High inflation, restrictive monetary policy decisions and increased volatility. This is, in a nutshell, the new reality we find ourselves living in, described in the US by the newly-coined phrase “higher for longer”, meaning we’ll see higher interest rates over a longer period.

Previously, when we talked about “lower for longer”, i.e., low interest rates for a long period, we now find ourselves immersed in a diametrically opposed situation. So, what are the macro implications? What are the consequences for the investment world, and does a multi-asset approach still make sense in this context?

Investors’ concerns

The first concern for investors is that something in the financial system could break. This constant search for a new balance by central banks has started to show some cracks in the system, and eventually, something could start to crumble, as happened in March with the mini banking crisis, with the Silicon Valley Bank hit by losses on its mortgage-backed security portfolios due to soaring interest rates. Fortunately, this time the regulations put in place after the global financial crisis of 2008 worked and no bank suffered significant damage.

The second concern for investors, especially after the banking crisis, relates to the tightening of the credit cycle, which could exert further downward pressure on borrowing. Interestingly, US data for April, the latest available according to the latest quarterly report from the Fed, is surprisingly not worse than the previous quarter (given the banking crisis). This indicates that, although credit conditions remain very restrictive, the worst may be behind us. European data also seems somewhat reassuring, with our summary time series based on Eurozone bank lending standards suggesting improvement in both past data and future expectations.

Banks and mortgages

As a result, we now see mortgages skyrocketing. According to forecasts by major European banks, fixed-rate mortgages are expected to double, while monthly payments for variable-rate mortgages are set to increase by up to 60%. What are the consequences? Currently, in Italy, there are 14.9 billion euros in unpaid mortgage payments, and among the reasons for insolvency we see include the increased cost of borrowing, rising interest rates, and inflation. Bank of Italy data leaves little to the imagination. Interest rates in March were at 4.36%, up from 4.12% in February and 3.95% in January. Furthermore, the APR on new credit disbursements increased to 10.12% (compared to 9.8% in February), and interest rates on loans to non-financial corporations also rose from 4.3% to 3.55% the previous month.

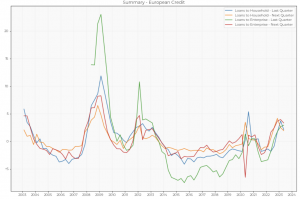

As for loans, the situation does not improve. As we can see in the graph below, the situation has not improved for both households and businesses. The positive aspect is that, compared to the past, there have been no deteriorations. This indicates that the search for balance by the ECB and Fed is still ongoing, and the battle is not yet lost.

Going into specifics in the world of loans, we can observe that according to the latest data from the ECB, restrictive monetary policy is having negative effects on loans. In the eurozone, loans have experienced a slowdown. The ECB’s unprecedented increase in interest rates over the past year has weakened demand for bank credit, consequently leading to a slowdown in consumption, in real estate and construction.

What to expect?

Overall, it’s difficult to draw conclusions about the impact that higher rates for a longer period could have, although it is likely that they will continue to weigh on economic growth and, to a lesser extent, financial stability. This is one of the main reasons why our portfolio positions remain relatively conservative. It is also challenging to determine how risky assets will perform in such a context and which asset class will have the best performance.

However, we believe there are two key points that investors should keep in mind:

- 1.Bonds finally make sense again. After years of zero yields, even short-term government bonds offer attractive interest rates, making them even more appealing to investors. In this sense, the multi-asset approach is more powerful than ever. “Higher for longer” implies a more hawkish and likely challenging environment, where diversification is crucial, especially with rates now at elevated levels. However, the narrative could change rapidly in the event of an economic or financial crisis.

- 2. Markets do not necessarily trust central banks and may assess a different number of rate hikes/cuts. In this case, clearly, the “higher for longer” narrative is even less daunting for markets, as it may not be reflected in asset prices.

Therefore, while it is true that markets do not expect rate cuts for this year, it is equally true that lower rates are expected as early as the first half of next year, both in the United States and in Europe.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

Giorgio Broggi: Giorgio joined Moneyfarm as a Quantitative Analyst in December 2021 and he is a member of the Investment Committee. Prior to joining the company, he worked at Barclays Wealth Management and S&P Market Intelligence, gaining expertise in Funds Research and ESG Investing. Before starting his professional life, he successfully completed a double-degree at Eada and EDHEC Business School, obtaining two Masters in Finance and specialising in factor investing and portfolio construction. He is a CFA charterholder.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.