What are we talking about? UK rates are set to rise soon – probably this year. The governor of the Bank of England, Andrew Bailey, took to the weekend press to tell everyone that the Bank “will have to act” against inflation. It’s the latest in a series of remarks about inflation that we’ve heard from Bailey and other senior members of the Bank of England in recent weeks.

Whats the reaction been? Financial markets have been paying attention. The market is now implying at least one 25 bp interest rate hike before the end of the year, and another three by next September. Back in July, financial markets expected maybe one rate hike in the UK over the following twelve months. The chart below, of the yield on UK 2-year gilts, illustrates the point, and the shift in expectations.

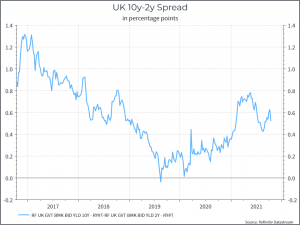

The Challenge for Central Bankers: The chart below is probably the more interesting one. It shows the difference between the yield on the UK 10-year bond, compared to the 2-year bond.

That relationship hasn’t moved as dramatically in recent months. If anything, that spread has declined from where we were earlier in the year. One interpretation of this flattening of the yield curve is that it suggests that the UK recovery isn’t very robust and – if the Bank of England does raise rates – it won’t take very long for the economy to slow down. This is one of the challenges of dealing with inflation that is at least partly supply-driven – as we’ve discussed before.

Where does this get us: Central banks seem to be talking less about inflation being transitory and are getting ready to act. The UK looks like being slightly ahead of the pack in this regard, at least based on the Bank of Englands commentary. It comes at a tricky time – supply issues remain, there’s disruption in the energy market, COVID cases are rising, but inflation is proving a bit stickier than the Bank would have liked. It’s probably not the best combination for UK domestic assets, at least in the short-term.