So far this year, markets have been turbulent. The situation in Ukraine has significantly affected financial markets, while other ongoing issues like inflation have played a role in portfolios dipping. All major indexes are down so far for 2022, with Europe the most heavily affected.

These issues have left investors with a lot of questions, not just about the outlook for portfolios but also how they should act in response to the turbulence. As a wealth manager, a key part of our role is being there to discuss these concerns.

So, for anyone unsure about how to proceed in this time of uncertainty, we’ve picked out a few of the questions we’re being asked by our investors and put together some answers based on our long-term, diversified approach to investing.

Is now a good time to invest?

This might feel like a big question, but the answer is almost always the same: yes. Every asset and every index has its ups and downs, but with a long enough time horizon the outlook for both is almost always positive.

People always want to feel that they’ve gotten their timing right when they invest. The truth of the matter is that this actually makes very little difference over the long run. When investing for the long-term, the impact of market timing (good or bad) fizzles out over time. Sound asset allocation and time in the market are the factors that generate the majority of returns on a long enough timescale.

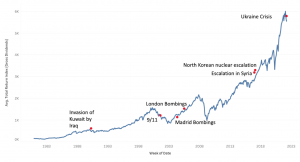

Geopolitical events do not tend to have a lasting impact on financial markets. Historically, dips have been followed by recoveries and these can be as dramatic and sharp as the downturn. Take the Covid-19 crisis as an example; unspent savings led to a spike in activity after society reopened and the recovery was swift.

If you’re considering whether or not now is a good time to invest, it might be illustrative to consider the alternatives. Inflation is high, so cash savings are all-but-guaranteed to lose value over time – current world events may actually worsen the inflation situation, too. Valuations, on the other hand, look less stressed and the long-term macro outlook for our key asset classes remains positive.

I don’t like volatility – what should I do?

For those that are averse to market volatility, the important thing to remember is that it is an integral part of investing. Ups and downs are normal and, to achieve returns that go over and above those of cash, you will have to take on some degree of risk.

At Moneyfarm, we build our portfolios with the expectation that these events will come and go. If you look back through historical market returns, you’ll see that there are periods in which markets go through downs as well as ups. The important thing to remember is the big picture. It’s a common human error to have a knee-jerk reaction in periods where the markets go down and, as such, miss the subsequent recovery. These recovery periods are some of the biggest positive moves and missing them can be extremely costly for long term success. It is always important to remain true to your timeframe and have faith that the asset allocation is built to withstand these periods.

Our consultants are on hand to help our clients navigate the two powerful (and often conflicting) parts of their investment approach: long-term financial goals and short term emotional responses. Emotions are normal, but you might make choices that have long-term financial implications. We’re here to help you make the most informed decision possible.

One thing you can do if you’re worried about volatility is to alter your risk level. We don’t recommend doing this often, however, and it’s important to have a chat with a consultant before doing so.

Should I cancel my direct debit?

It can be tempting to freeze your contributions during times of uncertainty and volatility. After all, it might feel risky to add more of your money to what is already a turbulent time for your portfolio.

There are, however, a lot of advantages to investing little and often, and this is particularly true in times of volatility. Over the long-term, regular contributions work to smooth out the ups and downs in the markets. You’ll buy when valuations are up and you’ll buy when valuations are down – cancelling during difficult periods means missing out on the opportunity to buy in at lower prices.

We often hear people say things like “I will wait until things are steady before contributing again.” This roughly translates to “I will wait until prices go back up before buying again.” The beauty of the direct debit is it allows you to buy into these periods of market weakness and these additions often tend to be the ones that contribute most to your long term success.

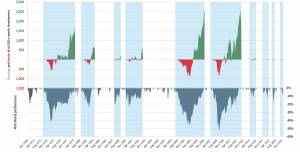

The chart above shows the performance of a £100-a-month investment during some of the worst market crises of the last 50 years. As you can see, investing in troughs would have mitigated the effect of negative market performance, pushing the investments into positive territory well before the market recovery was complete.

Drip-feeding cash into the markets is known as pound cost averaging and it’s a well-established financial practice. You can find more detail about its ability to help navigate volatility here.

Should I wait to utilise my ISA allowance?

The first thing to say here is that the answer will always depend on your personal financial situation. If you’re unsure about how much of your cash to put towards your annual ISA allowance, it might be useful to get in touch with an investment consultant.

If, however, you are waiting to use your allowance, you have to ask yourself exactly what you’re waiting for. If you’re waiting for markets to recover, then you risk missing out on exactly the kind of trajectory you want for your investments.

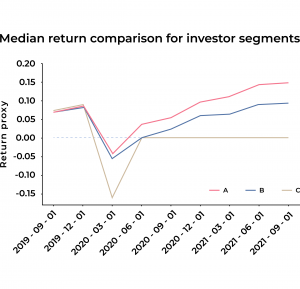

Markets can recover quickly. We only have to look as far back as 2020 to see just how sharp the bounce-back can be. When markets dipped following the outbreak of Covid-19, many investors disinvested or avoided putting any more money in until the situation improved. This led to many missing out on some of the biggest days for markets in recent years.

The chart above, based on the real performance of more than 10,000 Moneyfarm investors, tracks three different types of investors during the Covid crisis. The first (A) remains invested throughout, choosing to focus on the long-term. The second (B) disinvests before reinvesting at a more ‘palatable’ time. The final investor (C) crystallises their losses by disinvesting entirely and not reinvesting. We found that staying the course and being there for the full recovery was, on average, by far the best option.

Also, with a Moneyfarm account, you can split your ISA allowance across a few different risk levels. This means that you could utilise this year’s allowance at a lower risk level than you might normally use. Again, it’s worth speaking to an advisor for some guidance; they’ll help you with these decisions in the context of your long-term financial plan.

Crucially, you cannot utilise previously unused ISA allowances. Once the deadline for the end of the tax year passes, you’ll miss the opportunity to shelter your money in a tax-efficient wrapper. As the old adage suggests, there may be uncertainty in markets, but there will certainly be taxes in the future. Don’t waste the opportunity the government has provided.

Is Socially Responsible Investing still relevant?

Some of you have been asking whether or not a commitment to ESG-focused investing is still relevant in turbulent times. We’d actually argue that, over the past couple of months, Socially Responsible Investing has only become more relevant.

The current state of the energy market has been making headlines for some time, with the price of oil, in particular, fluctuating dramatically. This has translated to record prices for fuel in the UK. If anything, these high prices could hasten the transition to cleaner energy sources – Germany, for example, aims to get 100% of its energy from sustainable sources by 2035.

One focus for governments in the coming years is likely to be the establishment of more stable energy supply lines. We believe that the current situation could speed up the process and that ESG criteria could benefit in the long run.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.