After a year of intermittent lockdowns, remote working and international travel all but disallowed, the attention of the world is finally turning to a life after Covid-19. Perhaps more quickly than anyone had predicted a year ago, multiple vaccines have shown encouraging efficacy rates and global mass vaccination programs are kicking into gear.

These large scale immunisation programs represent a route out of the restrictions placed on populations globally. Quite apart from the social and health implications of a move towards normality, the opening up of society will bring with it all sorts of economic consequences. Broadly speaking, a route out of lockdown signals the end of the extreme economic suppression that has defined the last year, as entire industries frozen by the pandemic are thawed.

For investors, the situation is more complicated. Growth in economic activity does not necessarily equal returns and, indeed, many investors have seen their portfolios perform well since the initial shock in March 2020. As a wealth manager, we see significant areas of opportunity over both the medium and long term, with value stocks and emerging markets expected to lead the charge.

Value stocks have the potential to outperform

Over the course of the pandemic, growth stocks have shone. As you might expect in a time of increased reliance on digital products, tech stocks (particularly in the US) have enjoyed significant growth. In fact, the last five years or so have been fruitful for stocks with high growth potential.

The chart below highlights the negative trend in value stocks over the past decade versus those classed as growth stocks. You can see how, as 2020 ushers in the pandemic, value takes a plunge.

As we turn our attention to the medium and long term, however, we see potential in value stocks. As society opens up, the ‘old economy’ sectors hit hardest by the pandemic – the likes of energy companies, airlines, financial services – will begin to look more attractive, particularly after months of near-zero interest rates and governments being seemingly willing to support economies until vaccines are rolled out.

We think the confluence of an economic recovery and support from governments and central banks may help value stocks going forward. There are already clear signs of a shift away from growth, with the Nasdaq slumping into correction territory – defined as a 10% dip from recent highs – just this week as a result of sliding tech stocks.

Towards the end of 2020, we made a change to add more value stocks to our portfolios. These stocks, which have been downtrodden for the past decade or so, have a good chance of making a comeback if the broad-based economic recovery we expect comes to fruition. We will, of course, be monitoring their progress and potentially making adjustments accordingly, but the future looks brighter for these stocks.

Potential in emerging markets

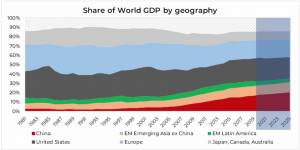

The outlook for emerging markets in the medium and long term is similarly positive. While the label is arguably too diverse to represent the reality for a lot of the economies it covers, we primarily expect Asian countries to lead the way.

There are a few reasons for this. Asian economies generally handled the pandemic in a relatively orderly fashion, while the maturity of these economies made them better prepared to handle a global recession than they have been in the past. In the coming years, it’s reasonable to expect that the lion’s share of global GDP growth will come from Asian countries, with China, in particular, expanding its economic and political weight.

This has a few key ramifications for the medium-term future. The rest of 2021 is likely to see a significant rebound in GDP. This is, potentially, a boon for the prospects of this asset class, particularly in the case of the Asian markets. The factors most likely to benefit performance in the short term are:

- A weak dollar, which historically means financial stability and economic performance in many of these countries.

- Commodities, which could be well placed to see a positive rebound across the rest of 2021.

- Good management of the pandemic in the most important countries of the index (Taiwan, South Korea, China) and therefore a faster economic rebound.

- Economic recovery in developed countries more generally.

- Low starting valuations for many emerging market assets

There are, naturally, long-term challenges for emerging markets to face. The development of tensions between the US and China is one – the two superpowers will make economic decisions and concessions that could determine the fate of entire sectors in the years to come.

If we widen the lens again and consider the rest of the emerging world, the most relevant news from the end of 2020 is the signing of RCEP – the trade agreement that aims to strengthen economic relations between 15 countries in the Asia-Pacific region. The deal, potentially the largest ever, affects more than 2 billion people with a combined GDP of around $26 billion.

These are developments that investors should keep an eye on going forward, and we will be reviewing the situation regularly to assess our own holdings. We are, however, convinced that both value stocks and emerging markets will play an increasingly key role in multi-asset portfolios over the medium-term. We have positions in both in our higher risk portfolios, and this is something we will assess further.

These details, alongside the expectation of a broad-based economic recovery after Covid-19, represent the green shoots of a future that investors are rightly feeling optimistic about.