What are we talking about? Equity markets have rallied in recent weeks, buoyed by hopes that inflation will fall and peak interest rates won’t go beyond current market expectations. Over the past couple of days, however, we’ve seen stronger than expected data in the US – in economic activity (in the service sector), wage growth and job creation. That’s raised concerns about the trajectory for interest rates, but it also highlights a dilemma that Central Banks face around wage growth. It’s particularly relevant for the UK.

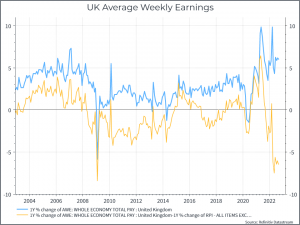

What dilemma? The problem goes something like this. Central Banks want inflation to return to 2% (or say they do). They see wage growth as an important benchmark for keeping inflation around that level. Wage growth, in the UK, is currently running somewhere above 5% – a rate that’s not consistent with the Bank of Englands inflation goals. But inflation is running at 10% – so in real terms, workers are worse off – the cost of living crisis. The chart below illustrates the point – the blue line represents the annual growth in average weekly earnings. The yellow line subtracts annual inflation from that figure. Real wages haven’t fallen so sharply since 2009 – and then only briefly.

Currently the UK is experiencing a wave of industrial actions, as unions try to recoup some of their lost purchasing power. If they fail, their workers will be worse off. If they succeed, there’ll be concerns about rising inflation expectations, and the Bank of England may see the need to keep interest rates higher for longer, with knock-on effects for growth and unemployment. It’s a concern raised recently by Monetary Policy Committee member Catherine Mann.

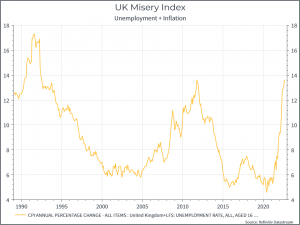

One other way of expressing this problem is in the so-called Misery index – which combines inflation and unemployment. The index is currently at its highest level since the early 1990s, thanks mostly to high inflation. Unemployment has, so far, remained low. But you could envision a situation where rising unemployment partly offsets some declines in inflation.

Where does this get us? It looks set to be a difficult few months in the UK – with slowing growth, higher interest rates and high inflation all putting pressure on UK households. In the short-term, inflation is the key variable. Lower inflation gives the Bank of England a bit more leeway on monetary policy and makes life just a bit easier (but not by much) for households. We’ve seen some signs of improvements elsewhere – in the US and Europe – even if inflation is still far above the 2% target. We’d expect to see something similar in the UK, even if the timing is uncertain. Today it looks like it’ll take some time for British workers to regain the purchasing power they’ve lost over the past year, and the faster they do, perhaps the higher interest rates will need to go.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.