Luckily, managing your pension to stay on track to reach your retirement goals doesn’t need to be complicated or intimidating. The right regular investment plan can help you unlock the future you deserve, and give you the financial confidence to focus on the important things in your life today.

Moneyfarm has just launched its Pensions eBook, Retire Sooner with the Moneyfarm Pension, which decodes the pensions landscape to help you be in the best position to reach your retirement goals.

With information on the tax benefits available to you, the role of investment advice, three regular savings plans and information on self-employed personal pensions, the eBook will help keep you on track to get the retirement income you deserve.

Simple rules to maximise your pension

Putting your savings in an account for retirement can often feel like a black hole, but growing your money for the future doesn’t need to be difficult. There are some simple rules you can follow to help you maximise your returns to help reach your financial goals.

These golden rules are:

- Start as early as possible

- Invest as much as you can

- Invest regularly

- Diversify your investments across asset classes and geographies

- Don’t let unnecessarily expensive fees eat into your returns

Here we look at the benefits of regular investing.

Regular investment plans

Few would advise investors to try and time the market. It’s too difficult and can leave the fingers of the most established and experienced investors rather burnt.

Instead, investors can manage the risk of timing and actually maximise returns by setting up a regular direct debit. Investing regularly smooths out the price you pay for an asset. It can lower the amount you actually pay for it during periods of volatility.

Known as pound cost averaging, this simple trick can help maximise returns over the long-run.

But setting up a direct debit has more benefits than that, it takes the hassle out of investing for people who are too busy trying to juggle their career with the school run. It also allows you to ignore market noise and avoid potentially costly knee-jerk reactions.

Regular investing with Moneyfarm

The two golden rules of saving for retirement are start as early as possible and save as much as you can. But how do you know if you’re doing enough to be on track to have the retirement you want?

That’s why Moneyfarm has created three regular investment plans to help investors understand whether they’re doing enough to achieve the retirement they want.

The regular investment plans popular with our investors are £400 a month, £800 a month and £1,600 a month.

By setting aside this much each month you could be on track to a comfortable retirement income in less time than you think! However, it also highlights the dangers of not investing enough, or leaving it too late.

How long will it take you to save for retirement?

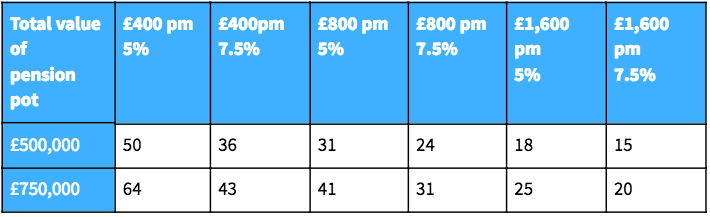

A look at the table below shows that by investing £400 a month in a diversified investment portfolio, you’d build up a pension pot that could provide you with a £25,000 annual income (£500,000) in 36 years, and a £37,500 annual income (£750,000) in 43 – assuming annualised growth of 7.5%.

If you take a more conservative view and pencil in annualised growth of 5%, it would take your 50 years to get £500,000 and 64 years to get £750,000.

It’s reasonable to expect that you can earn an annualised return of at least 5% from a balanced and diversified portfolio over the long term. Over the last three decades, a 60/40 diversified portfolio has returned an annualised 7.5% – we’ve got more information on this below.

Assuming 5% is your return, you can then withdraw 5% from your pension each year. Theoretically, you’ll never deplete the nominal value of your pension.

That means that for an annual income of £25,000, you’ll need a pension pot worth £500,000. For £37,500 a year you’ll need £750,000.

Fast track to retirement

It’s probably not a surprise that the more you can invest each month, the quicker you can get to your desired pension pot size.

If you invest £800 a month into your pension, it will take 24 years to get a pension pot worth £500,000 and 31 years to get £750,000 – assuming 7.5% growth.

When calculating these numbers, we assumed you invested in a balanced diversified portfolio with 60% exposure to equities and 40% exposure to bonds.

If you’d started invested in this 60/40 model portfolio in 1990 and continued to today, your money would have grown by an annualised 7.49%. We’ve assumed this rate of growth for our regular savings plans below, along with a more conservative 5% growth estimate.

These numbers also include an annual fee of 1% and include the impact of a 2% rate of inflation on the value of your savings pot.

If you can afford to put £1,600 in your pension each month, you’ll quickly see the benefit on the size of your pension pot. It will take just 15 years to generate £500,000, and just 20 to enter retirement with £750,000 saved up.

*These numbers include the 25% boost you’ll get from the government in the form of tax relief.

Tax benefits to a personal pension

There are many benefits to saving in a personal pension, with one of the largest being the generous tax benefits.

When saving into your pension, you can claim tax relief relative to your income tax band. Someone on a basic rate tax band can claim 20% tax relief, which turns an £8,000 contribution into £10,000.

If you’re a higher rate taxpayer you’ll only pay £6,000, or just £5,500 if you’re an additional rate taxpayer for an overall £10,000 contribution. Remember, you’ll get just the basic rate of tax relief on your contribution in your pension. You’ll have to go apply for the rest through your annual tax return.

This tax relief effectively gives you a 25% boost to your savings. Imagine you’re paid £1,250 as a basic rate taxpayer. You pay £250 to the taxman (20%), and decide to put the remaining £1,000 straight in your pension.

The government tops up your contribution with the £250 they assume you paid in tax when you got paid. This is equivalent to 25% of your net savings.

This can make a real difference over time, and can be a real boost to your pension pot. Moneyfarm is one of the only digital wealth managers to provide this basic rate tax relief at source.

Then, once you’ve reached retirement, you can take 25% of your pension savings as a tax-free lump sum. You’ll pay tax on the remainder in-line with your income tax band. This will likely fall to the basic rate during retirement.

To make the most of your pension contributions, set up a direct debit with Moneyfarm today.

Our free Pension Drawdown Service helps you make confident, stress free decisions to stay in control of your retirement income.

You can use Moneyfarm’s Pension Calculator to help you work out how much you need to be saving a month to get the income you want in retirement, or start one of Moneyfarm’s regular investment plans.

Making sure you plan for retirement in the best way for you and your family can be difficult. If you need any help, talk to an independent financial adviser and be sure to read our pension guide.