The below is an extract from Monefarm’s Strategic Asset Allocation 2023 document. Read the full report here and the video presentation here.

Last year was a nerve-wracking year for investors. During volatile times and extreme market conditions it is easy to focus on what went wrong and lose perspective. We think that using Strategic Asset Allocation is the perfect tool to avoid getting influenced by market news and focus on the future.

A few months ago, we asked some of our customers about their main worries regarding their investments. There were several concerns that we’ve highlighted below and answered. We don’t have a crystal ball to look into the future (nobody does of course). However, we are confident that we can give investors the navigational tools to cruise the next few months and help them look more confidently ahead.

How long will the recovery take?

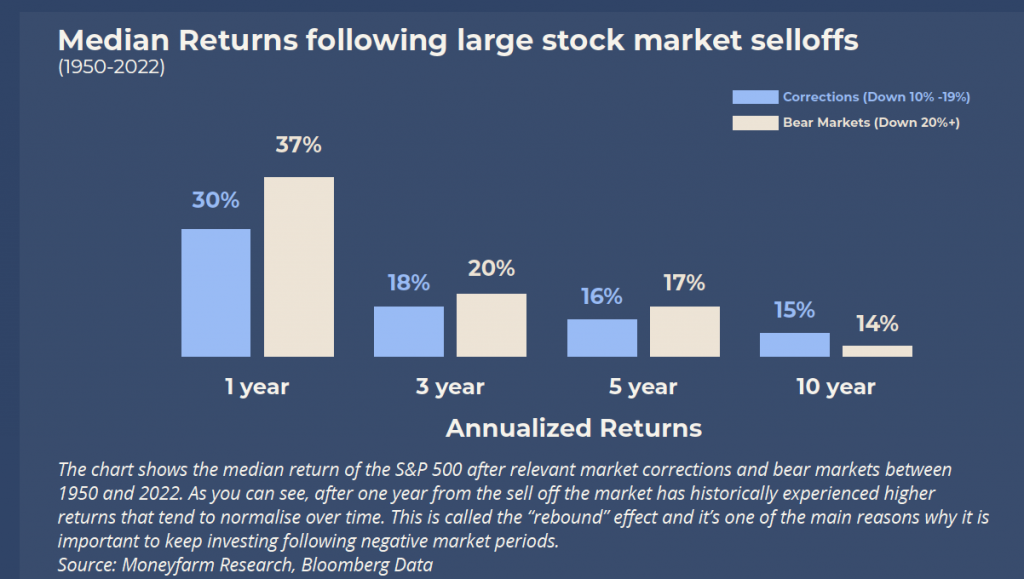

Over the last few decades, stock markets have had plenty of bear and bull runs. A bear market, by definition, is a fall of 20% or more while falls between 10%-20% are considered merely a correction. Historically, markets tend to have stronger performances after bear markets rather than corrections.

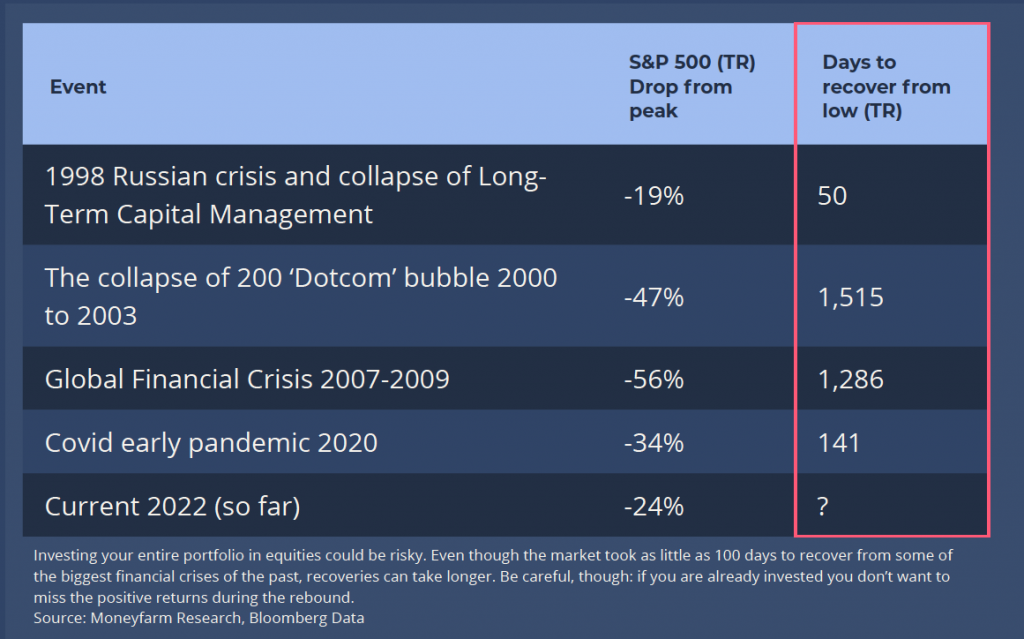

When it comes to recovering from a market downturn, risk management and diversification are key. In some cases, a recovery can take quite a long time, particularly if the portfolio is not diversified and 100% invested in US equity funds, for example.

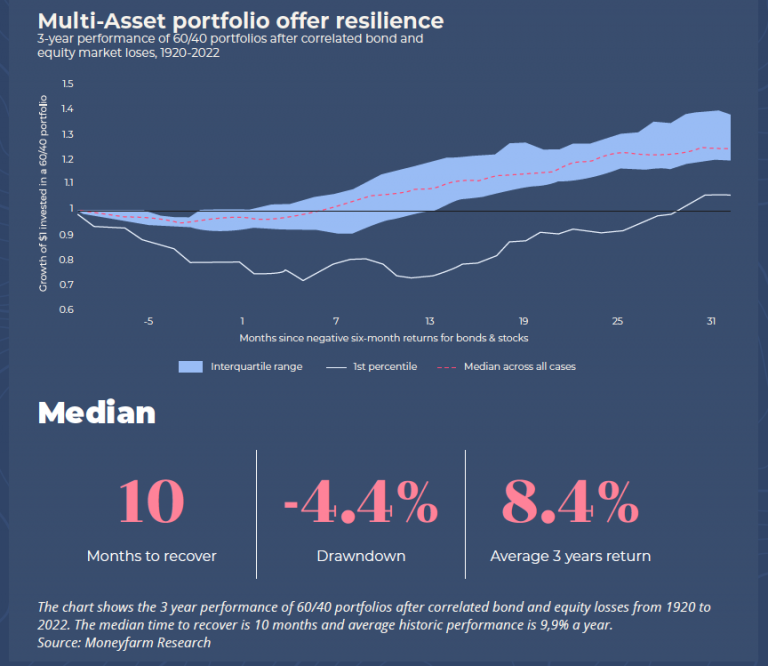

Recovery can typically take as long as four years if we look at the last four financial crises. But this all really depends on the structure of your portfolio. After particularly bad years, where both equities and bonds generated a loss (as is the case

in 2022), multi-asset portfolios tend to recover more quickly and, in the majority of the cases, it takes them less than 10 months to break even.

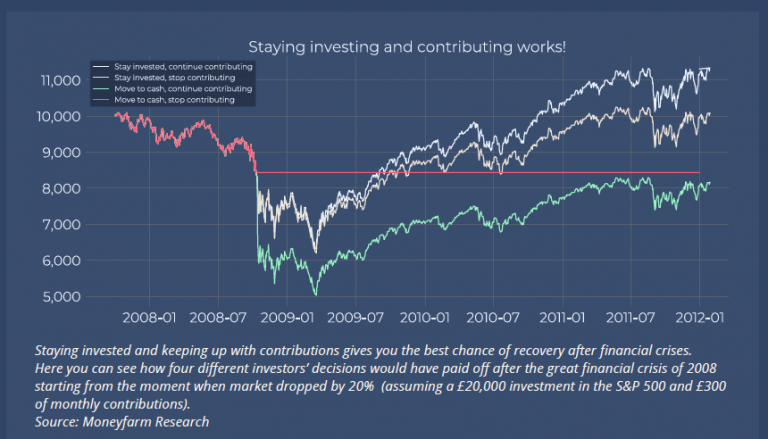

Things look even better for investors who stay invested and keep on contributing to existing investments. We know this is not always possible but it really is the best strategy to adopt even during volatile market conditions. An investor that makes regular contributions but who disinvests after the first 20% drop of a 70/30 portfolio during the Global Financial

Crisis (GFC) would typically take one extra year to break even, and would have missed around 30% of cumulative profit by then.

The natural conclusion from this analysis is that it’s best to hold on and be patient. Moneyfarm acknowledges that investing during a downturn can be extremely stressful. However, historically, the easiest way to recover has been to remain invested and to keep on contributing to existing investments (if possible).

Will we see returns as high as the ones we have experienced before?

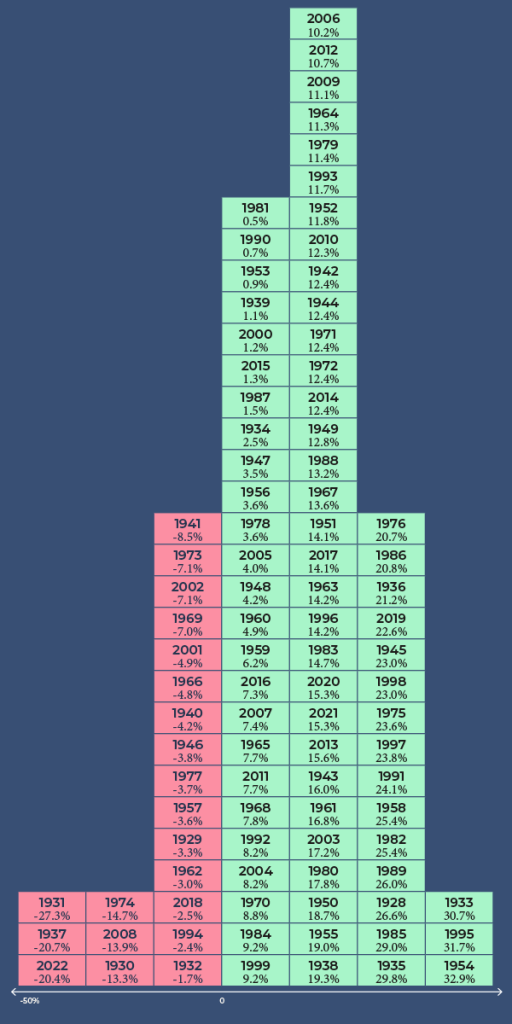

If you were to look over several decades you will notice that there are positive as well as negative years. For instance, 2021 was a year of great performance and, interestingly, it is not an outlier when looking at the past performance of a 60/40 allocation (S&P 500 and US Treasuries).

In contrast, 2022 certainly is an outlier in terms of performance – down 20.4%. However, when you compare the number of positive years to the number of negative ones, statistically it’s more likely that we’ll see more 2021 type returns and not years that perform dismally, like we saw in 2022.

There are no particular reasons to believe that returns will be lower in the future, especially if you also consider that, typically, markets tend to perform extremely well after an exceptional correction such as the one we saw in 2022. Looking at data from 1950 to 2022, a bear market correction is usually followed by an returns averaging 20% per year over the next three years per year. This is positive news for investors but means riding out the volatility first before the good years follow.

What should I do as an investor?

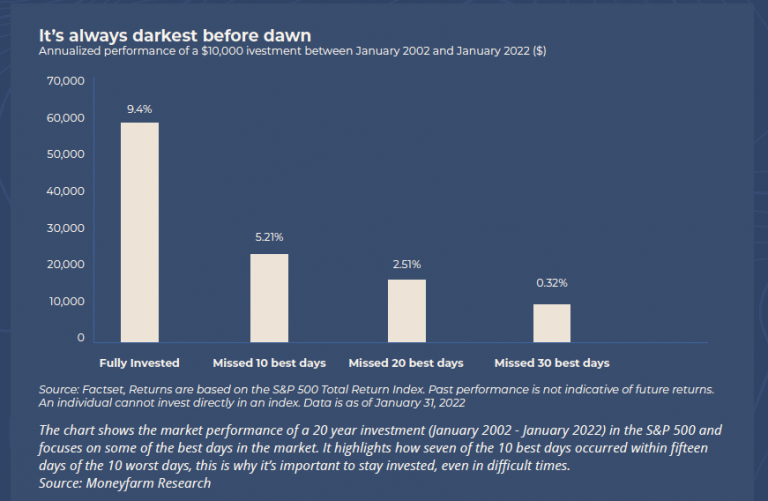

While things may seem volatile, Moneyfarm believes that staying invested (and keeping up with contributions – if possible) is the best strategy. There will always be a reason not to invest or to disinvest, but missing out on markets’ rebounds could be detrimental to achieving your long term financial goals. Missing 10 of the best days, which usually occur within 15 days of the worst 10 days, can halve performance of a portfolio when looking at

the last 20 years.

As can be seen by the above chart, it’s clear that the times where people would’ve chosen “not to invest” would have represented a missed opportunity. From the 2008 financial crisis to the Covid pandemic, markets have always recovered. The reality is that we live in a world that keeps moving forward. The upward trend of the graph demonstrates the simple, inevitable, progress of humanity. Few have the skills and foresight to time markets but if you remain invested you should, ultimately, benefit from the upswing when it happens.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.