The last few days have seen markets shaken by Silicon Valley Bank’s (SVB) demise, the Californian institute that built its business serving the start-up ecosystem and that today is in receivership and looking for a ‘white-knight’ buyer.

The bank was victim of a bank run that led to its insolvency. The story has made headlines around the world for the direct market consequences of the crisis but, perhaps most importantly, for fears of contagion that could have potentially involved both the global banking system and the tech sector (a risk that was immediately averted by Fed’s intervention).

We have closely monitored the crisis and we will continue to do so. However, here are our preliminary conclusions:

- Silicon Valley Bank is an institution operating in a very specific environment. Analysis of their balance sheet reveals inadequate diversification and questionable risk management. Therefore, we do not think that it will be symptomatic of a more general problem within the banking system.

- The crisis of confidence matured in the peculiar environment in which the SVB operated (relatively few clients with large account balances). We believe that the countermeasures put in place by regulators should prove sufficient to defuse the situation.

- We deem that the risk of contagion through the interbank channel is negligible.

- Finally, we think that the strong negative market reaction (especially in Europe) should be seen in light of the positive sentiment that the sector experienced over the last two months with many investors likely profit taking rather than panic selling.

Beyond this crisis, we believe that the banking and financial sector deserve special attention and the Fed will have to take into account the current environment prior to making new monetary policy decisions regarding inflation. In the aftermath of SVB’s fall, the market is pricing in at a higher probability of a 25 basis point hike at the next meeting (from an almost certain 50 basis points pre-SVB crash).

Silicon Valley Bank (SVB): the story

Silicon Valley Bank was founded in 1983 by Bill Biggerstaff and Robert Medearis during a poker game. The first office was opened in 1983 in San Jose (California) and, two years later, the Paolo Alto office was inaugurated. In 1986, SVB merged with National InterCity Bancorp and opened an office in Santa Clara. In 1988, SVB completed its IPO raising $6 million in 1990 and inaugurated its first office near Boston to serve Route 128 technology corridor (the Northern California Silicon Valley in the 70s and Route 128 in the Boston area had attracted international praise as a pioneering world centre for electronic innovation).

After expanding overseas in 2004 (with the opening of its India, London, Beijing and Israel branches), in 2012 there was the 50-50 joint venture with the Shanghai Pudong Development Bank to provide capital to start-up technology entrepreneurs in China. In 2015, SVB provided banking and financial services to 65% of all start-ups.

What happened?

The SVB was one of the largest US banks with around $210 billion in assets, making it the 18th largest lender in the US. SVB rode the wave of successful start-up investing in 2021 with its deposits increasing from $102 to $189 billion. The bank, in search of returns, decided to invest $120 billion in long-term government bonds, and Mortgage Backed Securities (totalling $91 billion in fixed-rate bonds). This choice exposed SVB to heavy losses, given Fed’s aggressive rate hikes that brought down the value of bonds, causing the bank to lose several billion dollars on these holdings.

In early March, SVB announced a 1.8 billion loss and decided to conduct a capital increase of 2.25 billion to try to shore up their balance sheet. This capital raise, however, was unsuccessful and caused a crisis of confidence from investors and depositors, precipitating a run on the bank.. This resulted in the withdrawal of 42 billion (during the first half of the day on March 9 2023) leaving the bank with a negative cash balance of approximately $958 billion at markets close. Regulators stepped in to halt the outflows, and the bank was taken into receivership. As well as Silicon Valley Bank’s there were two more failures: Signature Banks and the smaller Silvergate Bank, known for its close ties to the cryptocurrency community.

A systemic problem?

As investors, the first question we should ask ourselves is whether SVB’s case (and that of the other banks involved) reveals weakness in the banking system at large, particularly if it involves larger players. To answer, a closer analysis of SVB’s assets and financial statements is required.

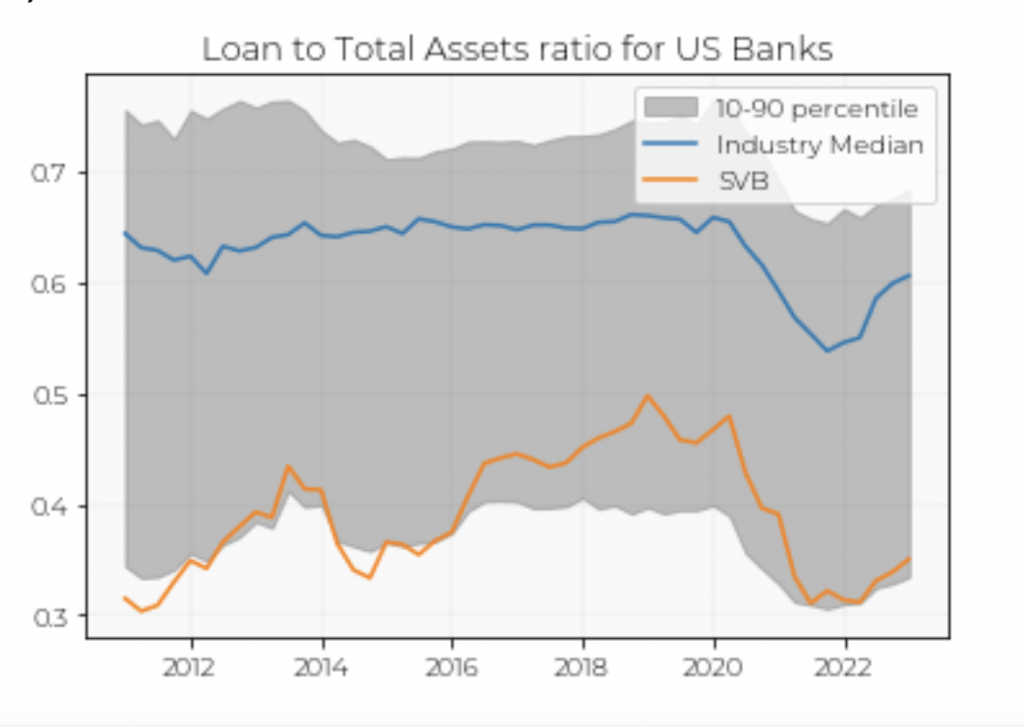

Let’s start with the assets side. SVB is a bank that decided to invest most of its assets in financial securities rather than in the traditional business of banks, loans (of various sorts). The graph, which measures the ratio of loans to securities purchased for the US banking industry, shows how SVB (orange line) has taken this ratio to an extreme compared to industry standards.

Investing in securities rather than landing is not inherently problematic, yet it differentiates the bank’s risk exposure compared to the sector generally, which is good news when considering whether the SVB crisis might have systemic implications.

A second interesting data point on SVB positioning comes from the analysis of its bond portfolio, which was ultimately accountable for the crisis. Within this portfolio, worth $120 billion, there was limited diversification with a large portion invested in MBS (mortgage-backed securities – financial instruments that use mortgages as collateral).

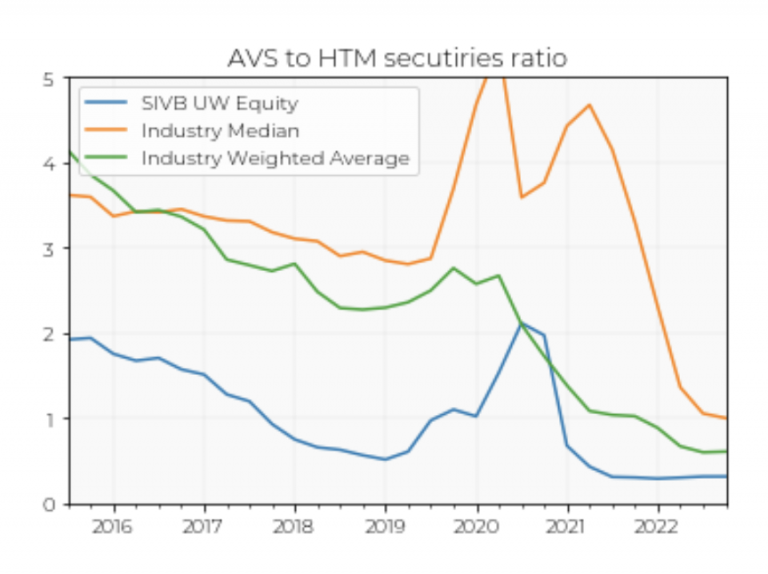

Another peculiarity is the fact of having the majority of these assets held on the balance sheet as Held to Maturity. When fixed income securities are held to maturity, their value and face value is unaffected by factors such as interest rate moves. However, if a bank experiences a liquidity crisis (as happened to SVB) and it is forced to sell these HTM assets, then the bank must realise a loss (as they are held on the balance sheet at a higher value than what they could be sold for today). As is shown in the graph below (the ratio of Held to Maturity assets to Available for Sales assets), SVB (blue line) had chosen to hold a much larger percentage than the industry average (green and orange lines).

This choice hid the bank’s exposure to interest rate risk and left the institution with a significant number of “unrealised losses” that masked its capital adequacy.

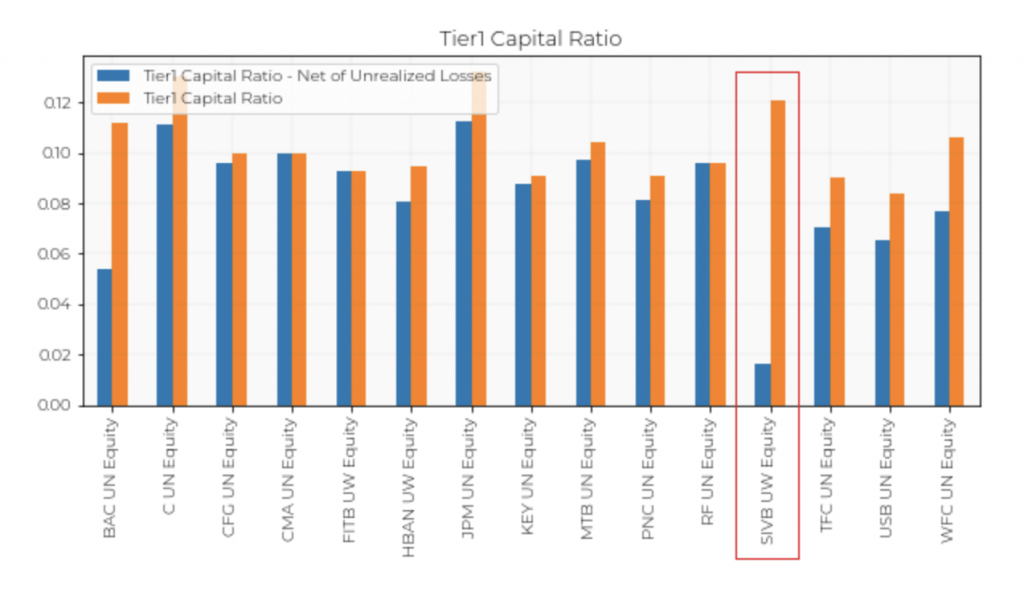

If we look at the capital ratios of the largest American banks, we notice how SVB (taking into account any realised losses – blue bar compared to orange bar) is at the bottom of the ranking with a Tier1 capital ratio of less than 2%.

In short, this tells us that SVB’s issues can largely be explained by a mix of excessive geographical and sectoral concentration, a questionable attitude to risk management, and careless financial and accounting decisions (such as the decision to not hedge some of these risks). Our basic view is that the problems at SVB aren’t unique, but SVBs business made it much more susceptible to a bank run. The problems are a function of banks having lots of deposits and investing them in longer-dated bonds. Those bonds fell in value as interest rates rose and effectively eroded the bank’s capital cushion. Most banks face this issue these days, but SVB had a less stable deposit base and a higher proportion of those bonds. These factors do not suggest that there is a direct and systematic risk for the banking system in relation to the Federal Reserve rate hikes.

So, it’s all sorted? Not so much. Equity markets are still falling and government bonds are still rallying – clearly not everyone is delighted. It’s hardly cause for celebration that Central Banks have had to ride to the rescue again, and investors are rightly asking where else there might be risks hiding in plain sight. On balance we think that the financial system looks ok.

We think there is differentiation between the strong (say JP Morgan) and the weak (SVB, First Republic) and that’s good news. But we think it’ll take some time for investors to gain comfort that the problems at SVB are contained. There are good historical reasons for that. The Financial Crisis of 2008 possibly began (depending on who you ask) with the failure of a couple of hedge funds at Bear Stearns – and at the outset it was argued that the problem was contained.

Where are we at: Fed’s latest moves

When financial crises are triggered by panic, it is the regulators and the state’s tasks to restore trust in the system to avoid the wave of fear affecting other, perhaps well-capitalised, institutions. “No losses will be borne by taxpayers” said Joe Biden, specifying how Silicon Valley Bank depositors will be fully and immediately repaid, and how stricter rules for banks will be deployed. The package of measures was managed by the US treasury, the Federal Reserve and FDIC (Federal Deposit Insurance Corporation). The package that Fed and FDIC put in place (which effectively guarantees all SVB deposits) includes measures that allow the Fed to finance struggling banks by lending liquidity against the par value of assets regardless of the current value. This has two objectives. On the one hand, to support the bank’s customers and, on the other, reassure companies and international observers of the solidity of the American banking system.

In the UK, HSBC has bought SVB UK – for £1 and presumably a commitment to fill whatever gap there is between the assets and liabilities. That’s probably a neater solution than the US version. It doesn’t involve government / Central Bank involvement, at least explicitly, and we don’t need to have long debates about moral hazard. The reason that it’s neater is presumably because, despite all the claims of how important it is for the UKs innovation hub, SVB UK isn’t very big and so HSBC didn’t need to try too hard to fill the gap. HSBC also has a large market share in the UK and would probably never be allowed to buy another bank in the UK under normal circumstances. But if you want to do a deal over a weekend, those are the compromises you need to make.

Will these moves prove successful in appeasing the panic? It is too early to say, yet what we can confidently say is that the SVB incident does not pose the threat of systematic contagion throughout the banking sector. The financial system, (the system of loans and interdependence between the various institutions) is stronger and less connected than it was at the time of the 2008 crisis. Moreover, as we have discussed, SVB had a unique risk profile. The Fed plays a much more crucial role today in ensuring liquidity to the banking system now and, as of today, we do not see institutions directly exposed to the fallout There is also the issue of trust and public confidence in the sector. However, we believe that Fed’s intervention will help restore calm to the market.

From Moneyfarm’s perspective, we will keep monitoring the situation and evaluating possible impacts on monetary policy on the eve of US inflation data, which will show us whether the Fed has room to manoeuvre in relieving pressure on the system. The situation makes life harder for Central Banks. Inflation is still elevated, but the consequences of higher rates for the financial system are becoming clearer. As a result, markets expect the Fed to tighten less than they thought only a couple of weeks ago. It seems reasonable to assume that Central Banks will tolerate higher inflation for longer if the alternative is significant stress in the financial system.

Finally, we’d guess that volatility will remain elevated. The fear of the unknown is still too great, even if the Fed has moved swiftly to try to reduce the risk. There are a range of interesting questions – not least around the impact on the real economy. Will we see a slowdown in activity now, with SVB acting as a catalyst? Could this prompt inflation to slow faster? On balance, we’d guess not, but it’s something to keep in mind.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.