What are we talking about? With volatility returning to equity markets so far in 2022, we’ve looked at equity fundamentals and valuation. They suggest that equity valuations outside the US look quite reasonable – in line with long-term averages – while the US continues to trade above the average. Most equity market valuations have de-rated, as earnings have caught up with expectations. Corporate profitability is high, compared to history, in most markets, but we’ve seen a steady improvement in corporate profitability for some time. Finally, earnings revisions, while not as positive as during 2021, still look broadly supportive overall.

Details: We’ll look at this question on three levels – first, simple equity valuation – forward Price / Earnings. Second, corporate profitability – looking at aggregate profit margins versus history. And, third, from a shorter-term perspective, looking at earnings revisions – changes in earnings expectations for the coming year.

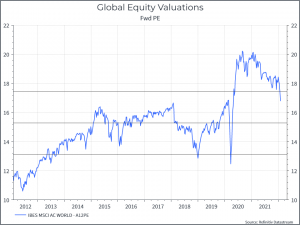

Valuations: The charts below compare the current forward Price / Earnings ratio against the average for the past ten years. On this metric, global equities look relatively highly rated versus history – almost one standard deviation above the long-term average. We can see that they have de-rated since 2020, as corporate earnings have begun to catch up with expectations of recovery.

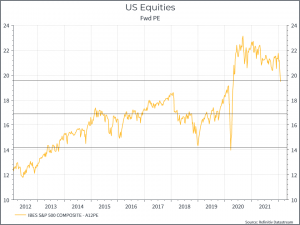

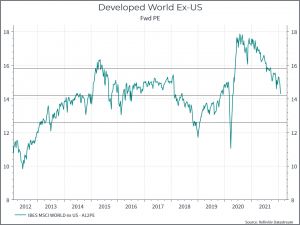

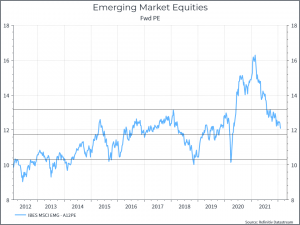

But the headline doesn’t capture the full story. The three charts below show the forward Price / Earnings ratio for US equities, the Developed World ex-US and Emerging Market Equities. There’s a clear contrast between the re-rating we’ve see in US equities, relative to the ten-year history, compared to the rest of the World. Outside the US, valuations are pretty close to their long-term average, for both Developed and Emerging Markets.

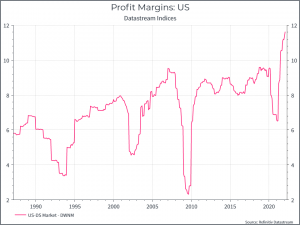

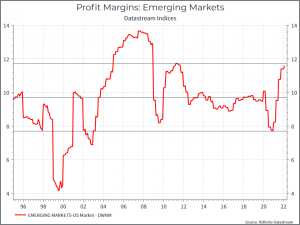

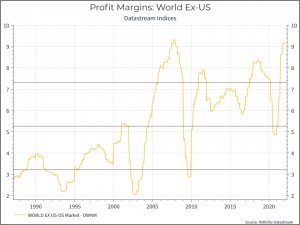

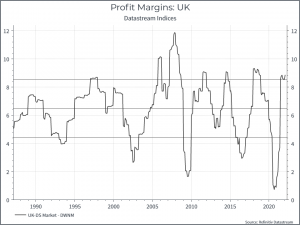

What about Profitability? The charts below show the historical net profit margin for different markets. Again, the US is a bit of an outlier, with its profitability at an all-time high, but the gap is a bit smaller. Most Developed Markets have seen margins drift higher in recent years, even accounting for the impact of economic cycles. Emerging Markets aren’t quite at the peak they reached during the commodities boom pre-2008, but their aggregate profitability has improved too.

It’s notable that in 2020, thanks in part to policy intervention, corporate profitability in most markets fell far less than during previous recessions (the UK was a bit of an exception here).

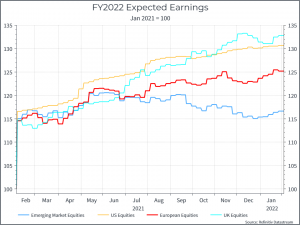

Earnings Revisions: The third topic to consider are earnings revisions. The chart below shows 2022 expected earnings for the US, Europe, UK and Emerging Market equities. In Developed markets, we can see that earnings expectations continue to drift forward (at least on these estimates). For Emerging Markets, we’ve seen a slight pick-up from the lows reported in December.

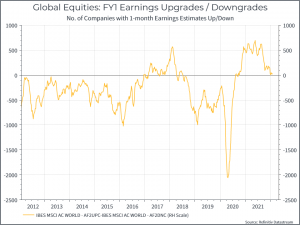

This chart looks at slightly different data. It measures the number of companies whose earnings estimates are rising, versus those with falling estimates. As you’d expect, in 2020 lots of companies saw their earnings slashed and it seems fair to say that many analysts underestimated the speed and extent of the recovery, leading to strong upgrades in 2021. As we enter this year, it seems a bit more balanced. That’s not bad, compared to history, but it’s a bit less supportive than might have been the case last year.

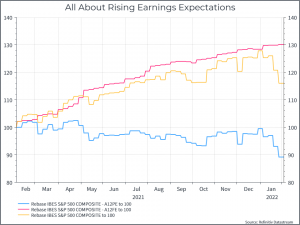

Finally, the last chart breaks down the performance of US equities between valuation and earnings. Over the past year, we can see that improved earnings have driven the market higher, while the valuation has remained largely unchanged (albeit at a higher level than the historical average).

Where does this get us? The charts above suggest that equity valuations outside the US look fairly reasonable, compared to history. Corporate profitability should probably be the area of greater attention, but we expect profit margins to remain resilient overall, at least in the short term. As the charts show, recessions can do a good job of bringing down corporate profitability in the short-term, but that’s not our base case today! Other questions, like industry concentration and excess profitability, usually take longer to address.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.