So, you’ve taken the first few steps towards investing – you’ve put together an emergency fund, paid into a workplace pension and chosen a risk level that feels right for you. Whatever you’re saving for, these are the important starting points on anyone’s investment journey.

Battle of the Tax Wrappers: SIPP vs ISA: Summary Table

| ❓ What does an ISA and a SIPP stand for? | ISA: Individual Savings Account SIPP: Self-invested Personal Pension |

| ⚖️️ Is an ISA better than a SIPP? | It depends on the individual’s financial goal and circumstance |

| 🆚 Should I choose a SIPP or an ISA? | An ISA offers more flexibility than a SIPP. The pension value of a SIPP over time is greater than an ISA, but the funds in a SIPP are locked away till age 55 |

| 🆚 Should I choose a SIPP or an ISA? | A SIPP has better tax benefits; a 20% tax relief, and the annual allowance is 2x |

For a lot of people, though, it can feel like you’ve only just scratched the surface, and that the world of investing gets more and more intimidating the deeper into it you go. It can often be very difficult to choose between the various products on offer.

Horses for courses

Choosing the right investment product means taking a few different factors into account. An ISA will always have the most flexible tax wrapper, for example, and you can use the funds whenever you want. However, you can only put a maximum of £20,000 in per year and the wrapper is less efficient for inheritance tax than a SIPP.

GIAs are even more flexible than ISAs – you can invest as much as you like. This makes them an ideal option for people who have already filled their ISA allowance for that given tax year. Although, investors should be aware that gains you make could be taxed if you go over the capital gains allowance for the tax year.

Self-invested personal pensions (SIPPs) have a number of different benefits. While invested, the investments are held in a tax wrapper. When you then go to take funds out, 25% is tax-free, with the rest taxed at your marginal tax rate.

Pensions are not included as part of your estate when you pass it on as inheritance, which makes the SIPP the most efficient vehicle from an inheritance tax point of view. Lastly, if you invest into a SIPP from your bank account, the government will add a tax credit, so you get an immediate boost. These savings will be locked away, however, until you’re 55.

A closer look at tax

The best way to establish the tax wrapper that’s right for you is to think about the end goal of investing and work backwards from there. For most people, the ultimate aim of investing their money is to maximise their net worth – so, which product is best for this?

For every £1 of income, investing in a pension (workplace, SIPP etc) is the clear winner for maximising your net worth. Firstly, if you invest into a SIPP, the government will add a 25% tax credit. This means for £1 of SIPP contributions, your net worth increases by £1.25.

If you invest via your salary, the funds leave your paycheck before tax has even been taken. This means the funds have not had any tax (assumed to be 20%) applied to them, while also making the amount you are taxed on (post contribution) lower – ultimately meaning you pay less tax!

Another bonus here is that your employer legally must contribute to your pension if you earn over a certain, extremely low threshold per month. Amounting to at least 3% of your yearly earnings, this minimum contribution from your employer is another great way of boosting your net worth, as this will be a significant boost to your savings.

Should I choose a SIPP or an ISA?

So, which tax wrapper is better for growing your wealth? It’s a difficult question to answer because circumstances play a role, but we’ll take a look at the numbers to give you a breakdown of the differences between the two.

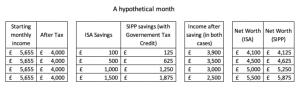

To quantify the difference between investing into a SIPP and an ISA we looked at the savings of two identical hypothetical investors, with one investing into a SIPP and the other into an ISA. The table below demonstrates the effect of investing on an investor’s net worth, depending on the investment vehicle and the amount invested.

As you can see, the more you invest the more the government tax credit bumps up the value of your investment, so the greater the disparity between the eventual values. Invest £100 in an ISA and you could have £125 in your SIPP, whereas £1,500 becomes £1,875. The ‘net worth’ takes into account not only your investments but also your income after those investments have been made, giving you an overall figure.

Clearly – assuming you invest immediately after being paid – your net worth is noticeably higher when investing in a SIPP. Saving for retirement is incentivised by the government, and the tax credit can make a real difference to savings over time.

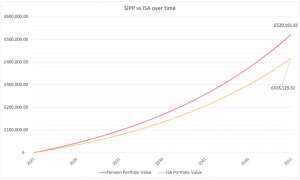

To highlight how impactful the difference between investing in a SIPP VS an ISA can be, the chart below shows the value of a hypothetical portfolio over 30 years, if you continued to invest £500 a month.

As you can see, over an extended period of time (assuming you contribute £500 into your ISA, and £500 – with the £125 tax credit added – into your SIPP), the added tax credit enjoyed when putting money into a SIPP leaves an investor significantly better off. This is, of course, a hypothetical scenario and returns over time can vary significantly, but the fundamental difference in the money put away makes the tax credit a powerful factor.

The bottom line

So, if you are happy to lock your savings away until the age of 55, then a SIPP will maximise your net worth. Anyone with financial security elsewhere might consider this the best option for their retirement. Unfortunately, life is rarely this simple, so there are a few factors to consider first.

While the first 25% of what you take out of your pension is tax-free, anything else taken out will be taxed at your marginal rate. You also must stay under the lifetime allowance – currently £1,073,100 – otherwise there will be further (more impactful) tax charges.

ISAs and GIAs will always be the more flexible option. If you’re looking to save for a house, your child’s university fees or you suddenly find yourself with a one-off expense or opportunity, you won’t be able to use your pension. This is why anyone who thinks they may need to access some of their savings before the age of 55 should either consider an ISA over a SIPP or simply hold some money separate from their long term investments.

However, while the flexibility to take money out can be valuable, if you’re looking solely to maximise your net worth, then a pension is the clear winner. Tax credits, employer contributions, and favourable tax treatment all combine to make the pension the wrapper that grows your wealth best.

FAQ

What are tax wrappers in the UK?

Tax wrappers are tax breaks that the UK government offers to investors to help shield their savings and investments from taxes. Examples include an individual savings account (ISA) and a self-invested personal pension (SIPP).

Can I have both ISA and SIPP?

Yes, you can have an ISA and a SIPP simultaneously. Both types of accounts offer tax advantages., so you don’t need to choose between an ISA and a SIPP. You can also combine both of them, which is the strategy that will be most attractive to investors.

When can I withdraw from a SIPP?

You can withdraw funds from a SIPP once you reach age 55 (57 from 2028).

Jack is passionate about technology and the investment world, and how the two together can provide better client outcomes. He is an Investment Consultant at Moneyfarm.

Jack is passionate about technology and the investment world, and how the two together can provide better client outcomes. He is an Investment Consultant at Moneyfarm.