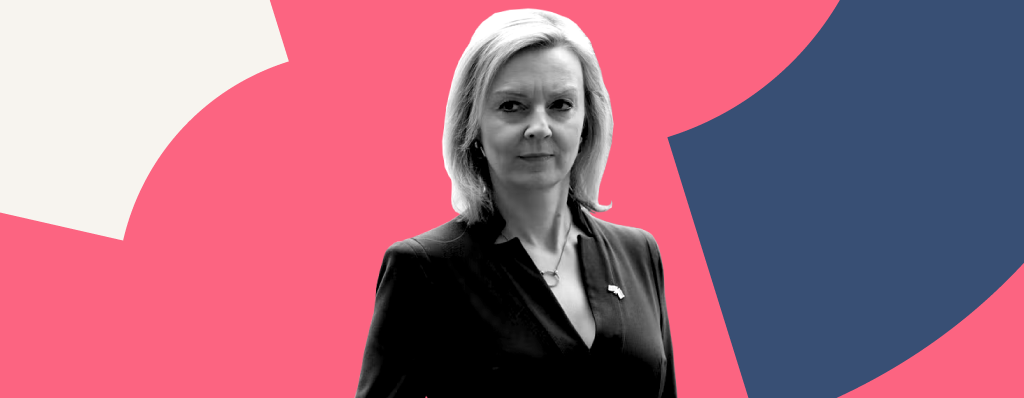

Liz Truss has resigned as Prime Minister, defenestrated in short order by Tory MPs. A new Prime Minister is set to be in power within a week. It’s no surprise the opposition are calling for an immediate general election – claiming that the Conservatives no longer have a mandate to lead from the public.

But the Tories didn’t become one of the most fearsome election-winning machines in Western politics by caving into the opposition. We assume that they’ll find someone reasonably credible to occupy 10 Downing Street and try, as effectively as possible, to rebuild their shattered credibility.

Two years is a long time in politics. It may not be enough time to allow them to win the next election, but it could prevent the electoral bloodbath that a snap general election would produce. However, it’s uncertain if two years would be enough time to shake off the UK’s current poor reputation with financial markets.

Having the same Prime Minister for more than three months should be a good start, but this is only a small step in the right direction. What the UK needs is stability and robust ideas.

While too much pressure had built up for the PM to stay, her resignation will still have an impact on our finances. We think it’ll take a bit longer for UK rates to come down and that will prove painful for those needing to re-mortgage and applying for a mortgage.

A bit of stability in economic policy would be a welcome relief, but the early signs from Chancellor Jeremy Hunt is that he’s keen to cut costs as well as roll-back the mini-budget tax cuts. That might prove challenging in the current economic and social environment, and we’d guess that he’ll end up doing less than what he’s currently promised.

But, once again, policy must take a back seat to politics – hopefully that won’t last much longer, but there are enough open questions to make political uncertainty contribute to the volatility of the UK market for a while. But if there are any grown-ups left in the Tory party, now would be a good time to stand up and help to create stability once again.

We’d expect market volatility to remain high for now, and that’s only partly due to UK politics. That said, opportunities can be found in volatile markets too. It’s not all doom and gloom for investors. UK assets do look relatively cheap in a global context. We’ve added to the UK large-cap equities in our most recent rebalance and we may see further opportunities in the coming months.

It will be a bumpy road ahead but the key is not to panic and stay the course with investments. If you cash out too soon you could lose out when markets are on the up again.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.