What are we talking about? The Bank of England raised its base rate by 50 bps today to 1.75%. That hike was largely in line with market expectations. The accompanying forecasts, however, make unpleasant reading and point to a longer period of pain for UK households than the Bank had previously expected.

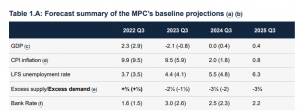

What about some details? With inflation above 9% and rising, a 50 bps increase in the base rate wasn’t particularly controversial. But the table below shows the change in the Bank of Englands macro forecasts. The numbers in parentheses are the forecasts from the May Monetary Policy report. The picture is unattractive. GDP estimates are lower, inflation and unemployment estimates are higher.

The forecasts point to an extended period of pain for UK households – particularly with inflation staying higher for longer. The assumption that inflation will persist above 9% in the year to September 2023, but then fall sharply thereafter, seems a bit heroic – you’d imagine that one of those forecasts will prove incorrect. What’s less clear, of course, is which one! In general, we think inflation could fall faster than this assumption but UK specifics (notably around utility bills) might be relevant. On the other side, you could argue that forecasting a sharp decline in inflation was a requirement to justify the forecast for a lower Bank rate in 2024. Otherwise, the forecasts might have had to reflect a stable or rising policy rate in the face of a stable or rising output gap (the excess supply / excess demand line).

All of these mental gymnastics speak to the significant challenges that the UK faces. It’s possible that this collection of forecasts could prompt a further fiscal policy response – perhaps continued support for lower income households.

What does it all mean? Forecasts change frequently, and the Bank of Englands are no exception. But taking these at face value, they suggest that the UK recovery from this bout of stagflation might take longer than elsewhere in the Developed world.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.