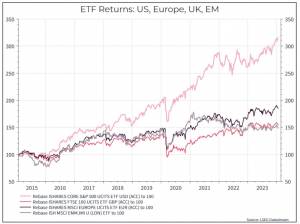

As we think about the outlook for 2024 and beyond, one of the key questions is the outlook for US equities. That’s not just because US equities represent such a large weight in global markets (around 60% of a market-cap weighted ETF), but also because of their historical performance. The chart below shows the relative returns for ETFs for the US, Europe, UK and Emerging Markets. The outperformance of the US has been notable. For higher-risk portfolios, the decision on US equity exposure has been one of the biggest drivers of portfolio performance.

There are lots of stories to tell about how equities perform. For the US, for instance, we can talk a lot about the growth of big tech stocks. But for the sake of simplicity, we wanted to think about two things – company earnings and valuations.

The chart below shows the US equity index compared to a measure of corporate earnings. The lines don’t align exactly, but the basic message seems clear – if companies grow their earnings over time, their aggregate value goes up. The stories actually need to translate into something tangible.

And for the sake of completeness, here’s the same chart for Emerging Market equities – where the earnings picture has been more mixed. Again, the lines don’t match precisely, but they do tell a similar story.

Let’s look at the earnings across the four markets over time. As expected, US companies have grown their earnings faster than their peers over the past decade, while Emerging Markets have been the relative laggard. UK earnings are also quite interesting – delivering better results than you might have expected, but also proving more volatile during COVID.

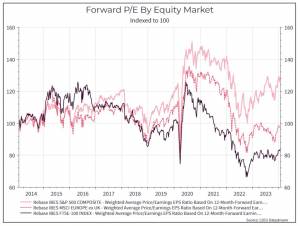

But the performance of US equities hasn’t just been down to stronger earnings. Relative valuation has also played a role. The chart below shows how the forward Price / Earnings ratio for the US, UK and Europe Ex-UK has changed over the past decade (taking February 2014 as the starting point). There are a few interesting points. First, there has been significant divergence since COVID – with US equities re-rating relative to the UK and Europe. We’d argue that this reflects optimism about the tech sector in the US (which is a heavyweight in the index) and the generally stronger growth outlook. Second, the de-rating of the UK is notable, looking some 20% cheaper on this metric than it was back in 2014.

So the combination of sustainably stronger earnings growth and higher valuations have helped propel US equities ahead of their global peers over the past decade. How should we think about the future? As always, it’s a bit of a mixed bag. US equity valuations are relatively higher compared to their developed market peers. That’s been true for a long time. At some point it will matter, but it’s always tough to time when that will be. At the same time, their earnings outlook is also probably better – even if it is driven by a relatively small number of large tech companies. Is that earnings momentum set to continue? At the moment it looks likely. Betting too aggressively against US equities has historically been a difficult game to play.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.