What are we talking about? As we think about the challenges facing the Bank of England, we look at slowing growth, rising inflation, poor consumer confidence and a still robust labour market. We wanted to explore that a bit more.

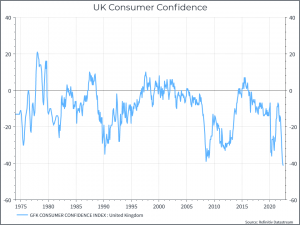

What do we see? Consumer confidence is weak. The chart below shows a diffusion index (positive minus negative) going back to the 1970s. The July reading was the lowest on record. It’s also worth mentioning that UK consumers, at least on this measure, are usually pretty grumpy, but that’s a topic for another time.

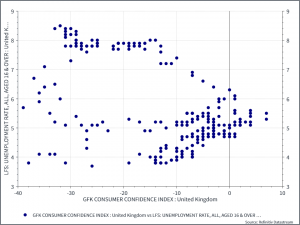

We then compared Consumer Confidence against the unemployment rate over the past twenty years. At first glance, this doesn’t tell us very much.

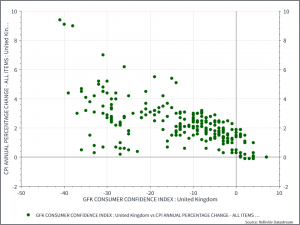

If we replace unemployment with 12-month inflation, we get a bit more of a signal. It seems fair to say that the higher inflation rate, the lower the level of consumer confidence.

Intuitively, that seems to make sense. Unemployment, traumatic though it can be, primarily affects a relatively small percentage of the working population. Inflation, on the other hand, affects pretty much everyone. That partly explains why Central Banks are so keen to bring inflation back down to more normal levels.

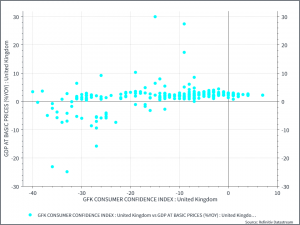

Just for good measure, we did the same scatter plot for consumer confidence and growth. As with unemployment, it tells you relatively little – even if you took out the COVID period.

How do we relate this to interest rates? The Bank of England has raised rates by 50 bps today. That’s going to put more pressure on households already struggling with rising utility bills and food prices. But these charts would suggest that policy-makers should stay the course and bring inflation down – it’s a better outcome for consumers in the end.