Will the cost of living increase in 2023 in the UK? Thankfully, according to the Bank of England, the inflation rate is expected to fall starting from the middle of 2023, returning to around 2% over the course of the next few years.

| What was the UK inflation rate of 2022? | The Consumer Prices Index indicated inflation of consumer prices in the UK was around 10.7% higher at the end of 2022 than the previous year. |

| Will the cost of living go down? | The Bank of England is predicting a decrease in inflation starting in the middle of 2023. |

| Why increase interest rates during inflation? | Greater interest rates decreases borrowing for both individuals and companies, slowing demand helping to stabilise prices. |

Rising cost of living explained

Inflation describes a long-term, widespread increase in the cost of products and services throughout the economy, which reduces both consumers’ and businesses’ purchasing power. A unit of currency effectively buys less as a result of the increase in pricing, which is sometimes stated as a percentage. In other words, because of the cost of living increase in the UK, a pound will not buy as much today as it did yesterday, meaning the everyday costs in your budget, like the cost of raising a child in the UK, the cost of a therapist in the UK or going to a private dermatologist are significantly greater than in previous years. Needless to say, big expenses like the cost of getting married in the UK are not even pricier now than ever before.

To monitor the increase in inflation, or the decrease in purchasing power, economists use the average price increase of a selection of products and services (the Consumer Price Index) over time as a proxy for the rate at which buying power declines.

The rising cost of consumer products due to rising inflation has been attributed to high consumer demand in 2022 as the pandemic eased its grip on the economy and supply chain bottlenecks arising from geopolitical conflicts.

Current inflation rate in the UK

Since 2021, consumer price inflation has increased in many countries. One major aspect is supply limitations brought on by the pandemic. Demand for goods and commodities has surged as the global economy emerges from its recession, particularly for consumer items. Additionally driving up commodity costs and inflation globally is the situation in Ukraine.

The Consumer Prices Index (CPI) indicated that inflation of consumer prices in the UK economy was around 10.7% higher at the end of 2022 than they were the previous year.

Will the cost of living go down?

The Bank of England is predicting a decrease in inflation starting in the middle of 2023, mainly for three reasons:

First off, the cost of electricity won’t keep increasing so quickly. The government has put in place a program that limits energy costs for homes and companies for a period of six months.

The Government’s Energy Price Guarantee (EPG) package is set to cap the unit price of household energy, which means the inflation rate will be lower than it would have been under previous household energy price caps. According to the Office for Budget Responsibility, without the EPG, inflation would have reached a peak in early 2023 of 13.6%, 2.5 percentage points more than anticipated with the EPG.

Second, import prices aren’t expected to increase as quickly as they have been over the past year. This is because some of the production challenges that companies have previously experienced are beginning to disappear. Imported food had become more expensive as a result of rising transportation costs brought on by high crude oil prices, supply-chain bottlenecks of agricultural products from Ukraine. The cost of food and non-alcoholic beverages continued to be among the key factors raising living standards in the UK. From minus 0.6% in July 2021, it has risen steadily for the past 15 months, according to ONS.

Third, the demand for products and services in the UK is expected to decline. This will be due in part also to increasing interest rates, which means that many consumers will have to pay more for borrowing. Some enterprises will also be subject to higher borrowing rates. We are aware that this will make life difficult for a lot of people on top of increasing groceries and energy costs.

So, what can you do to protect your wealth from the corrosive effect of inflation? Inflation causes cash to lose its value in the market, that’s good financial planning is key to maintaining wealth.

In times of high inflation, it’s generally a good idea to invest in things like government bonds, since the interest rates are high and the risk on the returns are relatively low. Speak with a financial advisor to set up a general investment account and come up with an investment strategy. Financial advisors will help you learn how to invest your savings effectively and develop a strong investment portfolio.

Why is cost of living going up in the UK?

In addition to the factors listed above, another significant contributor to the rise in cost of living in the UK is energy prices, including rising residential energy tariffs and gasoline prices.

According to the Bank of England, domestic gas prices rose by 129% and domestic power prices by 65% between November 2021 and November 2022. Following the start of Russia’s full-scale invasion of Ukraine, gas prices reached record highs and continued to rise for the majority of 2022 due to shortages of Russian supplies. Gas and electricity prices are related and have exhibited comparable trends.

Cost of living chart by year in the UK

The following chart from Statista illustrates how much the typical working individual is likely to spend each week on food, clothing, transportation, social activities, and household goods in the UK.

Since this time last year, the price of domestic fuel has more than doubled, while the price of food and beverages has jumped by over a third. A 45 percent increase in the price of social and cultural activities has also been noted.

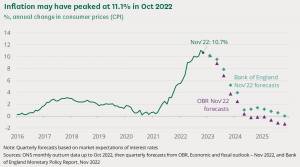

The above graph from the House of Commons Library illustrates the rate of inflation in 2022 compared to previous years. Rising inflation has been attributed to increases in the costs of consumer products, which are supported by high consumer demand and supply chain bottlenecks. The cost of food has also increased significantly during the past 12 months.

Cost of living increase calculator

The Bank of England has an inflation calculator that you can use to calculate how much goods or services cost or will cost, based on the rates of increase of those goods or services from the Office of National Statistics.

The calculator uses Office for National Statistics Consumer Price Index (CPI) inflation data beginning in 1988. While prior years used their calendar year averages, the current year’s monthly computations are based on the most recent CPI level. Prior to 1988, CPI estimates were modeled using information gathered for the Retail Price Index (RPI).

The calculator makes use of the Consumer Price Index (CPI), which is the indicator the government uses to determine the inflation target for the Bank of England. The Consumer Price Index incorporating Owner Occupiers’ Housing Costs, the Office of National Statistics’ primary measure of inflation, is a more reliable substitute (CPIH).

Why increase interest rates?

Many have questioned how raising UK interest rates at this time will be beneficial. Some claim that it won’t address the roots of inflation and will instead worsen the strain on household finances.

Many people are struggling with the rising cost of living in the UK. However, if national banks do nothing to curb inflation, we will continue to experience raging inflation, disproportionately affecting those with the lowest incomes and those with precarious jobs.

Price increases in the UK will be slowed down by higher interest rates. It will ensure that the current rate of high inflation does not continue.

Read more about how the UK is responding to the cost of living crisis.

FAQ

What is inflation?

Inflation refers to a period of long-term, widespread increase in the cost of products and services throughout the economy, reducing both consumer and business purchasing power.

Why is cost of living going up in the UK?

The rising price of energy due to political conflicts and the ecological transition of the economy, as well as strains on supply chains have given rise to increased costs of consumer goods and services in the UK.

Will the cost of living go down in the UK?

According to the Bank of England, the inflation rate is expected to fall starting from the middle of 2023

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.