In 2019, Italy signed a memorandum of understanding with China related to the new Silk Road and the Belt and Road Initiative (BRI). Since then, several governments have come and gone in Italy, leading up to the one presided over by Prime Minister Giorgia Meloni. There have also been political changes, with shifts in the geopolitical landscape of major Western countries. In the United States, Joe Biden took the reins of the world’s largest economy after Donald Trump, and relations with China changed further, especially after the Dragon’s lack of response following the invasion of Russia in Ukraine. In 2023, these two superpowers clashed in the fields of chips and semiconductors, and in recent months, Biden, reflecting the level of tension, referred to Chinese President Xi Jinping as a dictator.

It is in this geopolitical scenario that there have been press reports about Italy’s decision not to renew the Memorandum on the Silk Road. It’s worth noting that Italy was the only G7 country to have signed the agreement in 2019, a decision that goes against the stance that the NATO bloc wants to take towards China.

While the decision not to renew the agreement carries significant political weight, can we expect economic repercussions, and if so, what kind?

The answer is not simple because the Memorandum is an agreement oriented towards the development of long-term commercial and infrastructural projects that are difficult to estimate economically. Therefore, it may be more useful to look back and analyse whether and to what extent Italy has benefited from it in the past four years.

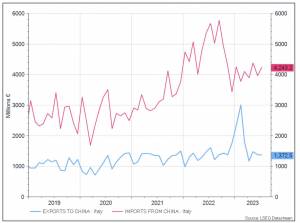

As you can see from Figure 1, imports from China to Italy have increased significantly since 2019, with substantial increases, especially in 2021, and a noticeable upward trend in 2023. On the other hand, Italian exports to China have remained relatively unchanged during the same period. This dynamic certainly favours China, resulting in a trade surplus for China in its trade with Italy.

Figure 1 – Historical series from 12/31/2018 of Italy’s imports and exports to China.

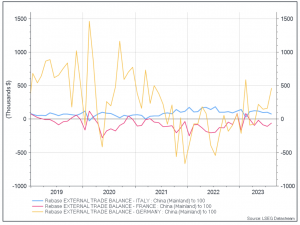

Comparing the trade balances of Italy, France, and Germany over the same period is interesting to see if and how the Silk Road Memorandum has influenced Italy compared to other EU countries that did not sign the document with China.

As shown in Figure 2, using data from the National Bureau of Statistics of China on trade balances, from the Chinese perspective, the trade balances of Italy and France have remained relatively stable during the period in question, while Germany’s trade balance shows greater volatility. In the period between 2021 and 2022, it can also be noted that Germany’s trade balance went into negative territory due to increased exports to China, a dynamic not observed in France and, especially, Italy despite the signing of the Memorandum.

Figure 2 – Historical series of trade balances with China for Italy, France, and Germany, indexed at 100 starting from 12/31/2018.

From this perspective, it could be argued that the BRI has not had significant impacts on Italy. Instead, it can be said that since the beginning of this “collaboration” through the signing of the Memorandum, China has been the country that has reaped the most benefits, and it has not even led to the development of a privileged commercial relationship. Supporting this thesis are Foreign Direct Investment (FDI) data published by Rhodium Group, which show that Chinese investments in Italy have dropped drastically in recent years, from $650 million in 2019 to $33 million in 2021, data also influenced by the COVID-19 pandemic.

In any case, regardless of whether the BRI has had a commercial impact or not, economic relations between China and Italy are deep-rooted, with China accounting for 9% of Italy’s imports and 4% of its exports overall. For this reason, the situation is delicate, and any political repercussions resulting from the non-ratification of the memorandum could have economic repercussions that need to be closely monitored.

Davide Petrella: Davide is a Portfolio Manager at Moneyfarm. He earned an MSc in Quantitative Finance from Politecnico of Milan Graduate School of Management and a MSc in Physics at University of Rome La Sapienza. Davide started his career in Anima Sgr in 2017 as Assistant Portfolio Manager in the multi-asset team and then he moved to Allianz Italy in the ALM & Strategic Asset Allocation team. From January 2022 to January 2023 he worked as Quantitative Analyst in the Fixed Income Boutique of Vontobel Asset Management in Zurich, working closely with Portfolio Managers in order to build quantitative front-office solutions for the boutique.

Davide Petrella: Davide is a Portfolio Manager at Moneyfarm. He earned an MSc in Quantitative Finance from Politecnico of Milan Graduate School of Management and a MSc in Physics at University of Rome La Sapienza. Davide started his career in Anima Sgr in 2017 as Assistant Portfolio Manager in the multi-asset team and then he moved to Allianz Italy in the ALM & Strategic Asset Allocation team. From January 2022 to January 2023 he worked as Quantitative Analyst in the Fixed Income Boutique of Vontobel Asset Management in Zurich, working closely with Portfolio Managers in order to build quantitative front-office solutions for the boutique.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.