Please remember that when investing, your capital is at risk. The value of your portfolio with Moneyfarm can go down as well as up and you may get back less than you invest. Past performance is not a reliable indicator of future performance. The views expressed here should not be taken as a recommendation, advice or forecast. If you are unsure investing is the right choice for you, please seek financial advice.

If you were actively invested during 2022, you may have been tempted to disinvest as markets tumbled, thanks to an almost perfect storm of financial headwinds. First, there was the ongoing geopolitical turmoil caused by the war in Ukraine; this, in turn, drove up energy prices across Europe and the US, so vastly increasing inflation at rates not seen since 2008. Central banks attempted to stave off these inflationary pressures by hiking rates 21 times in the UK up until the last quarter of 2023. This confluence of events hit households and investors hard and was one of the worst years of market performance seen in years. However, during all that time we had one simple message, and that message was clear: stay invested for the longer term to take advantage of a market bounce back.

And so it proved. 2023 was a bumper year for investors who stayed the course. This outcome was by no means guaranteed, as many economic and financial indicators were heavily imbalanced at the beginning of the year. What we can say is that one of the key themes of the last 12 months has been the normalisation of many factors that created a favourable environment for both stocks and bonds to recover much of the lost ground from the previous year. So what happened to create this ‘bounce-back’ effect in markets in 2023?

Inflation, tamed?

The main economic variable of the recent period has been inflation. The unprecedented recent price growth forced central banks into a super-restrictive monetary policy that penalised investments and the economy. This situation also had an indirect effect on the value of asset classes; markets discounted the possibility that the economy could enter a recession with inflation still out of control. Managing such a situation would have been particularly challenging, both from an economic policy and market perspective.

Fortunately, as the year progressed, inflation decreased in all major geographies (although perhaps not as quickly as central bankers hoped), and the economy did not enter a recession, bringing the intertwining of macro indicators within more manageable parameters. The chart below does not describe the inflation trend itself but rather the inflation surprise, i.e., how much the actual dynamics of prices differed (positively or negatively) from consumer expectations.

*Data as of 23/01/2024

A recession that never came

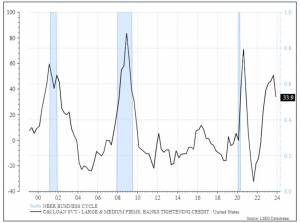

As we’ve briefly touched upon already, another central theme of the past year was the spectre of recession. Entering 2023, this possibility was by no means guaranteed but was the common denominator in many of the scenarios being considered. Restrictive monetary policy affects the economy in various ways. One of these is the decrease in available credit. When interest rates are higher, it is more expensive to borrow, and therefore, the demand for credit decreases. This is usually accompanied by a more cautious attitude from banks, which adopt higher standards for loans (also because the alternative of keeping liquidity parked becomes more attractive).

In the past, there has always been a very clear relationship between credit tightening and recession. As we can see, in the last 25 years, credit tightening has always been followed by a recession. In 2023, this has not happened yet; on the contrary, credit conditions are becoming more favourable without the economy going through a negative phase. Another interesting piece of evidence is that the credit tightening in 2023 (mainly caused by the effect of interest rates) was not as pronounced as in previous recessions, where there was also a decline in loan demand due to a negative assessment of the state of the economy.

*Data as of 23/01/2024

We believe it is still too early to declare that the soft landing has been a success, that the recession has been definitively avoided. On the contrary, we think it is likely that we will see some sort of economic slowdown (which will not necessarily be dramatic). What we can say with greater confidence is that we have avoided a scenario of recession and uncontrollable inflation. In the event of an economic slowdown, we believe central banks will have room to support the economy, and in the case of a mild recession, this could create a favourable scenario for both stocks and bonds.

Bonds and stocks: A tale of two asset classes

But how did asset classes behave during this year full of pitfalls? The growth of stocks has been driven by valuations, primarily supported by confidence derived from the fact that some more negative economic scenarios have been neutralised. Whilst we saw great performance, a lot was concentrated in the largest market, the US, with the S&P 500 and NASDAQ climbing to 25% and 43% respectively.

*Data as of 23/01/2024

On the bond side, even though inflation drifted lower, Central Bankers kept a fairly hawkish message, wary of declaring victory too soon in their battle against inflation. As a result, bond yields drifted higher for much of the year.

Where does all this leave us? First, the bond asset class, despite volatility, proves to be an excellent diversifier, even in a not particularly favourable year like the past one. Second, if the prospects of monetary policy confirm the direction of the last months of 2023, we believe that there are conditions for bonds to record better performances.

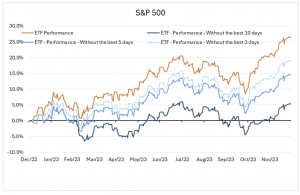

Remaining ‘In it to win it’

Although we would never dream of comparing investing to playing a lottery, the National Lottery’s old tagline ‘you have to be in it to win it’ still rings very true to us when it comes to long-term investment. A good example of this was, in fact, last year when the majority of the S&P index’s positive moves were contained in just 10 days. It’s worth noting, however, that this performance was mainly concentrated within the S&P’s ‘Magnificent Seven’ stocks (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla), and as inflation drifts lower we should see a broader recovery across the US economy.

*Data as of 23/01/2024

Missing those crucial moments is something we often see with those who have disinvested following a period of negative or even neutral performance. Of course, we understand the desire to see growth in clients’ portfolios but, once again, our message this year is one of staying invested for the longer term so you can potentially expose yourself to these periods of positive momentum.

Remember, even seasoned investors find it next to impossible to time the market. That’s why we always ensure our portfolios are constructed with the longer term in mind, allowing us to capture periods of positive momentum across a range of asset classes while aiming to mitigate potential downturns in the markets.

Tim Badouin: Tim is an Investment Adviser at Moneyfarm, having joined in November 2022 as a Senior Investment Consultant. Prior to working at Moneyfarm, Tim has worked in financial services since 2019, with experience across insurance, retirement and inheritance tax planning, business development and client-facing roles. He currently helps customers achieve their financial goals, conducts portfolio reviews and writes articles for Moneyfarm. Tim currently holds an Investment Advice Diploma from the CISI – with the view of becoming Chartered in the near future.

Tim Badouin: Tim is an Investment Adviser at Moneyfarm, having joined in November 2022 as a Senior Investment Consultant. Prior to working at Moneyfarm, Tim has worked in financial services since 2019, with experience across insurance, retirement and inheritance tax planning, business development and client-facing roles. He currently helps customers achieve their financial goals, conducts portfolio reviews and writes articles for Moneyfarm. Tim currently holds an Investment Advice Diploma from the CISI – with the view of becoming Chartered in the near future.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.