What are we talking about? We’ve seen a few indicators recently that show weaker economic growth. Equities, however, remain pretty resilient. How should we think about this?

Can you relate economic growth and equity returns? This topic is worth a longer discussion. As you’d guess, the evidence is mixed. There’s some literature that shows very little correlation between growth and equity returns. The first point to mention is on valuation – if growth is strong, but valuations are high – that might suggest that equities already price in that growth. There might be a stronger relationship between economic growth and corporate sales and earnings.

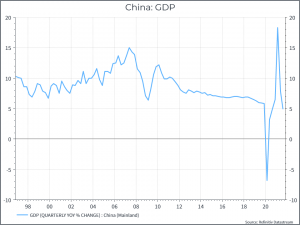

In terms of the historical data, the impact of China is also notable, where very strong real GDP growth hasn’t always translated into corporate profitability. We can also say that real GDP growth may not be the most relevant metric for equity investors. After all, investors eat nominal returns – or so the line goes. In any event, we should at least acknowledge that short-term economic growth might not be the most relevant driver for equity returns.

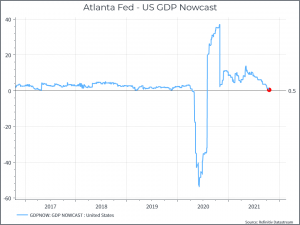

What about the current macro environment? The current growth environment looks a bit weaker than we might have expected a few months ago. Here are a few charts to illustrate the point. The first shows a “Nowcast” for US GDP (from the Atlanta Fed) – suggesting the US economy is only growing at 0.5% – that seems a bit dramatic, but the direction of travel (slower than the recent sharp recovery) seems clear enough.

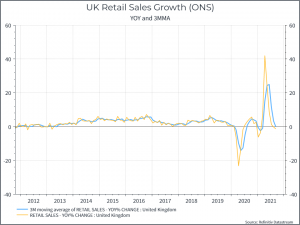

Closer to home, we’ve seen weaker-than-expected retail sales for September – reflecting, we’d guess, the combination of higher prices, supply chain issues and the steady increase in the number of COVID cases.

And, finally, we’ve seen a relatively weaker-than-expected GDP print for the third quarter in China – below 5% year-on-year.

What about equities? Despite this – we’ve seen a fairly strong equity market over the past few weeks. One global equity ETF is up around 4% in sterling since its recent low on October 4th – what might have prompted the recovery after a fairly weaker October. Have equity markets already digested the short-term economic weakness?

Earnings Season: One possible explanation might be the robust earnings season that we’re seeing in the US. Just as a bit of background, US corporates generally report earnings quarterly, and mostly match the annual calendar. So, by the end of the month following the quarter, we generally have some new information about the state of Corporate America – or at least those that have listed equities.

What we’ve seen so far is that listed US businesses are doing pretty well – at least versus expectations. Factset publishes pretty comprehensive updates over the course of the earnings season. Of the 23% of companies in the S&P 500 that had reported, 84% of them reported earnings that were better than analysts had expected (the long-term average for that figure is 76%). The percentage of companies that beat revenue expectations was also above their long-term average (76% versus 67%). And their profit margins might not be quite as strong as the record figure for 2Q, but it’s still high relative to history.

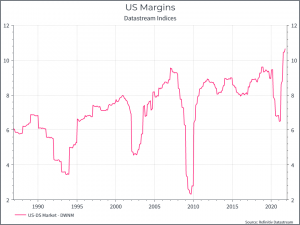

The chart below shows long-term margins for the broad US market – it doesn’t capture the current reporting season, but we can clearly see how much US corporates have improved their profitability over the past thirty years. And we continue to debate how sustainable that trend is over the long-term.

The cynics on the Asset Allocation Team will suggest a) companies manage expectations so they always beat earnings – until they really can’t, b) we should care more about revenues, which are more difficult to “manage” over a single quarter than earnings and c) it’s only 23% of the S&P 500, and if you’re going to report weak numbers, why do it early?

Leaving the cynics alone for a moment, it still seems clear that listed US businesses continued to do well in the third quarter. But maybe that doesn’t fully capture the full extent of the challenges – supply chain, inflation etc – that we’re currently seeing. Looking at data provided by Reuters, we can see that for the companies who’ve reported so far, on average expectations for the next quarter have reduced very slightly (by less than 1%) – presumably as analysts have digested feedback from company management about how their businesses are currently doing. Unfortunately, we don’t have good data on whether that’s a normal trend or not, but it’s probably worth keeping an eye on.

Where does this get us? So far, we’ve seen what looks like a disconnect between macro data (slowing) and the current earnings performance of large US corporates (still holding up). We can certainly argue that large US corporates don’t represent the world (or even all of the US), but they’re definitely relevant for a lot of portfolios. And so far we haven’t seen significant changes in expectations for the future, although it’s something we continue to monitor. We’re also wrestling with how to interpret the macro data – is it a sign of a sustained slowdown or will we look back in a year and view this as a temporary period of higher inflation and weaker growth. For now, we’ve been content to keep our equity exposure unchanged during our last rebalance, reflecting our cautious optimism about the shape of the recovery – despite all of the short-term macro noise – and the ability of listed businesses to manage their way through the range of challenges we’ve seen.