We are in an extraordinary period for both global health and the global markets. Just as governments attempt to grapple with the spread of Covid-19, markets have been significantly affected and uncertainty has defined the last month.

While this is, first and foremost, a global health crisis, when valuations are low, opportunities are presented to investors to get into the market for a fraction of the price and benefit from the potential of stronger long term returns.

Invest today

Just as we encourage anyone with existing investments to keep the faith and maintain a long term investment outlook, it’s important to see the current volatility in the markets within the context of this broader picture. Missing out on periods of recovery can be expensive and selling at the bottom is a surefire way to cement the losses suffered in the downturn.

On the contrary, now is a good time to consider investing in global markets. While there is no guarantee that conditions will improve quickly, those that make investments at or near the bottom of the dip will see the greatest returns when the eventual recovery begins.

Investors with longer time horizons are in a position of relative privilege when it comes to fluctuations in the market. At Moneyfarm, we have built our investment strategy around the longer-term perspective. An ability to withstand short term fluctuations puts an investor in a position to capitalise on long term growth and periods of recovery.

Don’t miss out on the recovery

Historically, periods of significant decline tend to precede periods of significant growth as markets recover. This represents a huge opportunity for anyone who hasn’t yet filled their ISA or pension allowance for the tax year, or wants to proactively use their allowance for the coming tax year, to invest at a discounted rate and reap the benefits as the recovery takes place (regardless of how long this takes).

Data from MSCI USA net return in USD shows that, since the financial crisis in 2008, only 2018 saw the stock market finish the year with negative growth overall. Historic data tends to show that years of poor performance are followed by periods of strong performance. 2019, for example, was the best performing year in the US equity market since 2012. 2009 saw a similar spike.

March 9, 2020, constituted the 7th largest single day market drawdown in the S&P 500 since 1940. Of the top 20 drawdowns across these eight decades, though, only two (in 1940 and 1946) failed to be followed by a positive return after 18 months. The other significant drawdowns saw subsequent growth in the following 18 months to the tune of 24.8% on average.

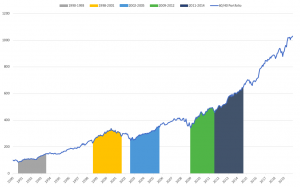

We looked at the last 30 years of performance of a hypothetical portfolio made up of 60% equities and 40% bonds. These saw no portfolio model drift and investments took place at the bottom of the market. The highlighted sections represent periods of recovery after slumps and, as you can see in the chart, periods of decline have historically been followed by extended and often significant growth.

This graph also demonstrates the value of sticking with your investments. The often rapid uptick after a slump makes buying back in to watch the recovery period difficult. It also demonstrates the value in buying when prices are low – in no instance was buying at the bottom not rewarded in the subsequent years.

After the tax year end

For investors that have already used their 2019/20 ISA allowances and for those with the capital to make the most of both allowances, considering accelerating their 2020/21 ISA contributions (following the 5 April) may be an opportunity to benefit even further.

It may not be immediately obvious or comfortable to many that investing during a period of uncertainty can lead to positive returns over the long term. If the funds are not needed in the short term, though, it can be a great opportunity to get your money working for you at, effectively, a discounted rate.

If you want to discuss your options for the end of this tax year, or the beginning of the next one, please do not hesitate to get in touch with our investment advisory team.