What are we talking about? The Monetary Policy Committee (the MPC) of the Bank of England hiked its base rate by 25 bps to 1% – a move that was largely in line with expectations. The commentary from the Bank highlighted the challenges facing central bankers. The MPC highlighted the impact of Russia’s invasion of Ukraine – contributing to an increase in inflationary pressures and a weakening outlook for global, and UK, growth.

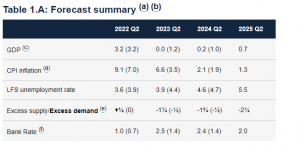

Let’s dig into this in a bit more detail: The table below from the May Monetary Policy Report illustrates the challenge for UK economy more broadly, and the MPC more specifically. The figures in parentheses represent the Banks forecasts from the February report.

Starting with annual GDP (the first line), we can see a sharp downgrade in growth expectations for the year to 2Q 2023 (from 1.2% to zero) and for the year to 2Q 2024 (from 1% to 0.2%). And it’s worth mentioning that the previous forecasts of around 1% growth were hardly robust.

On the inflation side, we see a steady upgrade in forecasts – representing a challenge for UK households. The Bank expects to see inflation back at its 2% target within the next couple of years, and then some way below target by 2Q 2025.

Interestingly, the Bank of England expects the labour market to remain fairly robust, with lower unemployment than previously forecasted for the next couple of years. But the direction of travel – ie steadily higher unemployment, albeit from very low levels – is consistent with a sluggish economy.

The next line is particularly interesting (for those who’re still reading!) – it shows the Banks estimate of the amount of slack in the economy. A negative numbers means that supply exceeds demand, and vice versa. The Bank reckons the UK economy is roughly in balance today and expects the amount of slack to increase over the next three years – significantly more so, than had been anticipated back in February.

And finally, the forecast for the Base Rate has also been raised quite sharply – from 1.4% to 2.4%.

Where does this get us? All things considered, it’s not a very happy table. Slow growth, high inflation, excess slack in the economy, rising unemployment and a higher policy rate is a challenging combination for the UK economy. You might reasonably ask why the Base Rate should still be at 2% in 2Q 2025, with inflation comfortably undershooting the target and a significant amount of excess slack in the economy. But given how much forecasts have moved since February, you probably wouldn’t want to put too much weight on an estimate for 2025. The forecasts also suggest that the MPC is keen to normalise inflation relatively quickly (at least officially), even at the cost of slower economic growth, and the 3 MPC members who voted for a 50 bp rate increase would support that view.

What does it mean for portfolios? We’d say these forecast argue for conservative positioning for now – both in terms of equities and duration. In this case, that would mean shorter duration – given the focus on rates – but that might not always be the case. Broadly speaking, that’s where we think our portfolios are today. The challenge, as usual, is that financial markets have already moved to reflect some of these assumptions – global equities have sold off and bond yields are generally higher. Valuations today are generally more attractive than they were – even if they probably reflect some earnings risk. Bond yields are not high compared to historical averages, but if these forecasts are correct – and we see inflation start to normalise and growth below potential – then the case for longer duration bonds becomes a little bit stronger.