Markets have had a difficult start to 2022. A period of slow growth appears to have taken hold and preliminary data on GDP trends in both the Eurozone and the US have failed to meet expectations. These are expectations that had already been revised in the preceding months.

A Difficult Period for ESG Investments Examined: Summary Table

| 🌱 What is ethical investing? | An investment strategy that focuses on the investor’s ethical values |

| 🐋 How big is ESG investing? | 760 new ESG equity funds were launched globally in 2021. 2025 forecast shows a third of all global AUM will have some ESG mandate |

| ❓ Factors affecting the performance of ethical funds in 2022? | • Inflation • Ukraine war • Interest rate hike • Increase in energy prices |

| 🤌 What to do when ESG investing is underperforming? | Remain claim, seek financial consultancy and keep a long-term perspective |

The Covid-19 pandemic – which is ongoing in some areas – affected the prices of goods and raw materials, a dynamic further exacerbated by the ongoing crisis in Ukraine, particularly in the energy industry.

The consequence of this has been negative performances across all of the world’s main indices. This has, in turn, affected the performance of ESG portfolios, which have been further impacted by low exposure to investments in fossil fuels. However, we do still expect companies with strong links to fossil fuels to face significant challenges in the coming years, and that ESG portfolios will benefit from low exposure to these risks.

ESG is growing in popularity

Even with the current difficulties, socially responsible investing is growing as an idea. At both a global level, various strategies are being put forward and developed to create an increasingly sustainable world. By 2025, it’s expected that a third of all global assets under management will have some ESG mandate.

Another aspect to consider is the growing awareness that money can and perhaps should be invested responsibly from a social point of view, or at least be invested in line with the individual’s belief system. Very few people, for example, would want a portfolio that held Russian assets at this point in time.

Finally, if we take a look at the market trends, we see that more than 760 new ESG equity funds were launched globally in 2021 alone, along with 160 new or revised sustainable financial policy instruments. And, even in the face of a stressful market environment, the share of assets managed via ESG ETFs continues to rise.

Not only that, but new financial regulations are forthcoming for investors and companies alike. With every incremental step, there are clearer signs that investing in the future will be under the banner of sustainability and social responsibility.

To bring things back to the difficult start of 2022, there is no doubt that ESG investments have underperformed what many hoped they would. This may have made some investors uneasy and this is perfectly understandable. The important thing to remember, however, is that the causes of this dynamic are affecting both ESG and non-ESG investments. It’s also a moment to consider the importance of a long time horizon when investing.

Why ESG has underperformed recently

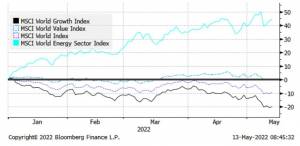

The chart below shows that ESG investments have underperformed in 2022 after a period of positive growth. You can see that, since the turn of the year, it’s been a particularly volatile period. Let’s take a look at the reasons for this underperformance:

Source: iShares

Firstly, changes to monetary policy brought about by inflation and the conflict in Ukraine have caused commodity prices to rise. This has, in turn, had a negative impact on interest rates and, consequently, the performance of ‘growth’ companies (those whose valuations are based more on future potential than earnings).

These companies tend to be more resilient during negative market shocks or recession but suffer more when monetary policy tightens and when interest rates increase, as they did at the beginning of 2022. So, these companies suffered in the first few months of 2022 – for example, the Nasdaq lost 27% while the S&P500 lost 17%. ESG companies are more likely to fall into the ‘growth’ camp than the ‘value’ camp and have, therefore, suffered in these market conditions.

Secondly, lower exposure to fossil fuel investments has also contributed. The energy sector was one of the few that has massively outperformed the MSCI World index so far this year (around +50% YTD). This is largely down to the exceptional profits made as a result of the commodity price rises caused by the war. With this in mind, even small deviations from the standard exposure to the energy sector can have a big impact on portfolio performance.

The main positive contributors to the returns of the S&P500, for example, have been ExxonMobil (+61%) and the Occidental Petroleum Corporation (+136%), both of which are absent in our Socially Responsible portfolios. They have an extremely low ESG rating, both according to Sustainalytics and to MSCI.

Finally, of over 300 ESG funds analysed, Moneyfarm’s Socially Responsible portfolios are among the best in reducing carbon risk and avoiding financing companies whose revenues are linked to fossil fuels.

This is an important validation for our sustainability ambitions but has, at the same time, caused underperformance in our ESG offering when compared to our standard portfolios. Our stringent methodology has, in this short-term instance, led to underperformance but the broader international situation must be taken into account here.

Key things to consider

Firstly, as we’ve already mentioned, energy companies have been the beneficiaries of the war on commodity prices, wildly outperforming since the beginning of the year. The question is whether or not we should expect these kinds of trends to happen in the future.

There’s no easy answer to this question; the landscape remains extremely uncertain and the prospects for energy prices going forward are yet to be seen. We can reasonably expect further tensions, due to the war and more potential bans on Russian energy suppliers, over the coming months.

The question is whether these tensions will keep prices high or cause them to rise further. It’s also worth considering the extent to which energy companies will continue to benefit from it, given the potential for bans and regulatory action which could and would affect the sector.

Secondly, growth companies are in a better position now than they were at the beginning of the year. Part of the reason for this is the fact that they have had a more marked depreciation in valuations versus wider equity indices, meaning there is greater potential for future multiple growths. In addition, interest rates are higher, with the US Treasury 10-year yield sitting at around 3% at the end of April versus around 1.5% at the beginning of the year. This means the future path of interest rates is now less likely to be in the upward direction from here, which will further help the valuations of growth companies.

In fact, we could expect the Growth sector to close the gap on Value when rates stop rising, thanks to higher expected earnings, more attractive margins and better valuations. The unknown element here is, once again, the consumer price index. Persistent inflation could continue to put pressure on the Fed, forcing it to raise rates more than expected.

The negative performances recorded in these first months of the year shouldn’t mean people take the decision to disinvest their capital. Staying calm, seeking financial consultancy and keeping a long-term perspective are the keys to both riding out the current wave of poor performance and capitalising on any recovery that comes.

FAQ

Why is ESG underperforming in 2022?

The biggest culprits affecting EGS performance are inflation and the conflict in Ukraine. Inflation has caused a hike in interest rates which is repressing the growth of companies.

What is the future of ESG investing?

ESG investing has a bright future. ESG investment funds doubled in 2020, and ESG assets are expected to hit $53 trillion by 2025, which represents a third of global assets under management.

Why is ESG important for the future?

ESG is important to investors and consumers, especially when deciding where they invest their money or what products they buy. It’s a way of helping companies be transparent about how they operate and manage their environmental impact innovatively so that everyone can make informed choices.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.