What are we talking about? At some point we think inflation will begin to slow. We’ve said that before (as have lots of other people), but we think we are seeing some grounds for optimism.

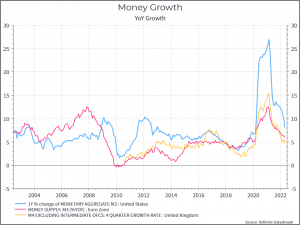

Why could inflation fall? Despite very high inflation, there are a few reasons for cautious optimism. First, lets channel our inner Milton Friedman. Broad money growth accelerated during the pandemic (see chart below) and has begun to slow (see chart below).

Second, we see some signs of supply chains improving. The chart below shows some benchmark container freight rates. They’re still clearly high, but they’ve begun to fall.

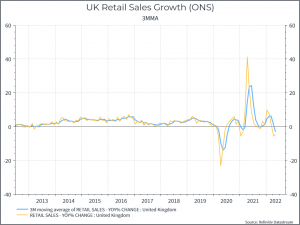

Third, we sees signs of weakening demand. In the UK we’ve seen retail sales declining year-on-year.

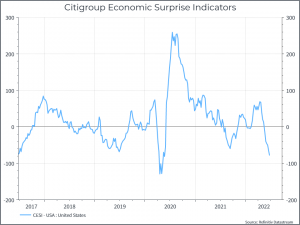

In the US, the Citigroup Economic Surprise indicator (a broad measure of economic performance relative to expectations) has turned negative.

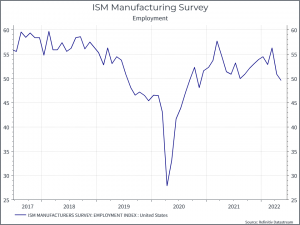

Overall, employment in Developed Markets remains robust, but unemployment is generally a lagging indicator. Nonetheless, the employment index from the ISM Manufacturing survey has begun to show some weakness (see chart below).

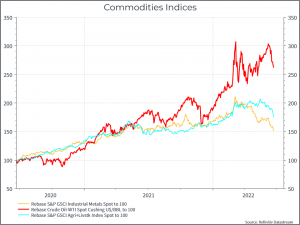

On the commodity side, we’ve begun to see some signs of weakness, albeit from high levels. The chart below shows oil, industrial metals and agricultural commodities.

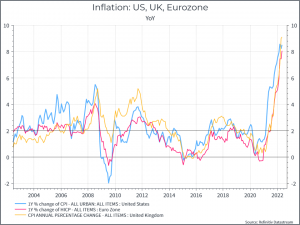

Now inflation remains stubbornly high, as we’ve seen (see below), but we see some indications of normalisation on both the supply and the demand side.

Central banks will continue to hike rates (as per market expectations), even as Developed Market economies begin to slow. That raises the likelihood of a recession in the next twelve to eighteen months. The message, at least from Fed Chair Powell, seems to be that that is a price worth paying to bring down inflation. Others may call it a policy mistake, but that may not be how the Fed or the Bank of England perceive it.

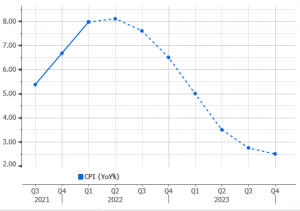

In any event, there are some early signs of softer data – the key questions are 1) will it continue and 2) how quickly will that translate into slower inflation. We believe that macro data will continue to soften, in the face of tighter monetary policy. And we would guess that, even given all the supply-side risks (Ukraine etc), we would expect to see inflation begin to slow over the coming months. In fairness, that’s inline with current market expectations (see chart below on US inflation forecasts), but given how often inflation estimates have been revised upwards, you might be sceptical about any inflation forecasts.

From a portfolio perspective, we continue to debate these scenarios. If we do see a scenario of “lower inflation sooner”, the most aggressive approach would probably be to buy duration (ie long-dated bonds) and growth equities – in a world where growth becomes scarcer. We’re not there yet, but it’s a scenario worth considering.