Fed Chair Powell and his colleagues on the Fed Open Markets Committee continued their successful balancing act yesterday. The FOMC statement delivered no change to the headline numbers – rates stayed unchanged, as expected – and little shift in the commentary. The Fed continues to lead the market towards slowing its bond purchases towards the end of this year, without quite committing to it. Fed Chair Powell again successfully made the distinction between so-called “tapering”, ie slowing and then stopping the Feds process of buying bonds, with so-called “lift-off” – the actual raising of interest rates. If the Fed stays true to its unconfirmed schedule, then tapering should end towards the middle of 2022.

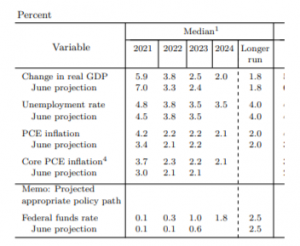

In terms of interest rate expectations, all eyes were on the so-called “dot plot” – the interest rate forecasts from individual Fed members. The table below gives a summary.

The median rate expectation rose very slightly for 2022 – basically two governors changed their views – and by a little more in 2023. We’d argue that’s within the arc of analyst expectations ahead of the meeting, and probably less than the more hawkish commentators might have expected.

The FOMC also introduced a projection for the Fed Funds rates in 2024 – of 1.8% – suggesting that even three years from now, real interest rates (ie adjusted for inflation) will still be negative.

So the direction of travel seems fairly clear, even if the Fed won’t make too many firm commitments. In the short term, commentators may focus on how quickly the Fed reduces its purchases, how soon after that it begins to raise rates and how the dots move. But a policy rate below inflation in 2024 is hardly the mark of restrictive monetary policy.