What are we talking about? As COP 26 is in full swing, there’s been debate around the role of “free markets” – as the solution or the villain, depending on your perspective. It’s a term we struggle with as it applies to financial markets in 2021.

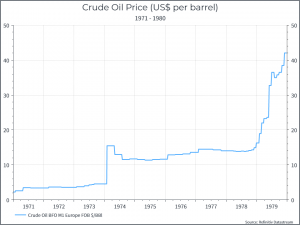

What free markets? When we look back our investment discussions, it’s tough to argue that financial markets are “free”. The minutes of our meetings are full of references to government policy, central bank decisions, changes in regulations etc. This has been particularly true over the past eighteen months, but the aggressive policy actions (or their promise) have been a characteristic of financial markets in the 21st century – from the TARP programme post-Lehman to Draghis “whatever it takes” moment on the Euro. In all these scenarios, there are those who believe that each intervention was a mistake – storing up future, larger, problems. And, if you want to go back even further, you can look at the OPEC oil shock of 1973 as a policy decision (see the chart below for its impact).

That’s certainly not to deny the role of financial markets (free, managed, regulated – depending on your preference), only to suggest that the drivers of financial markets can often be found in policy decisions.

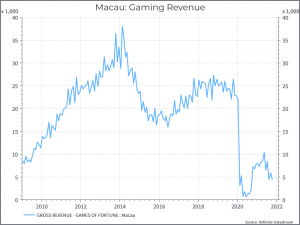

Just to provide a slightly off-beat perspective, the chart below shows aggregate gaming revenues for the Macau casinos (some of which are listed). The two periods of significant policy intervention (2014/15 and 2020) are pretty clear.

What does this mean for Climate Change? Once the hot air of COP26 has dissipated, we’ll be trying to understand the consequences. In all likelihood, some of that will be about potential policy changes, designed to move the world closer to net zero. Inevitably, there’ll be winners and losers, and we’ve seen financial markets already react (witness the flows into “ESG” products). Occasionally you might hear people hark back to some halcyon days when markets were “free” – but they weren’t. Policy has been a feature of financial markets for a long time. And we don’t think that’s likely to change.