This month’s market update focuses on another difficult period in financial markets. With the crisis in Ukraine ongoing and inflation a concern for households across the UK, the situation is tricky. For our team of portfolio managers, the question is whether we’ll see an improvement from here or if the situation may get worse before it gets better.

May 2022 Monthly Market Roundup: Summary Table

| ❓ What is causing the difficult period in financial markets in 2022? | Inflation and the ongoing Ukraine crisis |

| 🏦 What is the top priority of the Bank of England in 2022? | UK inflation |

| ☝ What is the response to the cost of living crisis in the UK? | The Bank of England raised rates by 25 basis points |

| 📈 If UK inflation keeps soaring? | The Bank of England may hike interest rates by 50 basis points |

In the video above, Moneyfarm’s Chief Investment Officer, Richard Flax, discusses the policy side, the macro environment and financial markets to give a rounded picture of how April unfolded.

Inflation the top priority

For Central Bankers, the top priority is (and is likely to continue to be) inflation. In the UK, for example, monthly year-on-year inflation figures have only gone in one direction and fears we may not yet be at the peak are real.

The responses to the cost of living crisis have differed from country to country, with the Fed raising rates by 50 bps in the US, versus the 25 bps hike in the UK – three of the nine members of the Monetary Policy Committee favoured a 50 bps increase but were outvoted.

This fairly decisive action comes after Central Banks were seen to be taking their time. It’s a delicate balancing act to strike, but the message from the Fed and the Bank of England seems to be that the risk of a recession is an acceptable price to pay to bring down inflation.

The macro environment

If we consider the macro environment, it appears to look difficult in the short term. Growth expectations in Developed Markets have been revised down as inflation expectations have risen, a difficult combination for any investor.

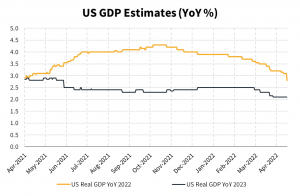

The graph below, for example, details the consensus estimates for 2022 and 2023 GDP growth in the US. The chart shows a steady downgrade to growth estimates over the past few months, impacted by expectations of higher rates and the fall-out from the invasion of Ukraine.

China’s continued use of fairly drastic measures to combat Covid-19 has caused problems, bringing with it a sharp slowdown to growth and there is likely to be disruption in global supply chains in the coming weeks as a result.

We’re also seeing demand weaken as consumer sentiment worsens. The good news here is that, for now, the labour market remains pretty solid – unemployment is low and job openings remain high.

Some positivity in financial markets

Despite the difficulties inherent at present, there is some cause for cautious optimism to be found in financial markets. Firstly, valuations have clearly improved. In equities that’s particularly true outside the US large-cap names. In bonds, we’ve seen US 10-year yields go above 3%.

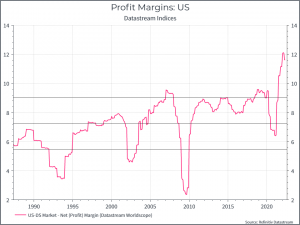

Second, the chart above demonstrates that corporate earnings, which have been way above long-term averages for some time now, have remained pretty resilient so far. We’d expect to see some earnings downgrades over the coming months, but the overall corporate profitability still looks good.

Where do we go from here?

Whenever difficult periods come, it’s more important than ever to focus on the long-term and view the volatility within its full context. We could begin to see some improvements over the coming months, although the path there could prove to be bumpy. As ever, our asset allocation team will be monitoring markets daily and remain ready to make any changes necessary to keep our portfolios fit for purpose.

If you’d like to discuss your portfolio or the outlook for the future in more detail, please don’t hesitate to get in touch with a member of our team of investment consultants. They’re on hand to talk you through your options and to answer any concerns you might have.