It’s fair to say that financial markets got off to a rough start in 2022. A coalition of uncertainty caused by the tightening of monetary policy and the war in Ukraine took its toll after an extended period of relative calm.

The US economy was expected to grow in the last quarter; instead, it shrunk. This can largely be attributed to declines in net exports and private consumption, along with the continuing rise in inflation. Naturally, this leads us to look to the fundamentals, to assess the potential effects of the current climate on our portfolios in the coming months.

Our analysis has reinforced our approach – we will maintain a conservative positioning, staying alert to the potential opportunities the market can offer going forward. This is the fundamental approach we take throughout uncertainty.

A difficult start to the year from a growth perspective

The coalescent uncertainty caused by geopolitical upheaval, high inflation and monetary tightening has led to slower growth, lower earnings and higher discount rates. The IMF has revised its growth estimates for 2022, dropping them from 3.8% to 2.3%. This is a heavy cut, particularly when you consider that it had estimated growth of 4.2% back in October 2021.

This downward adjustment will affect not just this year but also the next, with growth forecasts of +1.7% being revised to a more realistic +0.5%. These more optimistic estimates were based on a scenario in which the pandemic faded into relative obscurity and society fully normalised. The war, along with rising inflation, has dented these growth prospects.

Some positive signs from the markets

Against this backdrop, by looking at the data at a granular level, we can see a few causes for optimism as we look to the future. Let’s start by analysing the macroeconomic foundations. This week, our Investment Committee took a deep dive into inflation – we are, cautiously, starting to see some faint signs of a slowdown. Of course, it’s too early to declare victory, but slower inflation could provide both markets and consumers with some welcome relief.

In any event, a more optimistic scenario goes like this:

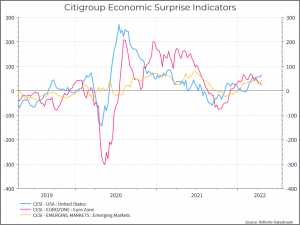

First, the macro environment (aside from inflation) isn’t that bad. The chart below illustrates the point. These are economic surprise indicators, essentially taking aggregate macro data and comparing them to analyst expectations. Negative numbers mean the data is coming in worse than expected, and vice versa.

So, in early 2020 we saw lots of weaker-than-expected data as the global economy shut down – while from late 2020 onwards, we saw better-than-expected data, as the global economy began to recover. Today, we can see that macro data is still coming in a bit better than expected. The most recent European PMI data, for instance, tells a similar story. So far, the global uncertainty hasn’t been as bad as analysts might have expected, even if they’ve been downgrading their growth forecasts.

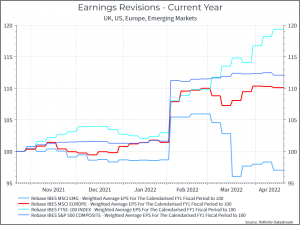

Second, earnings estimates are holding up ok. The chart below looks at earnings revisions in the US, UK, Europe and Emerging Markets. For context, the jump in late January is when the time series moves from 2021 to 2022. What we see is that, so far, earnings expectations in most Developed Markets have held up fine, while Emerging Markets have seen some downgrades.

Data from the current US earnings season – the first quarter of 2022 – paints a similar picture. With only around 20% of companies having reported so far, we see that about 79% have beaten expectations (according to Refinitiv) – that’s marginally ahead of the 5-year average. It’s early days, admittedly, but the current reporting season in the US is fairly supportive.

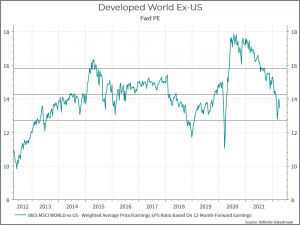

The third aspect to consider is valuations. The chart below shows the forward P/E for Developed Markets Ex-US. It shows the sharp de-rating from the highs of 2020 (when markets moved quickly to price in an earnings recovery) and now sits a bit below the 10-year average.

In contrast, valuations in the US remain above their long-term averages, but they have also de-rated, albeit less dramatically. But, if earnings do prove resilient, we can argue that valuations, particularly outside the US, look supportive.

So, what does this all mean?

We can make a case that the macro data, earnings data and, at least in some parts of the world, equity valuations are all supportive – at least relative to current expectations. The challenge, we think, is how this data will evolve. We’re yet to see the full impact of the war in Ukraine and tighter monetary policy on economic growth and earnings.

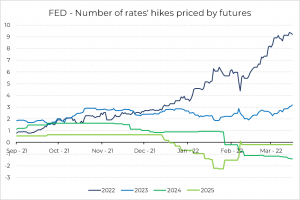

The chart above shows the number of rate hikes in the US priced in by fixed income markets. You could argue that equity analysts haven’t really reflected the impact of higher rates on their earnings forecasts so far. We’re not convinced that earnings will be quite as resilient as the consensus appears to believe, but that’s an assumption we continue to debate.

Ultimately, we’re keeping our conservative positioning for now, given all the uncertainty, but we continue to monitor markets for opportunities.