Inflation, defined as the sustained increase in the general price level of goods and services in an economy over a period of time, is one of the most detrimental forces facing investors as it erodes the real returns of investments. Therefore, any long-term investment strategy should consider provisions against inflation risk.

Inflation-linked bonds are issued by?

Typically by the government of a sovereign nation

The UK inflation-linked bonds are linked to?

The Retail Price Index (RPI)

Are inflation-linked bonds a good investment?

Yes, they are good investments in times of inflation

How to buy UK Gilts?

•Through a stockbroker

•Directly from the government

Many types of assets and investment strategies offer inflation risk protection to investors. For example, the inflation-fighting nature of some commodity assets has routinely been documented. Additionally, some equity sectors, such as import and export stocks, are also sensitive to an expected price pressure (e.g. energy).

However, the most common building block of an inflation-beating strategy is likely to come as inflation-linked government bonds. Many governments of developed countries issue inflation-linked bonds as a way to hedge their inflation-linked income (tax income) and provide low-cost financing.

What are Inflation-linked Bonds or ILBs?

An index-linked bond (ILB or ‘linker’) is typically issued by the government of a sovereign nation. Its cash flow is similar to a nominal government bond with periodic coupon payments and principal repayment at maturity. Coupons and principal payments, however, will grow with inflation specified by a given referenced index.

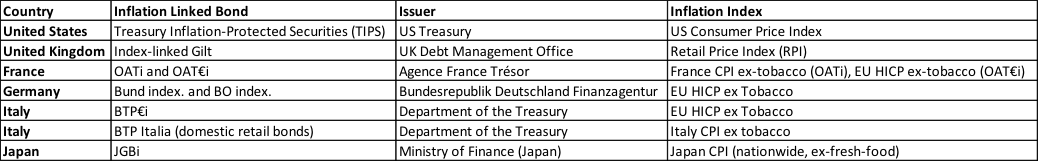

Therefore, most linkers provide a guarantee of at least 100% of capital repayment at maturity (except in the UK, Canada and Japan) which protects investors against a prolonged period of deflation. The table below illustrates some of the most common inflation bonds:

Linkers are often compared against the fixed-rate government bonds (where coupons and principal do not grow with inflation) of similar maturity, where their yields are evaluated. The yield on a fixed-rate government bond is typically called the nominal yield, which comprises of the real yield of the bond investment together with the effect of inflation, whilst the return on linkers investment is simply just its real yield as the bond return is specified as a rate in excess of inflation.

Therefore, this difference between nominal bonds and inflation-linked bonds raises an important concept known as the break-even inflation rate, which refers to the difference between the yield on a nominal fixed-rate bond and the real yield on a linker of similar maturity and credit quality.

If inflation averages more than the break-even rate, the inflation-linked investment will outperform the fixed-rate bonds. Conversely, if inflation averages below the break-even, the fixed rates will outperform the linkers.

How do inflation-linked bonds work?

Inflation-linked bonds UK or index-linked bonds UK measures coupon and principal payments against the inflation-linked gilts issued by the UK government. The UK inflation is measured by the Retail Price Index (RPI), and it is used as the benchmark.

The principal and coupon are inflation-adjusted, so the principal and coupon amount paid to the investor increases when RPI rises. For instance, if inflation moves from 4% to 6%, the coupons and the principal will increase by 2% to accommodate the rise.

Although coupons are paid twice a year in the UK, the RPI index movement determines each payment. Inflation-linked bonds in an investment portfolio allow investors to hedge part of the portfolio against inflation.

What is the impact of inflation on an investment portfolio?

Inflation has a negative impact on investment portfolios. Inflation on an investment portfolio means a loss of investment value, especially with fixed-income assets, such as bonds, CDs and treasury bills.

Interest rates on fixed-income securities remain the same, so when inflation rises, bond prices fall due to the erosion of the purchasing power of coupon payments. As a result, the present value of future cash flow payments is reduced.

Inflation has a positive impact on commodities and real estate. Since commodity prices are directly related to the price of goods and services, an increase in one will cause an increase in the other, e.g. gold and oil. For real estate, property owners set the price and can choose to increase rent/sale cost when the price of goods and services increases. For these reasons, a well-diversified investment portfolio is key.

When comparing ISA vs bonds, stocks and shares have held up against inflation over the past 30 years. The price of a company’s stock should rise slightly as the cost of goods and services rises (increase in revenue). Also, value stocks perform exceptionally well during times of high inflation. Inflation impact differs depending on the type of asset, which is why diversification is critical for any investment portfolio.

Are inflation-linked bonds a good investment

Inflation-linked bonds are especially good for unexpected short-term inflation as it gives investors an interest rate that adjusts with inflation. Investors can use them to offset the effects of rising inflation on their portfolio value or to express views on future inflation. If they’re right about inflation, they’ll make money later when inflation later rises.

Inflation-linked bonds protect the purchasing power of an investment. For instance, if you buy an ILB for £500 with an annual fixed annual coupon rate of 3%, you’d be paid $15 as interest per annum each year if inflation remains unchanged. However, if the RPI increase by 2%, you will receive £510 as principal at maturity and £15.03 as an annual coupon payment.

Let’s not forget that inflation-linked bonds provide a steady income stream via coupon payments. So they are seen as a pretty safe investment that is used to diversify their portfolio and minimise risk. Ethically, investors are also helping the government repay debts and fund projects that might benefit the community.

How do I buy inflation-indexed bonds?

There are two ways to buy inflation-indexed bonds.

- Inflation-indexed bonds issued by the UK government are listed on the London Stock Exchange. Therefore, investors can buy them directly on the open market as they would buy regular stocks.

- Another way to invest in inflation-indexed bonds is to buy an inflation bond fund. With rising inflation due to Covid-19, there has been a surge in demand in the UK for these bond ETFs. UK Index-linked gilt ETFs can invest in fixed securities such as corporate bonds and government bonds. These inflation-protected UK bond ETFs include INXG, GLTL, IGLT and GILI.

You can make purchases via financial or trading platforms. Ensure that the financial services that offer UK Index-linked gilt ETFs are authorised and regulated by the financial conduct authority (FCA). You can also speak to financial advisers for more information about existing UK gilt portfolios.

ILBs: Performance and Risk

The risk associated with inflation-linked bond investments includes mainly sovereign credit risk and interest rate risk. Sovereign credit risk typically refers to the risk of a government becoming unwilling or unable to meet its loan obligations.

Typically speaking, a linker’s cash flow is heavily skewed towards its maturity date as a more significant proportion of the coupon payments are embedded in a later part of its term. Therefore, it is more sensitive to the sovereign credit risk than the corresponding nominal investment bonds. However, sovereign risk is considered to be low for most developed country governments.

Arguably a more significant type of risk for investing inflation-linked bonds would be interest rate risk, which is the sensitivity of bond yield to any changes in market interest rate measured by a term called duration. The higher the duration of a bond, the larger changes in the bond’s yield in response to changes in market interest rate would be.

Additionally, the interest rate risk for a linker can be evaluated by reviewing the yield equivalent fixed-rate bond and beta, which measures the yield sensitivity of a linker to a change in the equivalent nominal yield. The commonly accepted assumption for the beta value of linkers across different markets is 0.5.

Investing in inflation-linked bonds via ETF instruments

Compared to holding inflation-linked government bonds, exchange-traded funds (ETFs) of linkers often allow investors to construct an inflation-shielding strategy efficiently within their portfolios. In most cases, it will also be more cost-effective than using more traditional investment vehicles or directly investing in inflation-linked bonds.

Developed market inflation-linked ETFs (despite the small size of its ETF universe compared to that of other key asset classes) provide full coverage of the whole maturity spectrum of the inflation-linked market and improve the liquidity of the underlying market, making it easier for investors to access it.

Inflation-linked bonds are typically biased to long-dated maturities. As a result, the linker ETFs tend to have high duration metrics. Therefore, an inflation hedging strategy may hold a mix of asset classes to account for different time horizons in addition to linker ETFs.

The annual management charge for most inflation-linked bond ETFs is between 0.20% to 0.25%, measured in terms of assets under management. This cost compares positively to those actively managed and traditional index-tracking funds.

According to Morningstar, an investment research firm, the average annual management fee for an active fund varies between 0.75% and 1.5%, whilst the average management fee for a passive index-tracker would be around 0.40%. As cost is the only certainty when investing, one can argue that using inflation-linked ETFs as one of the building blocks for portfolio construction is compelling.

Photo by JOHN TOWNER on Unsplash

FAQ

Are inflation-linked bonds taxable?

Yes, inflation-linked bonds like Gilts or UK Government Bonds are taxable. This is because interest in gilts is paid before tax deductions and is liable to income tax as it is seen as savings income. However, individual investors are exempt from capital gains tax on gilts but may be liable to pay income tax on accrued interest on the sale or transfer of gilts.

Is now a good time to buy inflation-linked bonds?

Inflation-protected bonds are attractive in times of inflation as it generates greater returns. With the current UK inflation rate on the rise, diversification using inflation-linked bonds to offset portfolio volatility is an attractive option in times of high inflation.

Can I lose money in inflation-linked bonds?

While you may not lose money on your principal amount, you can lose money on the coupons paid on inflation-linked bonds. This is because, during times of deflation, gains from coupon payments decrease by the same rate of inflation. However, most inflation-linked bonds are protected against deflation, as the principal and coupon can’t decrease below an initial floor limit.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.