As with all investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. You should seek financial advice if you are unsure about investing. The views expressed here should not be taken as a recommendation, advice or forecast.

With Moneyfarm DIY Investing, you have the freedom to make your own investment decisions. With direct access to the stock market, you can choose to invest in a wide range of assets tailored to your unique preferences and goals.

Our DIY service is an excellent complement to our managed portfolios, giving you the best of both worlds – expert portfolio management and the ability to select individual investments that reflect your personal values.

What’s more, our expert team uses in-depth research and data analysis to provide insights and market updates, helping you make informed investment decisions that align with your long-term wealth goals.

What can you invest in?

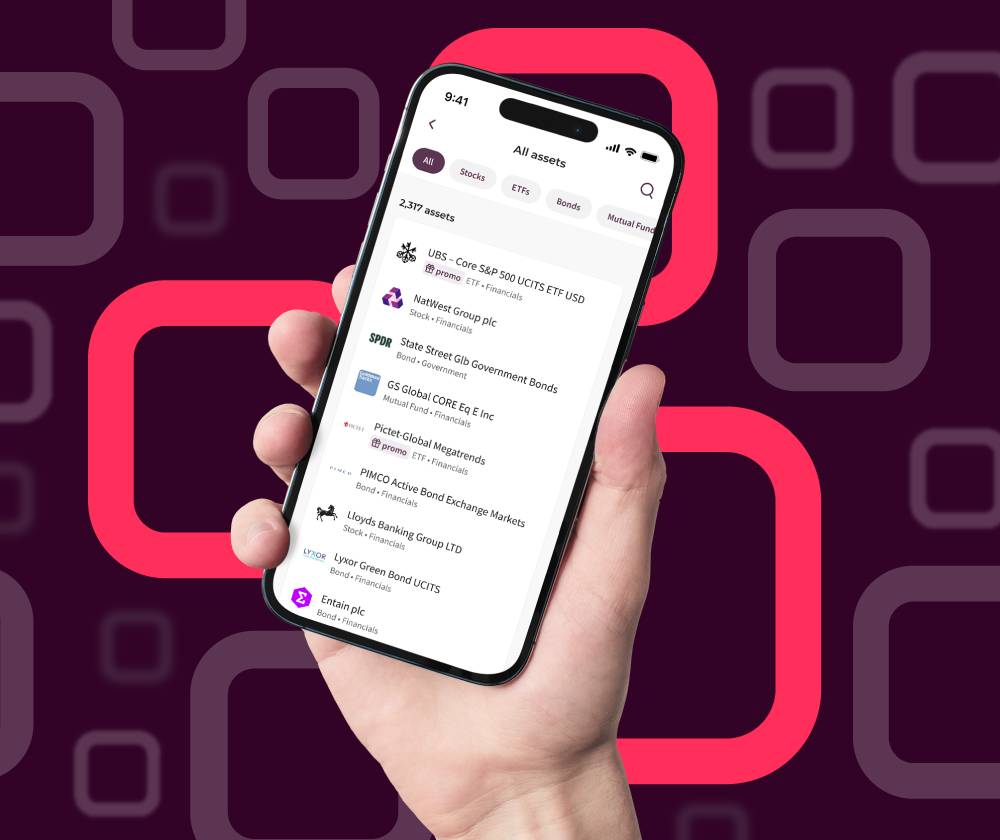

Our DIY Investing platform offers over 1,000 different assets, including stocks, ETFs, bonds, and mutual funds. You can create a custom stock portfolio, generate steady income with bonds, achieve broad diversification through ETFs, or gain access to professional fund managers by investing in mutual funds.

With such a wide array of investment options available on our DIY Investing platform, you have the freedom to build a portfolio that reflects your individual values, risk tolerance, and wealth goals.

As always, our pricing is competitive and transparent. You can begin your DIY Investing journey with us at no cost. It’s completely free to open an account. We charge a flat fee of just £3.95 per trade for stocks, ETFs, and mutual funds, and £5.95 per trade for bonds.

Getting started with Moneyfarm DIY Investing is simple. You can access the platform using either a General Investment Account or a Stocks and Shares ISA, which allows you to invest tax-efficiently.

We invite you to explore our DIY Investing service and experience the benefits for yourself. To learn more about Moneyfarm DIY Investing, visit our dedicated page here.

If you have any questions or would like further guidance, our expert team is always here to help. You can set up an appointment with us at a convenient time, and we can guide you through to get set up.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.