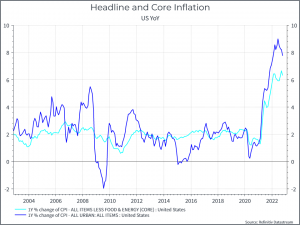

What are we talking about? As we mentioned, financial market participants have been quite focused on US inflation data. Yesterday inflation for October came in at 7.7%, better than economists forecasts. That prompted a sharp rally across bonds and equities, while the dollar weakened.

A bit more detail: US inflation has proven more sticky than many had expected – even when other indicators suggested that inflation should slow. Even when we saw inflation decelerate in September, it did so by less than the market had expected. That prompted more hawkish commentary from the US central bank and expectations for higher policy rates in the future. That, in turn, has weighed on risky assets.

The October release bucked that trend, showing both a deceleration (from 8.2% yoy in September to 7.7% in October) and a better-than-expected result (7.7% vs 7.9% expected). This was true both for headline inflation and core (ie excluding food and energy).

What does it mean? There are a few points to make. First, it’s good news. It suggests that inflation could be beginning to slow. Second, markets appear to believe that this could prompt a “pivot” from the US Central Bank which could mean a lower policy rate than previously expected. That might be a bit premature, given that we’re looking at only a single data point. We’d guess that various Central Bankers will stand up and talk about the ‘long road back to 2% inflation and the importance of not declaring victory / loosening policy too early’. But after months of disappointment on the inflation front, it’s reassuring to see some progress. Third, the sharp moves in financial markets are a bit of a cautionary tale for those trying to trade macro data. You’d infer that there were various market participants betting on a disappointing inflation print, and that prompted a pretty volatile trading day – great if you get it right, not so good, if you’re on the wrong side.

What happens now? There’ll probably be a lot of focus on the latest Fed statements, speeches etc – for any sign of dovishness. We’d guess there won’t be much. Then, it’s back to macro data – and signs that this inflation print is the start of a trend towards weaker demand and a better balance. You shouldn’t put too much emphasis on a single data point, and we expect that markets will remain volatile. But, after a difficult year, it’s good to see some positive news on inflation.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.