What are we talking about? Another day, another inflation discussion. US CPI for July was released today, showing a lower-than-expected increase. Year-on-year inflation came in at 8.5%, still miles away from the Feds 2% target, but better than the expected 8.7% figure that analysts had been looking for. After months of higher-than-expected inflation prints, this constitutes a relief. How long that relief lasts is less clear. Barring further shocks, you’d expect US inflation to slow from here, but that’s already a consensus view, even if the precise trajectory is up for debate. We’d argue that the bigger (negative) surprise would still be if inflation stays higher for longer.

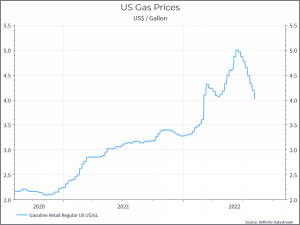

Digging into the details, we can see that lower gasoline prices helped bring down inflation, at least relative to last month. As the chart below shows, gasoline prices are well off their recent highs, but still some way above the level of a year-ago, thanks in large part to Russia’s invasion of Ukraine.

What happens now? We’d guess it goes something like this. First, there’s probably some relief in financial markets – the dollar should weaken a bit. Second, attention will likely turn again to the US Fed. Prior to this release, financial markets were leaning towards another 75 bps hike in September, and various Fed statements seemed to support that view. Could this result prompt a re-evaluation? The immediate answer has been yes. Financial markets went from a 70% probability of a 75 bps hike before the release to around 38% afterwards. Nonetheless, you’d guess that Fed governors might need more evidence than a single better-than-expected data point in the context of such high levels of inflation. If we do see inflation begin to trend lower, then attention will focus again on the labour market – which still appears very robust. That’s also likely to weigh on the Feds thinking.

Then there’s the question of the 2% target. Conventional wisdom says that it could be fairly “easy” to get inflation down towards 3-4%, but getting back to 2% from there might require more difficult decisions. (In the UK the probable next Prime Minister has already hinted she might like the Bank of England to walk away from its 2% goal, which is why you have independent Central Banks). It might be no accident that Fed governors have been out recently stressing that returning to 2% inflation is their clear goal.

But that’s a discussion for later this year and into 2023. For now, markets can be relieved to find an inflation figure that’s moving in the right direction.