculate alpha and measure a portfolio’s performance is to subtract its total investment returns from the relevant benchmark (e.g. S&P 500). However, the basic calculation of alpha can’t be used to compare an investment’s performance to a benchmark in different asset categories.

Jensen’s alpha or Capital Asset Pricing Model (CAPM) theory is a more complex measurement used to calculate alpha.. Jensen’s alpha formula uses risk-adjusted measures, while Capital Asset Pricing Model (CAPM) theory uses beta and free risk rate.

An alpha can be positive, negative or zero. Essentially, if an investment portfolio earned a return that matches the overall market benchmark return, the alpha should be 0. Portfolio managers should strive to get a positive alpha as opposed to a negative alpha. However, a negative alpha is not necessarily a bad thing.

For example, if mutual funds have a positive alpha of 4, that means that the fund is outperforming the market index or benchmark index by 4%. Likewise, if mutual funds have a negative alpha of 2, then the funds are underperforming the market by 2%.

Jensen’s alpha

Alpha is usually represented as a single number, which reflects how well an investment has performed compared to its benchmark. The basic alpha calculation simply subtracts the total return of your investment from the return of the benchmark.

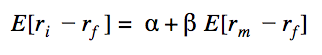

There’s a more advanced technique called Jensen’s alpha that includes Capital Assets Pricing Model (CAPM) theory and calculates the risk-free rate and beta.

Outlining the relationship between risk and return, CAPM is used to price risky assets, estimating the expected return for a given level of risk. In line with CAPM, to calculate Jensen’s alpha in a portfolio you need to know:

- R(i) – realised an average return of the portfolios

- R(m) – the realised return of the benchmark

- R(f) – the risk-free rate of return

- B – the portfolio’s beta

You’ll plug these numbers into the following equation to calculate alpha:

Excluding any market impact, the alpha will be zero – if CAPM is correct.

If the alpha isn’t a positive figure, the fund manager wouldn’t have earned enough return for the amount of risk she was taking. A positive outcome means the portfolio is earning excess returns compared to its benchmark in an uncorrelated way.

The difference between Jensen alpha and standard alpha is that the former allows you to evaluate the consistency of the excess return.

For example, assume you’ve invested in two funds, Fund A and Fund B. Both funds have the same level of standard alpha in the last year but performed quite differently.

Fund A performed below its benchmark for the entire year except for one day, where the performance was so strong it pulled the overall alpha of the year to positive. Fund B had a positive and systematic excess return over the benchmark each day of the year.

Understanding the risk/return relationship, which fund would you be more comfortable investing in?

In this example, Fund B would have had a more statistically significant alpha performance than Fund A, and perhaps it’s an investment with less volatility.

Alpha vs beta

Alpha and beta are two of many important measurements used to evaluate the success of an investment portfolio, stock or security. Alpha indicates how much money is made by an investment over time. Beta indicates the investment risk or how risky the investment is.

They help investors determine how well portfolio managers, mutual funds or robo-advisors perform when used against the appropriate benchmark index. A fund manager decides how much risk to take.

A beta of 1 means taking on as much risk as the broader market, and the same investment returns should be expected. A beta of below 1 means taking on less risk than the general market. However, a higher beta does not necessarily imply a higher alpha. The higher the alpha number, the better. The lower the beta number, the more stable the investment.

A beta that’s higher than 1 means the fund manager is taking on more risk and thus should expect greater investment returns. It’s important to separate whether any active returns above the market represent the additional risk that was taken or the fund manager’s skill.

What are the problems with alpha?

As with any theory, alpha is by no means infallible.

It can be quite difficult to find a comparable benchmark to assess the performance of your portfolio. But you need to choose this wisely to get a true reflection of the value active management has brought to your portfolio.

When there’s no suitable benchmark, analysts can now use algorithms and other models to simulate an index just for the purpose of calculating alpha.

Alpha versus efficient market hypothesis

Those who question the validity of alpha may fall into the efficient market hypothesis (EMH) camp. They believe that any risk-adjusted excess return is generated by luck rather than skill.

EMH suggests the market has already priced in all available information, so it is accurately valued. This would mean active managers don’t necessarily have an elusive edge over anybody else.

Whether you think generating market-beating returns comes down to skill or luck, we do know it’s near-on impossible to beat the market every year, and some active funds have been struggling.

At Moneyfarm, we have nothing against active investments, but we have a problem with the fees investors are often required to pay for active management. Overly expensive fees can damage performance and delay investors from reaching their goals.

The more money you can keep invested in the market, the better, as you can maximise your returns through compound interest. This is where your returns are reinvested to earn their own returns and can make a real difference over the long run.

It’s crucial investors understand how fees impact performance. Whilst you can never guarantee a return from your investments, you can control how much you pay in fees.

Active decision-making

Of course, when it comes to passive investments if the benchmark a fund is tracking falls in value, so will the fund. This means it’s doing its job correctly.

That’s why Moneyfarm builds investment portfolios that are diversified across asset classes and geographies to manage this risk. Diversification looks to offset any losses in your portfolio with gains made elsewhere.

You might want to invest in passive instruments to maximise your returns by reducing costs, but you can include an active decision-making strategy to build your portfolio in the best way to reflect your investor profile.

Our team of Investment Consultants can assess the impact fees are having on your portfolio, just book a call for a portfolio review.

FAQ

Is alpha a percentage?

Alpha is usually expressed by a single number, like 1 or 5. However, an investment’s alpha figure represents the percentage performance of stocks relative to an index. For example, if an investment has an alpha figure of 5%, then it performed five times better than the benchmark.

Is alpha positive or negative?

An alpha number can be positive, negative or zero. An alpha value greater than 0 indicates that an asset outperformed its index. Conversely, a negative alpha value indicates that an asset underperformed its index.

Is alpha better than beta?

It depends on what you want to measure. For instance, an alpha measures investment performance, while a beta measures the volatility of an investment.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.