In August, the positive momentum seen in markets across July slowed down, with uncertainty creeping in once again.

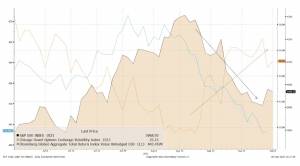

The performance of the main equity markets was negative for the month. The major US index, the S&P 500, lost 5.6%, in line with European stock exchanges, which lost 5.7%. Both Japan and the UK outperformed, thanks to an uptick in rates that rewarded the “value” portion of the equity market. Emerging markets struggled, but a dip of 2.7% was clearly better than that of other developed markets.

Bonds also suffered. The uptick in rates has depressed equity valuations on the one hand and, on the other, compromised the ability of bonds to act as a diversifier. The fall in f commodity prices – -3.8% overall, with oil at -9% and gold at -2.4%, is the final piece of a decidedly subdued puzzle for investors.

There are a few reasons for the dip in performance, but they share a common theme: widespread pessimism about the performance of the economy over the medium-term. More aggressive central banks, geopolitical tensions and resilient earnings estimates have us leaning towards caution for now, despite some attractive equity valuations.

Our positioning

There were signs even in July that we may not want to increase the risk in our portfolios just yet, and the last month has only strengthened that argument. The recent volatility in the markets and the geopolitical developments that surround it are not yet conducive to greater risk exposure.

On the equity side, US and emerging markets stocks are currently more appealing than European ones. On the bond side, given the fact that economic indicators have yet to dramatically slow due to higher interest rates, we are not ready to extend the duration of the portfolios, given the potential for this cycle of rate hikes to sustain for some time yet.

On commodities, we’re evaluating whether or not the negative economic momentum can outweigh the benefits that come with exposure to energy and other inflationary shocks that can cause the rest of the portfolio to dip.