What are we talking about? UK central bankers have been sounding a more dovish note recently, suggesting that they could wait to see the impact of the Omicron COVID variant before hiking interest rates. The latest monthly GDP estimate gave them some additional support – suggesting that the economy was slowing even before the emergence of the new variant.

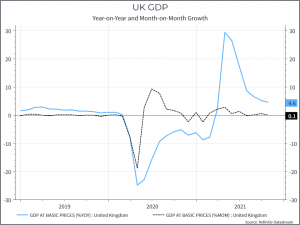

What about the numbers? The October monthly GDP estimate came in below expectations. The economy grew 0.1% in October (versus September), compared to a Bloomberg consensus expectation of 0.4%. The chart below shows the month-on-month and year-on-year growth.

The construction sector was particularly weak, declining 1.8% month-on-month, compared to expectations of +0.2%. The ONS (the UK statistical agency) commented on shortages in some construction materials and rising prices as being partly to blame for the slowdown we’ve seen in the sector in recent months.

What about rates expectations? The consensus view now seems to be that we won’t see a rate hike in December – although the consensus has been wrong before – and this data release gives the Bank of England a further reason to wait. The next important data release will be the November CPI report on December 15th. The Bank of England will be hoping for some respite on the inflation front since a slowing economy and stubborn inflation is not where they’d like to be as we head into 2022. We haven’t seen a significant reaction in markets, and that makes sense to us, given that monthly GDP arrives later than other macro data.

What does it all mean? The consensus thinks rates will stay lower for a bit longer, and that seems like a reasonable conclusion given the Omicron uncertainties and what appears to be a slowing recovery.