What really captured the attention of investors were not the decisions themselves, but the words of the ECB governor. Markets had already priced in no changes to policy interest rates purchase programs, but were caught off-guard by the wording used by President Lagarde on PEPP. “The PEPP, in my view, will end in March 2022.” Such a strong commitment was not expected by investors, who reacted by selling bonds, in light of which the Euro rallied vs major peers.

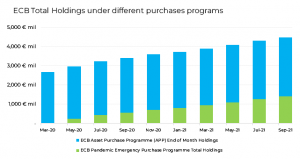

The PEPP was launched by the ECB in response to the pandemic. It was intended to support government borrowing to mitigate and overcome the economic and social impacts of the pandemic. The program, which was added to the APP (Asset Purchase Program – the ECB’s wider quantitative easing program, which had already been running for several years), was approved in March 2020 by the ECB’s board on the condition that it would finish by March 2022, as confirmed by Mme Lagarde. As this date approaches, investors are keenly focused on what will happen to the large amount of assets purchased under the program. Almost 2 trillion euros worth of public securities have been purchased by the ECB, with 75% of these assets being purchased under the mandate of the PEPP.

The role of the ECB post-PEPP will be key in understanding how governments will act with their continued fiscal stimulus planned for 2022 and onwards, with most planning to continue issuing debt to aid their nation’s recovery from Covid 19’s effects. Part of the fiscal expansion will be absorbed by the EU’s Recovery Fund, but any additional cost to issuing government debt will make recovery efforts more difficult. Investors will monitor the various budgetary rules and plans for future issuance, to try to understand any changes to the cost of issuing debt in the EU, and how much member states’ fiscal flexibility currently depends on the PEPP.

It is understandable that the ECB wants to keep flexibility around its policy, but markets reacted unfavourably to the uncertainty of what would follow the PEPP next year. Markets will likely need to wait until the December meeting for any further policy update.

The future path of interest rates seems to be another area of disagreement between markets and Mrs. Lagarde. Over the last two months we’ve seen investors pricing in at least one rate hike by the end of next year, while President Lagarde pushed back on such expectations.

We think this divergence stems from the different assessment of inflation. September and October have been characterized by building inflation expectations, and the risk of inflation upsetting the global economy seems to have grown. The argument that inflation is “transitory” seems to have morphed into a different, much more flexible, interpretation over the last month. Price increases in raw materials, wages and issues with supply bottlenecks have yet to fade.

So while investors are starting to bet on higher-for-longer inflation, the ECB still thinks that sooner or later these bottlenecks will be reabsorbed, and inflation will normalize.

The ECB does have an advantage versus the FED and Bank of England in that the underlying level of inflation, though higher than it has been historically, is much lower than in other developed economies. This makes an imminent interest rate hike from the ECB a rather less likely scenario.