What are we talking about? Last week we saw a pretty sharp reaction to news of a new COVID variant, Omicron. That was particularly true in commodities, where the oil price fell around 10% on the day. That’s potentially a silver-lining for high inflation, which is still, we’d argue, a significant macroeconomic and social challenge.

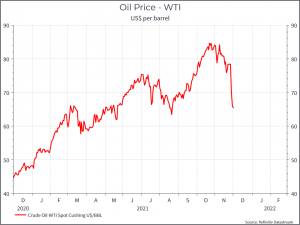

Some details: The chart below shows the price of oil (in the US) over the past year – a steady rise on the back of increased global demand (and the expectation of further increases) – followed by a sharp drop in the wake of new COVID restrictions.

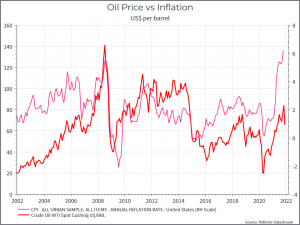

The next chart compares the oil price and consumer prices. As you might imagine, there’s some relationship between the two, reflecting the impact on manufacturing and transport costs – even if the current inflation spike is maybe more pronounced than the rise in oil might have predicted.

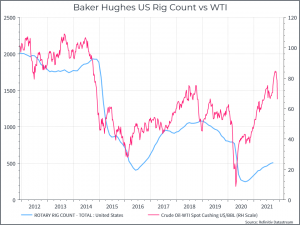

The final chart shows the oil price and the number of oil rigs operating in the US. We think it’s an interesting illustration of the way in which a rising price prompts a supply response – in terms of an increase in the number of wells. In this case, we haven’t yet seen a significant acceleration in the number of rigs operating but you’d guess that if the price of oil remains high, the rig count should move higher.

What about Omicron? This brings us back to Omicron. We’d argue that rising oil prices have had an impact in terms of higher inflation (but not the only one). And that the recent drop in the oil price, if it’s sustained, could help dampen inflation a bit going forward. That would certainly be a benefit for Central Bankers and households struggling to deal with the consequences of higher prices.