With interest rates in the UK at their highest rate since 2001, it’s hard not to be tempted by the promise of a fixed 4-5% yielding cash account. However, after the catastrophe of equities and fixed-income bonds in 2022, we’re now starting to see some recovery in investment markets, which makes 2023 even more complex to navigate.

So let’s go back to the start…

In order to navigate such a complex economic situation, we have to go back to basics to understand why 2022 was so unstable for equities and fixed-income bonds. And although there were a number of factors that affected the markets last year, such as the Russia and Ukraine Crisis, one of the main impactors was inflation.

Inflation is a key factor when it comes to the economy. It measures the rise and fall of the cost of living and gives an indication of how the UK economy is faring against other developed markets. It also measures the rise in the cost of living and as a result is something that policymakers work hard to control. Most central banks have a target to keep inflation at around 2% in order for the economy to tick over smoothly. However, when we saw inflation rise rapidly in 2022, this forced central banks to rapidly increase interest rates to fight this rise in inflation.

When interest rates rise, they do two things: they increase savings rates, making saving more attractive to the bank-based saver; and they increase the cost of borrowing, making debt and mortgages even more unaffordable. But how does this impact different asset classes?

Equities

Higher interest rates tend to negatively affect the stock market, as the price of borrowing increases which impacts company profits. Higher rates also mean future discounted valuations are lower, as the discount rate used for future cash flows increases. Along with increasing inflation and a higher cost of living, this is why we initially see equities fall in high inflationary environments.

Fixed income bonds

The clue is in the name with bonds. Bonds are usually issued at a fixed interest rate, paid as a coupon. Once issued, the coupon is fixed and never changes; however, interest rates can. Meaning that as interest rates change, the coupon of these bonds will become more or less attractive to investors.

And this is why we saw such extreme volatility in fixed-income bonds in 2022. As interest rates continued to rise, bonds became less and less attractive, affecting valuations and yields.

So why is it important to look at 2022 when making investment decisions in 2023? Looking at the downturn, and why it happened, is key when we’re looking at where to invest money in 2023. This is because, although past performance is not a reliable indicator of future results, historically we tend to see the most profitable years in the markets after the largest re-corrections. To reference some data, please see our P5 portfolio performance data below, from 1st January 2016 up until June 2023. P5 is a balanced, mid-weight portfolio with around 40% in bonds and 60% in equities.

The returns here are simulated using an assumed balance of £250,000, and the average management fee from our pricing model of 0.46% from 01/01/2016 to 31/10/2017, 0.55% from 01/11/2017 to 28/02/2020, 0.44% from 01/01/2020 – 31/05/2022, and 0.40% from 01/06/2022 – 01/07/2023. The returns are also net of management fees, underlying fund costs, and market spread. The returns are the total returns, so include all dividends. (Data Source: Bloomberg/xignite) Past performance and simulated past performance are not a reliable indicator of future performance.

If we take 2018 as an example, we can see performance was -5.5%, however, this was followed by 2019 which yielded a return of 14.6%. In a more extreme example, we can look back to 2020. In one month, from the 18th of February to the 18th of March, the level 5 portfolio went down 20%. However, the portfolio then made back 18% in the three months that followed (and continued to rally after that).

Interestingly, after each of these negative periods, we often found that clients most wanted to move to cash – to take the guaranteed return and therefore miss some of the most profitable periods. But this isn’t just the case with Moneyfarm portfolio performance. Typically, we tend to see these trends across the whole of the market and see negative years followed by some of the most profitable. This is why we talk about investing for the long term: you will always get bad years, but historically the good years outweigh the bad.

So what are we currently seeing in 2023?

So far 2023 has been a predominantly positive year for markets with 22 of our 24 portfolios yielding a positive return. There are a number of reasons for this: firstly, although interest rates are continuing to rise over the short term, we are seeing inflation react to this, lowering across the globe, even if not in line with expectations. To give some data, UK CPIH (A figure which tracks the cost of living, excluding owner occupiers’ housing costs and Council Tax) sat at 9.6% back in October 2022 and now sits at 7.9%. Whereas, the US sat at 7.6% back in October 2022 and currently stands at roughly 3%. This shows that, although shaky, we are starting to see inflation go down across developed markets, and it further shows why global diversification is important within managed portfolios.

As inflation continues to decrease over the short term, we expect it to positively impact equities and fixed-income bonds, as simply the cost of living increases at a slower pace, positively impacting company profits. We then expect this to be amplified when interest rates stop rising and, in turn, start to be lowered. This is a huge point for clients considering cash as opposed to equities and fixed income, as we really should be questioning how long these high savings rates are actually going to last.

Why time horizon is important

When it comes to cash and other assets, one thing for certain is that nothing lasts forever, which is why your time horizon is key when looking at the best plan for your savings and investments.

Over the short term, we can be fairly certain that interest rates will remain high to tackle inflation, meaning savings rates, whether it be in the form of a fixed rate ISA or a current account, hold less risk. However, for many investors, their investment goal isn’t short-term, but rather medium-to-long-term, and for these people, the question is a lot more complex.

Let’s take someone who has a medium time horizon of five years, for example. If an investor were to move out of investment and put money into cash, at least they could be certain that their funds will grow over the short term. But what happens when we start to see interest rates come down in line with inflation? The risk this investor faces is that they buy back into the market when interest rates are no longer attractive, but buy back at the top of the market, potentially missing a period of significant growth. Meaning the client sold low and bought high.

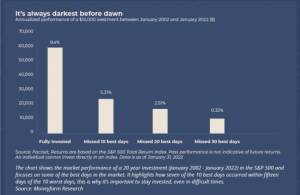

De-risking after a market sell-off and then up-risking after a market rally is a common behavioural bias we see with clients and can be one of the most destructive. We all know on paper to buy low, sell high, however, it can be difficult to follow this logic when you’re seeing negative portfolio performance and high cash yields elsewhere. To demonstrate this, look at the graph below:

You can see that when looking at a 20-year time horizon on the S&P 500, clients who stayed fully invested performed significantly better than clients who missed just the 10 best days’ performance. Showing that, typically, over the long term, clients who stayed invested and rode out volatility performed better than clients trying to time the market.

Risk vs reward

Along with your time horizon, another key point that must be considered is your attitude to risk. This is extremely important in the current climate as low-risk cash investments are offering fairly high-interest rates. This is definitely something to consider for low-risk clients as the current market allows savers to generate a fairly attractive return, without exposing their portfolio to volatility and risk.

Even for medium to higher-risk investors, we do believe that cash can be a good short-term option when looking at risk against reward. However, it should be noted that with CPIH in the UK at 7.9%, even with a high-interest rate of 5%, you’re still sitting on a loss of -2.9% when looking at real rates of return.

Let’s focus on the positives

The good news is that 2023 has been a relatively successful year for most asset classes, with cash interest rates continuing to rise, and equities and bonds – although more volatile, generating positive returns. Therefore, rather than letting yourself get bogged down by negative performance in 2022 and make impulsive investment decisions in 2023, take the time to think about the end goal for your funds, focusing on which asset class is most suitable for your time horizon.

To assist with your decision-making, we have a team of dedicated Investment Consultants here at Moneyfarm who are at your disposal for any questions you may have. To speak to a consultant regarding your options, please call 0800 433 4574 or book an appointment through your Moneyfarm account by selecting ’Speak to a consultant’.

As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. The views expressed here should not be taken as a recommendation, advice or forecast. If you are unsure if it is the right choice for you, please seek financial advice.

Lily Sparrow: Lily started at Moneyfarm as an Investment Consultant in January 2022 and has recently become a Senior Consultant within the team. Lily has worked in financial services since 2016, with experience across Insurance, Financial Advisory and Digital Wealth Mangement, in a number of business development and client facing roles. As a Senior Investment Consultant at Moneyfarm, Lily spends her days managing our client base, conducting portfolio reviews and assisting with PR, content and event management.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.