What are we talking about? As we enter 2023, we continue to wrestle with a couple of key questions – first, how sustainable will economic growth prove to be and, second, will we begin to see a normalisation in the global supply chain and, by extension, consumer price inflation.

Some of the most recent data comes from business surveys by the Institute of Supply Management in the US. It usually comes out a few days after the end of the month. A reading of above 50 is taken to mean that the sector (manufacturing or services) is growing. Historically that has usually translated into equities outperforming bonds.

What did the latest data show? The ISM report has quite a lot of data but there are a few points worth highlighting.

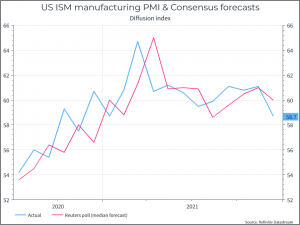

First, the Manufacturing PMI came in at 58.7, suggesting that the sector is still growing, even if that was a bit below consensus expectations (see chart below).

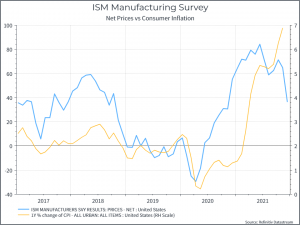

Second, in terms of pricing – more respondents indicated prices were rising rather than falling, but the difference between those two answers fell quite sharply. That might not be enough to call the peak in consumer inflation (as the chart below shows), but it’s at least grounds for some slight optimism on prices.

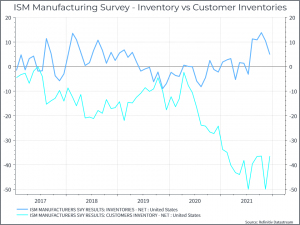

Third, customer inventories remain an issue. The firms surveyed indicated that their inventories were fairly balanced (between those saying inventories were too high or too low), but inventories at their customers remained very low by historical standards.

Usually, you might worry about rising customer inventories, but at this time, we might see rising inventories as a sign of healing in global supply chains.

Where does this get us? Well, it’s just one data release, but it’s a relevant indicator for the US economy and we’d argue it continues to tell a story of decent growth, some imbalances, but maybe some small signs of improvement in the outlook for US inflation.