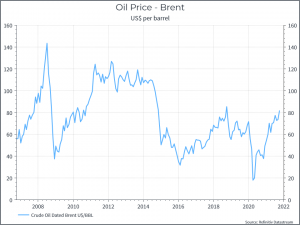

What are we talking about? Over the past few weeks, we’ve seen continued focus on both climate change, ahead of COP-26 and rising energy prices. The price of oil is now above $80 per barrel. That’s a sharp recovery from the lows of 2020, but some way below the peaks of the past decade (as the chart below indicates). We think this partly reflects increased demand as the global economy recovers. We’ve also seen sharp increases in a range of commodities. But looking beyond the rebound in the global economy, and without considering the negative environmental implications, it’s worth considering how much these two trends are related.

Sad Ironies: On the surface, there are good reasons why an increased focus on climate change might help prop up commodity prices. We’d argue that it’s really about two things – i) supply and demand ii) the period of transition from economies built on fossil fuels to ones built on renewable energy

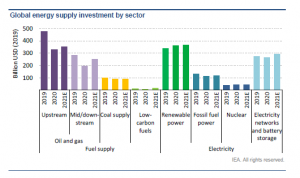

Let’s think about energy. If governments are serious about reducing CO2 emissions, and you have to hope that they are, then you’d expect that investment in upstream energy (basically drilling for oil) would decline. After all, if you’re an energy company making a multi-decade investment decision, you’d have to consider the possibility that demand might have fallen significantly by the time your investment actually starts to produce oil.

The table below (from an Investment Report by the International Energy Agency) tries to illustrate the point. Investment spending in upstream declined in 2020 and is expected only to partly recover in 2021. In contrast, investment in renewable power is expected to rise consistently. Inevitably COVID makes it tough to draw firm conclusions, but directionally it’s what you’d expect.

Now, the IEA also produced some estimates saying that oil demand would fall significantly by 2050 – and that’s required to get to net zero carbon emissions. But that estimate was premised on governments banning petrol cars by 2035. Potentially what happens between now and then is that investment in the sector declines (it takes a long time to bring a new oil field onstream) while demand remains fairly resilient,as the global economy grows and then gradually declines. That potential mismatch between supply and demand, and the long transition to renewable energy sources, might help some commodity prices to rise.

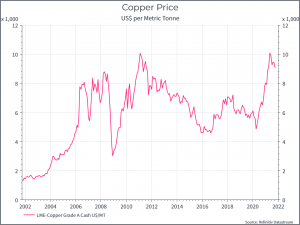

What if we’re all driving electric cars? As has been highlighted in the past – if you want electric vehicles to replace petrol / diesel, then you need to have an electricity grid that can handle it. And that, bluntly, means copper. Mining company BHP expressed their view neatly in their 2021 Annual Report: “Prices [for copper] are expected to rise compared to historical averages in the long term due to grade decline, resource depletion, increased input costs, water constraints, rising ESG standards, and a scarcity of high-quality future development opportunities after a poor decade for industry-wide exploration”.

It’s a nice summary and, as the chart below shows, it’s a view that has already gained traction in financial markets over the past year.

Where does this get us? There are some good reasons to think that a growing focus on climate change could benefit certain commodities. It’s not a new thesis (see for instance todays piece from John Authers at Bloomberg), and commodity prices have probably moved to reflect at least some of that. That argument was one reason why we didn’t move to add commodities during the most recent rebalance – although it’s something we continue to debate.

PS. There’s also an interesting question, if you subscribe to this view, whether you should focus on commodities or commodity businesses. After all, one argument for commodity prices to rise might be that commodity companies can’t actually produce the stuff.