During the 1980s, Japan experienced an unrivalled economic boom, fueled by soaring property and stock prices, following the familiar upward trajectory the country had experienced in the decades following the war. But this boom was short-lived and, in the early 1990s, the bubble eventually burst.

Asset values declined sharply, resulting in widespread bankruptcy, high levels of bad debt and a marked decline in consumer spending and investment. By the mid-90s banks were grappling with increasing amounts in non-performing loans, severely limiting liquidity in the market and hampering banks’ ability to stimulate economic growth.

These were the unique set of economic circumstances that characterised Japan’s so-called ‘Lost Decade’ from the early 1990s to the early 2000s. Growth was sluggish – at best around 1% GDP; at worst, rates were negative. Deflation, meanwhile, spiralled as unemployment rates soared to almost 5% and consumer sentiment plummeted.

This was all a significant departure from the high growth rates Japan had enjoyed in the immediate post-war era.

To combat the prolonged economic slump, the government and BoJ implemented a variety of stimulus packages (including QE), monetary policies and attempted structural reforms. While these measures eventually contributed to Japan’s eventual recovery, deflation stubbornly persisted, with CPI reaching a negative growth of -1.6% in 1999.

The economy gradually recovered, but progress was glacial. The world’s third-largest economy has experienced only moderate growth since 2000 but has also shown signs of its resilience and adaptability. Unemployment has remained low ever since and the country remains a global leader in technology and innovation. Tokyo, meanwhile, has made concerted efforts to diversify its trading relationships and expand into new export markets. But the ‘Lost Decade’ has left a lasting impact that still shapes Japanese economic policy today and lingers long in the memory of investors.

Surviving deflation…

In recent years, Japan has been struggling with persistent deflation. Since the second half of 2015, the annual change in the Consumer Price Index (CPI) has remained consistently below the target rate of 2%, prompting the Bank of Japan to implement extraordinary and ultra-expansive monetary measures.

Fig 1. Japan CPI (Consumer Price Index) and Core CPI YoY % Change

Japan introduced quantitative easing (QE) for the first time, which involves the central bank purchasing government bonds to inject liquidity into the economy to combat domestic deflation, in the early 2000s, and then resumed its use starting from 2010. In addition to QE, to give a boost to credit lending, in 2013, the Governor of the Bank of Japan, Haruhiko Kuroda, further lowered the reference rate to -0.1%, taking it into negative territory. As known, Central Bank interest rates have a stronger impact on the short end of the yield curve hence, when faced with the need to introduce an additional expansionary measure to control the long end of the government bond yield curve, Japan decided to use another tool at its disposal: Yield Curve Control (YCC). YCC essentially involves setting a target reference yield for 10-year government bonds and allowing it to move within a specific range. If the yield exceeds the upper limit of the range, the Bank of Japan intervenes with targeted purchases of government bonds to bring the yield back within the desired range. The same is done in reverse when the yield falls below the lower limit.

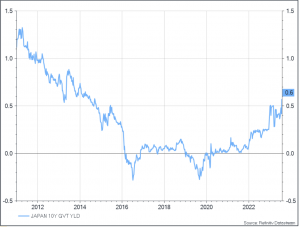

Fig 2. Japan Government Benchmark Bid Yield 10 Years

This control mechanism of the government bond yield curve proved only partially effective in stimulating the economy and it was sustainable until a few months ago, then something changed.

What if inflation arrives unexpectedly?

As is now known to everyone, 2022 brought back something that had been absent for years in the economies of developed countries: inflation. Due to the supply chain shocks related to the Covid-19 pandemic and, above all, the Russia-Ukraine conflict, commodity prices experienced a historic surge in a very short period.

This type of inflation, resulting from supply shortages, spilled over into consumer prices, forcing central banks to quickly raise their interest rates in an attempt to tame inflation dynamics and bring them back under control towards the 2% target. Did the same happen in Japan? Not quite.

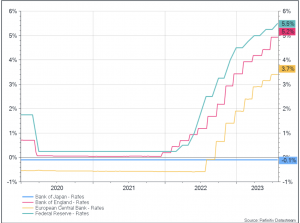

Although inflation returned after years of subdued levels also in the Land of the Rising Sun, the Bank of Japan decided to respond quite differently compared to the US, Europe, and the UK. What did the Bank of Japan do to counter it? Well, practically nothing.

After years of suffering from extremely low inflation despite expansive policies, the Bank of Japan chose not to fight the inflation surge with the hope of taming it in due time and eventually reaching the long-elusive 2% target.

What about markets?

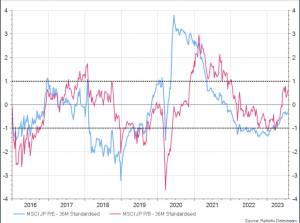

Fig 3. 36-month standardised trailing P/E (Price/Earnings ratio) and P/B (Price to Book ratio) for MSCI Japan

The Japanese stock market has delivered the best performance among developed countries since the beginning of the year, reaching levels not seen since the early 1990s. The Nikkei 225, at the time of writing, records a year-to-date return of 28.29% in local currency.

What were the causes of this rally? Primarily, two factors contributed to it.

Firstly, the interest rate differential between Japan and the US (currently at -5.6%) has led to a significant depreciation of the Yen against the US Dollar and other major currencies like the Euro and the Pound. As a result, Japanese assets have become cheaper for non-Yen-based investors, leading to a strong influx of capital from abroad.

Fig 4. Year-to-date performance of MSCI Japan (in JPY) and JPYSUD

The second factor behind the bullish movement is related to fundamental equity valuations. Our analysis indicates that at the beginning of 2023, the 36-month standardised values of the Price to Book (P/B) ratio and the Price-Earnings (P/E) ratio were below the historical average by one standard deviation, making the asset class attractive to investors.

But what’s happening now?

After months of observation, the Bank of Japan appears ready to take action to adjust its ultra-expansive monetary policy.

In recent months, inflation in Japan has reached levels exceeding 4%, with the Core component, which excludes food and energy prices, showing no signs of slowing down. The increase in the cost of living has put pressure on nominal wages, which, as of May 2023, have risen by 1.8% compared to the previous year, helping to preserve citizens’ purchasing power and gradually transforming supply-driven inflation from 2022 into demand-driven inflation, despite a slight, but continuous, decline in real wages (-1.2% YoY in May 2023). The depreciation of the Yen has also negatively impacted the trade balance, with imports down by 12.90% compared to May 2022.

Concerned about the risk of a rate hike, the market has started to test the upper limit of +0.5% defined by YCC on 10-year government bonds, putting pressure on the Bank of Japan’s new Governor, Kazuo Ueda. As a response, the Bank of Japan has recently announced an easing of its yield curve control policy by expanding the range for the movement of the 10-year yield, from ±0.5% to ±1.0%, in order to relieve the pressures from investors. However, this is not all, as Ueda openly discussed the possibility of raising interest rates in the near future, which have been steadily negative for years, but not before being sure that Japan’s 2% inflation target is stable and sustainable.

Fig 5. Main central banks’ main interest rate time series

What to expect in the markets?

Given the direction of monetary policy, the outlook for Japanese government bonds does not appear to be rosy. The relaxation of YCC and the change in expectations regarding possible future rate hikes do not bode well for Japanese bonds in the short and medium term. The 10-year yield recently broke the resistance level of +0.5%, currently standing at +0.646%, the highest value since 2014.

As for equities, the situation is slightly different. Despite the rally in 2023 and the relative deterioration of valuations, we believe that there may still be short-term value. The expected GDP growth in Japan, at 0.3% for Q3 2023 and 0.2% for Q4 2023, keeps potential recessionary concerns at bay. Additionally, the fluctuating performance of Japanese stock indices in recent decades means that Japan remains relatively underweighted in many institutional portfolios, and thus, there could be a lag of inflows that could generate further positive inertia for the asset class in the short term.

The yen, which in recent months has been an obvious choice as the funding currency for carry trades, is poised to experience a bullish trend of relative appreciation compared to other currencies, which could be characterised by significant volatility. This could erode the returns for all investors who have financed themselves in yen only to channel them into risk assets in USD or other currencies. Currently, the interest rate differential between the yen and the US dollar does not raise concerns, but a prospective change in the scenario of Japanese interest rates would make the yen less appealing as a funding currency, thereby altering the liquidity balances within the financial system with potential marginal repercussions on risky assets clouding the medium-term outlook.

Moreover, it is essential to keep in mind that the upward revision of YCC, coupled with a potential rate hike in the near future, reduces the previously experienced push on stock markets. Consequently, we believe that the best approach is to remain prudent and continue to maintain a well-diversified portfolio.

Davide Petrella: Davide is a Portfolio Manager at Moneyfarm. He earned an MSc in Quantitative Finance from Politecnico of Milan Graduate School of Management and a MSc in Physics at University of Rome La Sapienza. Davide started his career in Anima Sgr in 2017 as Assistant Portfolio Manager in the multi-asset team and then he moved to Allianz Italy in the ALM & Strategic Asset Allocation team. From January 2022 to January 2023 he worked as Quantitative Analyst in the Fixed Income Boutique of Vontobel Asset Management in Zurich, working closely with Portfolio Managers in order to build quantitative front-office solutions for the boutique.

Davide Petrella: Davide is a Portfolio Manager at Moneyfarm. He earned an MSc in Quantitative Finance from Politecnico of Milan Graduate School of Management and a MSc in Physics at University of Rome La Sapienza. Davide started his career in Anima Sgr in 2017 as Assistant Portfolio Manager in the multi-asset team and then he moved to Allianz Italy in the ALM & Strategic Asset Allocation team. From January 2022 to January 2023 he worked as Quantitative Analyst in the Fixed Income Boutique of Vontobel Asset Management in Zurich, working closely with Portfolio Managers in order to build quantitative front-office solutions for the boutique.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.