“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.”

So said Mark Twain, apparently. And it seems an appropriate quote to roll out when we think about fixed-income markets in 2024. Six months ago, aggressive rate cuts were a certainty in the US (and elsewhere) this year. Today, fixed-income markets are pricing in one cut, maybe. And there’s been talk that the next move could even be a rate hike.

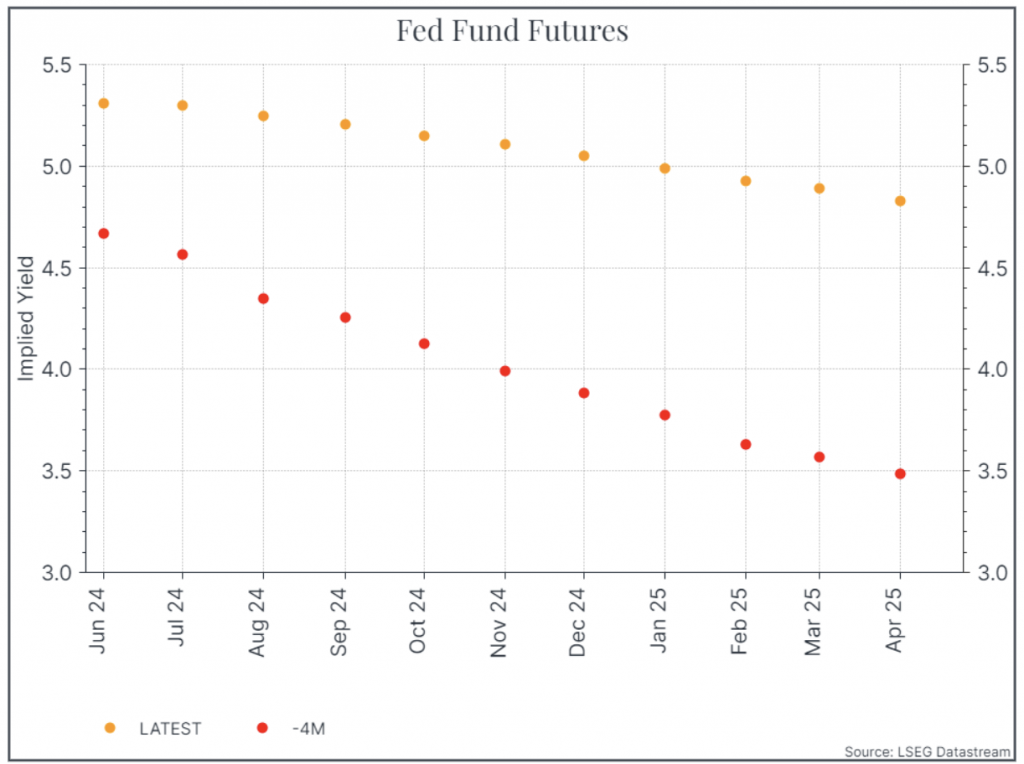

The chart below of Fed Fund futures shows the magnitude of the change. Today, the implied yield on the Fed Funds in December is above 5%. Four months ago, it was expected to be below 4%. That’s a pretty big change.

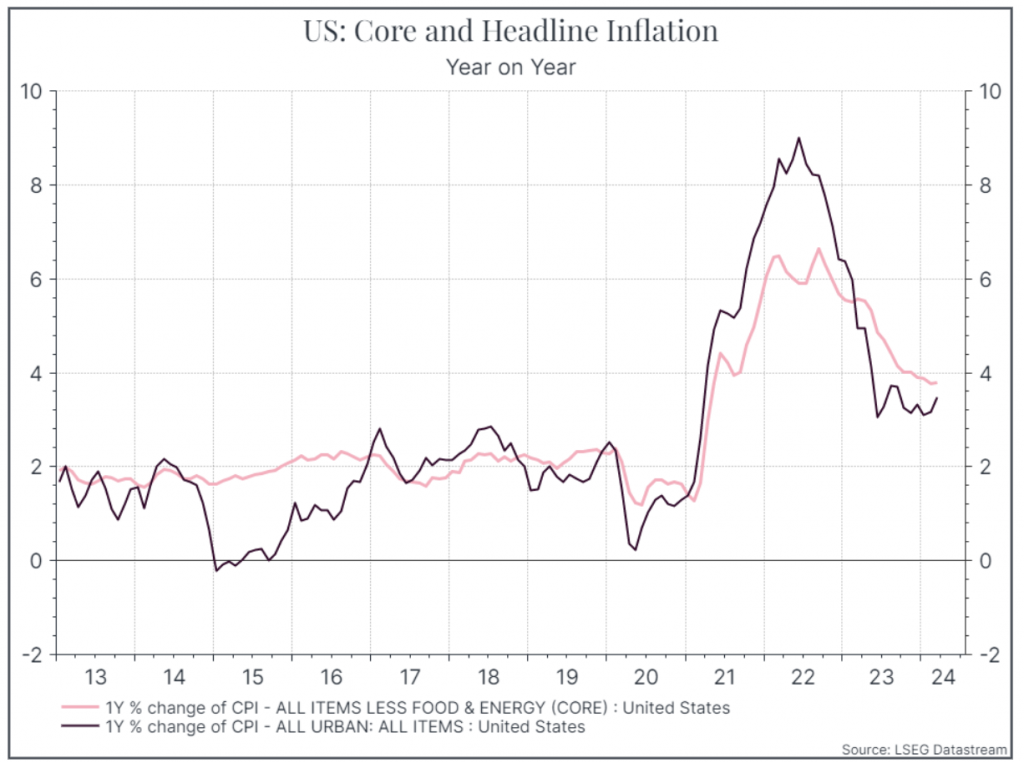

What’s happened? The short answer is that US inflation hasn’t come down as quickly as many of us had hoped. And that has forced Fed governors to change their tune. “When the facts change, I change my mind” as Keynes also apparently said.

A couple of charts illustrate the point. The first shows core and headline inflation (year on year) – still some way above the Fed’s 2% target.

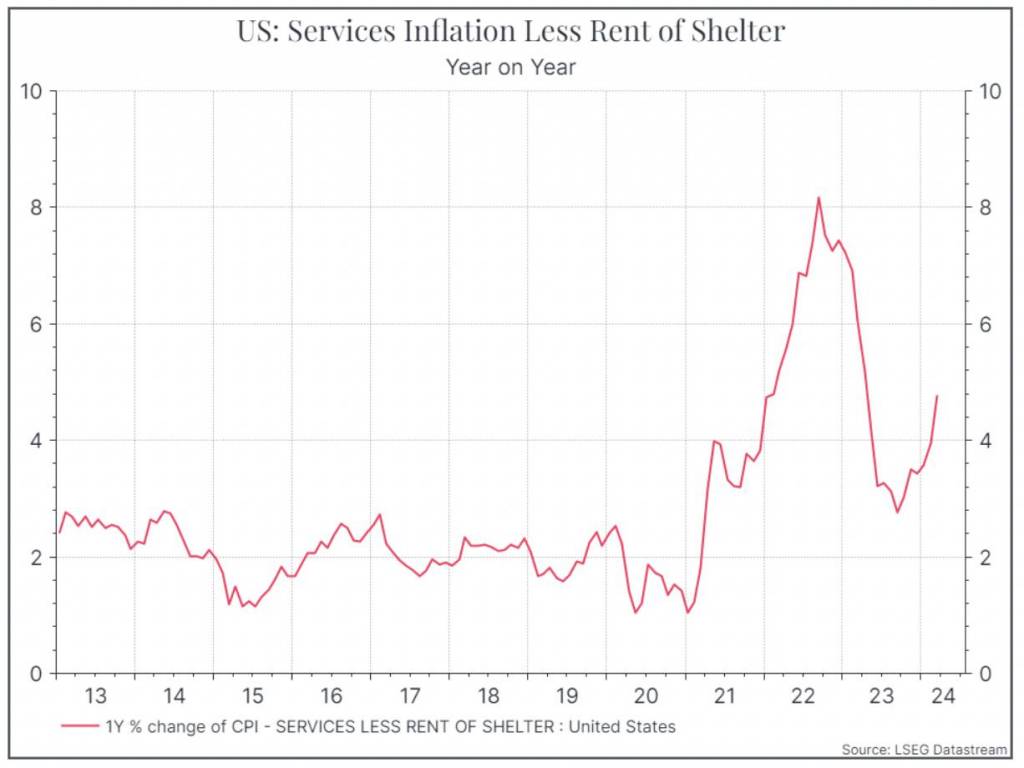

The second chart digs a bit deeper – showing services inflation (excluding an estimate of the cost of housing). This figure has accelerated in recent months, suggesting a fairly strong domestic economy and a tight labour market.

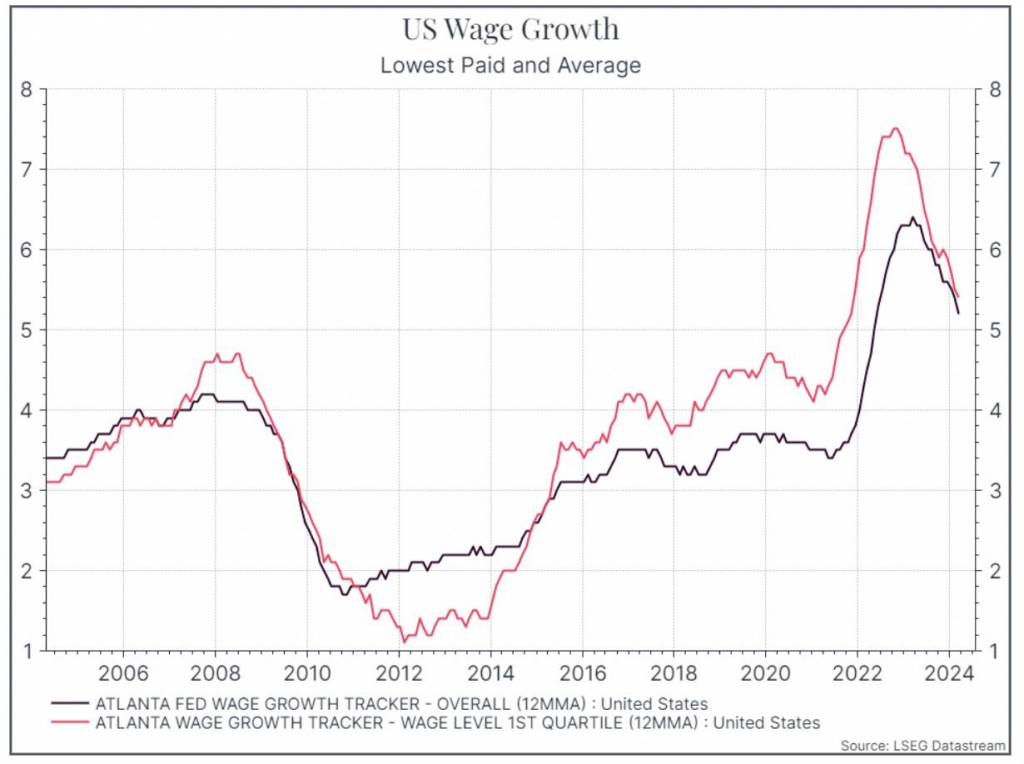

Other wage data supports this view. The chart below shows wage data from the Atlanta Fed for the average US worker and for the lowest-paid workers. Both measures continue to grow at a rate that probably isn’t consistent with a 2% inflation target. Now it’s reasonable to say that workers are still trying to regain their lost purchasing power after a period of strong inflation, but that doesn’t make life easier for Central Bankers.

And we can see that economic data remains robust. Even the latest GDP figures, which came in slower than expected at the headline level, showed pretty resilient domestic demand. The weaker headline figure was partly due to strong import growth. Stronger imports act as a brake on growth in the national accounts, but usually reflect strong demand in the economy overall.

Where does this leave us? The Fed is meeting this week and will announce its decision on Wednesday afternoon. The consensus is expecting no change, and by a very wide margin. As usual, the press conference will likely be more interesting. We’re looking for signs of how the Fed’s thinking has changed. Individual Fed governors have already indicated a more hawkish shift, in the face of strong growth and stubborn inflation. We’d expect to get further confirmation of that on Wednesday.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.