What are we talking about? Policy and politics have been key drivers for markets in 2022. With voting in the US mid-term elections in Congress just finished, it’s worth taking stock of what the impact might be?

What do the results show? Usually, the governing party suffers badly at the mid-term elections in the US. And expectations were particularly low for the Democrats given high inflation and a slowing economy. Overall, the preliminary results look better than the Democrats might have feared. But it still looks likely that the Republicans will take control of the House of Representatives and possibly the Senate as well. We probably won’t know who controls the Senate until after the run-off election in Georgia in early December.

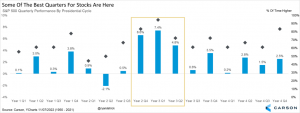

What does history say? History suggests that this period of time (ie end of the second year of a Presidential term) in a Presidential cycle is generally positive for US equities – see the chart below from the Carson Group.

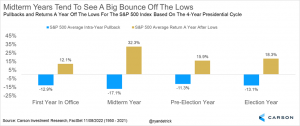

A “gridlock” scenario between a Democrat President and Republican / Split Congress is generally positive for US equity returns (the chart below again from the Carson Group illustrates the point). The logic, we guess, being that if the government can’t interfere too much, the private sector can get on with the business of generating profits.

What’s the caveat? The caveat is the increasingly polarised political environment in the US and, more specifically, the debt ceiling. Congress effectively sets a maximum level for US government debt and, as that debt has increased, Congress has generally raised it over time. But that process hasn’t always been straightforward, particularly recently. There have been occasions, notably in 2011, when the US flirted with a government shutdown or a technical default. It already seems clear that many parts of the Republican party are keen to make the debt ceiling an issue again.

When will it happen? Opinions vary, but sometime in the first half of 2023 seems like a reasonable bet for when the US will reach its debt ceiling.

What does it mean? The easy answer is “risk of increased volatility” in US assets, and probably globally. There are a couple of considerations. You might argue markets are already considering this scenario in some unquantifiable way – after all the Republicans were always projected to retake the House of Representatives. Maybe having a smaller majority than anticipated will give them pause before potentially shutting down the government, mostly out of concern that the electorate will view their actions badly – but today that seems a bit optimistic. All that said, the debt ceiling looks set to be a focus of attention as we head into 2023.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.