What are we talking about? Non-farm payrolls data in the US is usually a focus of investor attention. The view at the AAT morning meeting before the release was that strong employment data would be taken negatively by financial markets – as a sign that the Fed would need to stay hawkish to slow down demand. What we got was a slightly mixed bag. Headline non farm payrolls looked pretty robust, coming in slightly ahead of expectations. The unemployment rate (3.7% vs 3.5% expected) was a bit higher than expected, we’d guess partly because the labour force participation rate was higher. Nominal wage growth was pretty strong (above 5%), but slightly lower than expectations and negative in real terms. So at first glance, a healthy labour market, but enough signs of moderation (higher unemployment rate, slightly slower than expected hourly earnings growth) to give comfort to investors after a tough week.

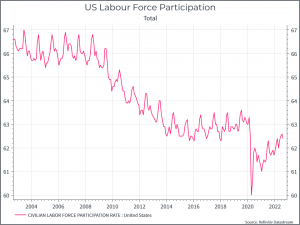

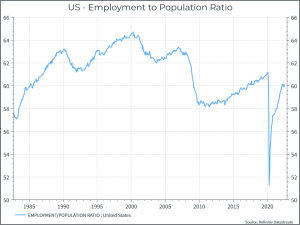

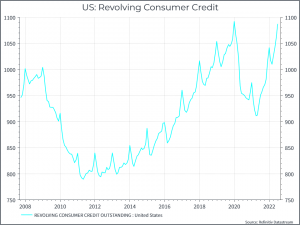

For the data nerds among us, the labour force participation rate is interesting. The first two charts below show US labour force participation and the employment-to-population ratio. They tell a similar story. Employment levels saw a step down after the Global Financial Crisis – and didn’t really recover during the years of tepid economic growth that followed. The pandemic recession saw a sharp drop in the number of employed workers and that figure has recovered, but is still below the pre-pandemic level. The third chart shows revolving credit balances in the US. Here we see a sharp drop during the pandemic, a result of government support and fewer spending opportunities. But we’ve seen a pretty sharp rise over the past year – possibly because some cohorts have run through their savings and are now using credit to fund their purchases, particularly given high inflation. If that’s accurate, you might expect a rise in the number of people actively looking for work over the coming months.

Where does this get us? The labour market still looks solid in the US, but there’s enough in the release to suggest that the labour market will slow in the coming months. Rising credit balances suggest that more people may be attracted / forced back into the labour market in the coming months, which might help improve the supply / demand dynamic further.