By Richard Flax, Chief Investment Officer at Moneyfarm

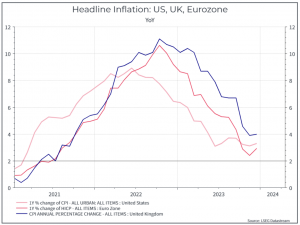

Inflation dominated the economic headlines again this week. December inflation prints showed a slight pick-up year on year, compared to the November numbers (see chart below). The results were also a little higher than economists had been forecasting.

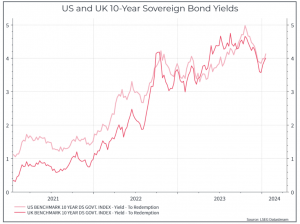

Coincidentally (or not) a number of Central Bankers in the US and the Eurozone came out to say that markets were getting ahead of themselves; that policy rates will come down this year (most likely), but not perhaps at the speed that some investors had been expecting. That has prompted government bond yields to move higher since the start of the year.

It’s a reminder that while inflation should continue to drift down towards Central Banks’ 2% target, it probably won’t be a smooth process. The ‘last mile’ to 2% could be challenging. Market expectations for policy rates can move around quite a bit over a short time period and timing these moves is very difficult.

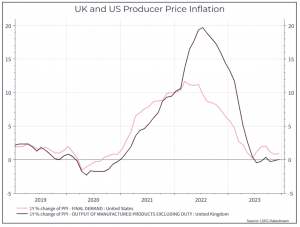

It wasn’t all bad news on the inflation front. Producer price inflation in both the US and the UK came in lower than expected. You’d think that should feed into lower consumer price inflation over time.

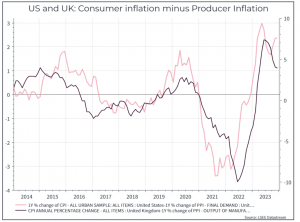

The difference between annual Consumer inflation and Producer inflation can be quite volatile, but it’s currently still well above the average for the past decade.

So we continue to think that inflation will drift lower as higher rates hit consumer demand. We think we’re already seeing that impact in the UK – where retail sales for last month were much weaker than expected. But it will take some time and Central Bankers will likely err on the side of caution. We think we’ll see the first rate cuts around the middle of the year, depending on the state of the economy.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

Richard Flax: Richard is the Chief Investment Officer at Moneyfarm. He joined the company in 2016. He is responsible for all aspects of portfolio management and portfolio construction. Prior to joining Moneyfarm, Richard worked in London as an equity analyst and portfolio manager at PIMCO and Goldman Sachs Asset Management, and as a fixed-income analyst at Fleming Asset Management. Richard began his career in finance in the mid-1990s in the global economics team at Morgan Stanley in New York. He has a BA from Cambridge University in History, an MA from Johns Hopkins University in International Relations and Economics, and an MBA from Columbia University Graduate School of Business. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.