The earnings season is a quarterly ritual for many equity investors, particularly in the US. The process goes something like this. US companies report financial results every quarter (European companies may only report every six months). Investors pay close attention to these results as an indication of how their investments are doing. So far, so obvious.

Behind this is a game. Most US companies indicate to investors what they expect to deliver each quarter – often with a surprising level of precision. The game is whether these companies can deliver results that are better than the forecasts they originally gave. You would have thought that that should be easy – keep expectations low enough and you’ll always beat them. Unfortunately, it’s not that simple – investors have expectations of their own of what sort of results the company should deliver. The company wants to keep those expectations high enough to support its stock price (with which management is usually compensated) while still being able to exceed them.

Exceeding expectations is good for a few reasons. First, financial markets live for surprises. A positive surprise usually moves share prices higher. Second, management teams that consistently deliver positive surprises can develop a reputation for running their businesses really well—whether that’s true or not. That can translate into a higher valuation as investors start to expect a better trajectory for corporate earnings in the future and better pay.

So much for background. What have we seen in the past?

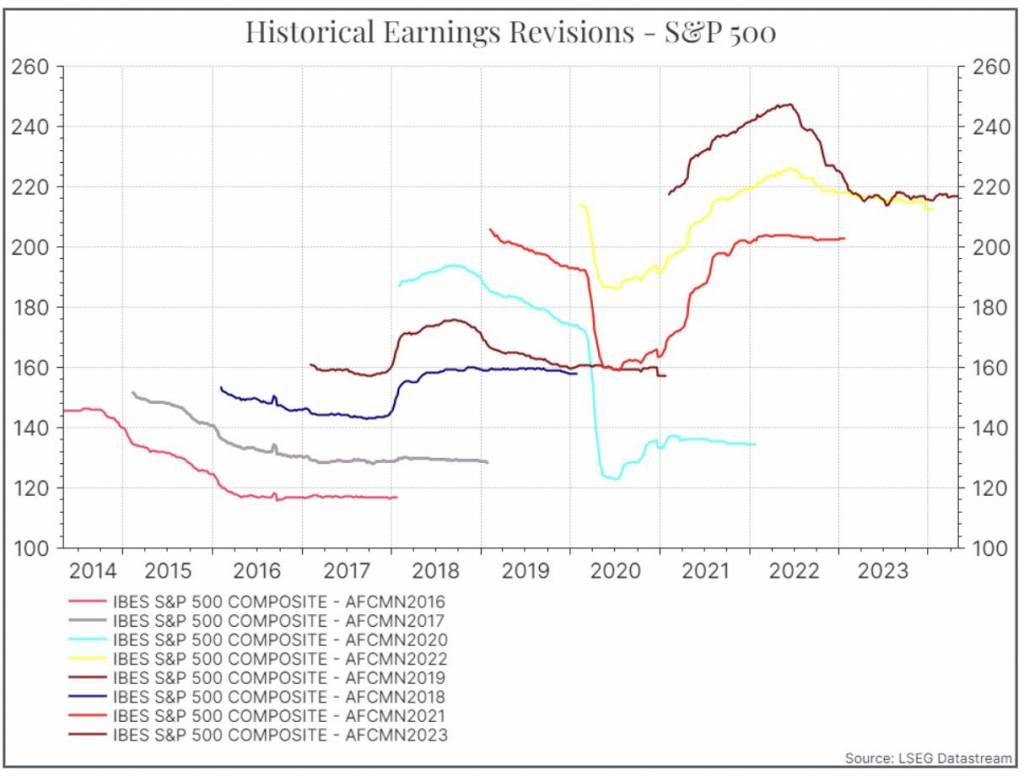

The chart below shows analysts’ forecasts for US equity earnings for the calendar years 2014 to 2021 – and how those expectations changed over time. As you can see, in many of those years, analysts started out pretty optimistic and then reduced their expectations over time – most notably in 2020. In this period, 2018 and 2021 were unusual in that earnings forecasts for the year ended up at least fairly close to where they began.

In a simple world, you might expect that improving earnings forecasts would translate into a higher share price – either for a stock or for the overall market. Unfortunately, it’s not that simple. Earnings upgrades don’t necessarily guarantee higher markets – witness 2018. The good news is that earnings downgrades don’t necessarily mean that markets will decline – witness 2020 and many others. Maybe the earnings game doesn’t matter so much after all.

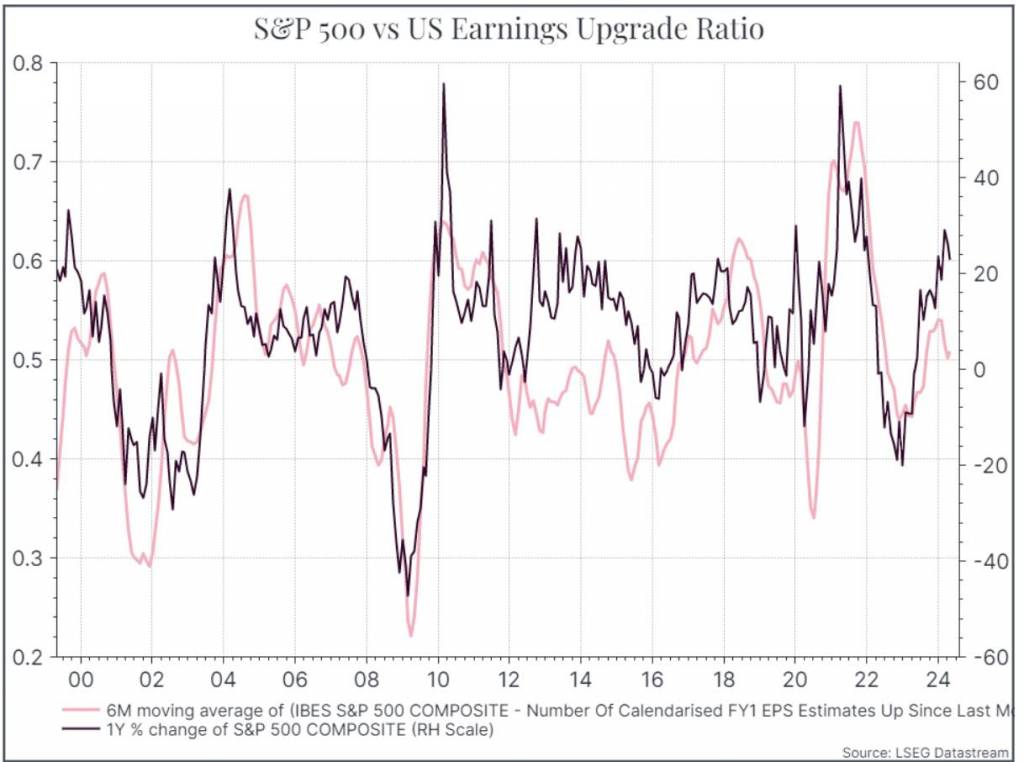

But it does seem that earnings do explain at least some market performance. The chart below looks at the return of the S&P 500 compared to the number of earnings upgrades over a six-month period. It’s not going to tell you if you should buy or sell today, but it does suggest that earnings revisions do matter, at least a bit, for short-term earnings.

So what do we see today? The “earnings season” is still underway in the US, but the partial data suggests that US companies have done fairly well versus expectations. The percentage of those companies reporting better-than-expected results is in line with the long-term average. Corporate profitability also looks pretty solid – ahead of the last quarter and in line with the same quarter last year. If you were more pessimistic, you might say that the actual reported earnings growth isn’t particularly strong, given the starting valuations – but overall the current picture from listed US corporates is a relatively positive one.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.