Have you been keeping an eye on the money markets? Have you noticed an increase in savings rates? Are you thinking about putting some money away for a fixed period of time, but you’re not sure what the best vehicle would be – a fixed-rate bond or an ISA? Well, if you are, you’ve come to the right place.

In this article, we are going to discuss the difference between an ISA and a bond, the pros and cons of premium bonds vs ISAs, how they work, and which one might suit you best. We will also talk about the term “ISA bond.” Please read on to find out more. Here is a more detailed overview of stocks and shares ISA.

| Bonds or ISA? | It depends on how much you want to invest and your risk tolerance |

| Are income bonds a viable option? | Yes, if you have more than £500 to invest |

| Are premium bonds a safe investment? | They are not really an investment; they are more like a lottery |

| What are some ISA benefits? |

1. Tax-free withdrawals 2. Wider range of investment options 3. Portability 4. No wrapper charges 5. No extra charges |

What is the difference between an ISA and a bond?

The term “ISA bond” is something of a misnomer. ISAs and bonds are not the same thing. They are similar in some ways, but they are different products – the difference between an ISA and a bond is that with an ISA, you have access to your savings, whereas with a bond, you do not. Also, an ISA is an investment account, while a bond is an investment security.

When you compare fixed-rate ISAs together with fixed-rate bonds, at least you have the peace of mind of knowing how much your investment could be worth upon maturity. But what about the stocks and bonds ISA, also known as an investment ISA?

About fixed-rate bonds

What is a bond? Is a fixed-rate bond an ISA? No, it is not. A fixed-rate bond is a type of savings account. This kind of account has a specific date at which you will be able to access the money you’ve invested – this is known as the maturity date. You can initially put any sum of money into the account, subject to the product provider’s terms. You will be advised exactly how much money your account will have accumulated at the end of the term. However, you will not be able to access this money before the said maturity date.

About fixed-rate ISAs

A fixed-rate ISA is a savings account that allows you to save up to a specific amount of money every year. For the 2025/2026 tax year, this amount is capped at £20,000. As with a fixed-rate bond, a fixed-rate ISA will run for an agreed period of time. Any interest the ISA accrues will be tax-free.

When they are fixed rate accounts, the difference between a bond and an ISA is that whereas you cannot access your savings in a fixed rate bond, you can in a fixed rate ISA, although an ‘early access charge’ will be levied if you do decide to withdraw. The same goes if you were to choose to close the account or transfer it to another provider before it matures.

The benefits of fixed-rate ISAs

Fixed-rate ISAs, being a type of savings account, offer additional benefits beyond those previously mentioned. In total, they can be summarised as:

- Being able to make tax-free withdrawals

- Having a wider range of investment options

- Portability

- No wrapper charges

- No extra charges

- Any income from an ISA doesn’t affect your age-related personal allowance

- There are no upper-age limitations

- Savings can be passed on to a deceased investor’s spouse via an inherited ISA allowance.

There are several different types of ISAs, each aimed at a specific type of investor. These include:

- Cash ISAs

- Stocks and Shares ISAs (also referred to as Investment ISAs)

- Innovative Finance ISAs

- Junior ISAs

- Lifetime ISAs

Stocks and shares ISAs can contain an ISA bond or two (or more). The reason that they include an ISA bond is to even out the risk element.

What are income bonds?

Income bonds are another type of investment vehicle that pays regular interest to the investor. You can invest anywhere from £500 up to a maximum of £1 million, spread across any number of different income bond accounts.

One big advantage of this type of savings account is that you have continual access to your funds at any time (no prior notice period is required) and without any financial penalty. Any interest your account makes (variable interest rate) is transferred directly to your bank account or Building Society account. You pay income tax on the gross interest.

Income bonds may be of interest to those who want to receive interest every month, but, having said that, at present, if your account balance is under £646, you won’t receive monthly interest payments. Income bonds might also interest those who want to add to their savings on an ongoing basis and those who want instant access to their savings.

Income bonds are not as interesting if you have less than £500 for investing or prefer a fixed interest rate.

What about premium bonds?

Premium bonds can be purchased by anyone over the age of 16. Premium bonds for children are also available. For anyone under 16, their parents, legal guardians, or grandparents are able to invest on their behalf. Each bond has a financial value of £1. The minimum investment is £25, and the maximum holding is £50,000.

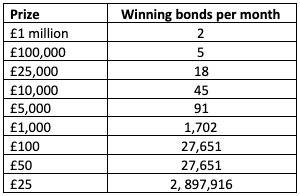

Rather than paying interest, premium bonds get entered into a monthly prize draw. The cash prizes that bondholders can win every month are:

The thing to understand when debating Premium Bonds vs ISAs is that people who invest in premium bonds do so as a gamble, as there are chances of winning big in the monthly prize draw. But bonds are only ever worth their face value, so if you don’t win a premium bond prize, your investment doesn’t grow. In real terms, it diminishes in value. Nonetheless, this is the UK’s most popular form of investment, with over 22 million people investing a total of more than £100 million.

How premium bonds vs ISA investments compare

When it comes to the question between ISA vs Premium Bonds, which way should you lean?

Purpose: Let’s face it, premium bonds are nothing more than a savings account that serves as a lottery whereby Ernie, short for “Electronic Random Number Indicator Equipment, selects random numbers that get compared to the serial numbers of bonds in the pool. The interest is swapped with the chance to win a tax-free prize, which you may never win. ISA is a tax-efficient investment account where you can save or invest money without paying taxes on the returns or interests.

Limit: When comparing premium bonds vs ISAs, both have a contribution limit. You can invest from £25 and £50,000 in a premium bond. With an ISA, you can contribute £20,000 per annum tax-free. This applies to cash ISAs (including fixed-rate cash ISAs), innovative finance ISAs, and stocks and shares ISAs. Junior and lifetime ISAs have different annual allowances – £9,000 and £4,000 per tax year, respectively. Any amount above the ISA allowance will be taxed.

Returns: As stated above, the return on a premium bond account is not guaranteed because the chance to win the monthly tax-free prize is uncertain. The odds of winning the big premium bond prize are 22,000 to 1. However, the return on investment for an ISA is guaranteed but is dependent on the type of ISA. While the interest rates on regular savings and cash ISAs are fixed and low, stocks and shares ISAs have a better return on investments, so, according to the law of averages, when it comes to the ISA or Premium Bonds argument, providing you are not risk averse, an ISA could be the best choice.

Access to funds: With regards to premium bonds vs ISAs, you can access the funds in both accounts. However, there is no penalty for withdrawing from a premium bond account, and you can access your money anytime. On the other hand, ISA withdrawals are allowed at any time, but ISAs may have restrictions depending on the type of ISA (Lifetime ISA) and the provider.

Risk: Premium bonds and Cash ISAs are considered to be low-risk investments, so in this case, the difference between a bond and an ISA is minimal. But stocks and shares ISAs have some risks involved, which can cause the value of the investments held in stocks and shares ISAs to increase or decrease depending on the investment’s performance.

The fact remains that, over time, when you compare a cash ISA or premium bond, money invested in premium bonds erodes in real terms, but less so than with a Cash ISA. So, you are probably best advised to spread your savings across various options by creating a well-diversified investment portfolio.

ISA bonds

Some people may refer to an ‘ISA bond’ when talking about stocks and shares ISAs, also known as investment ISAs. These products are interesting because, whereas the interest on fixed-rate cash ISAs and bonds is relatively low, you can earn a much higher interest rate with an investment ISA. But what it all boils down to is your attitude towards risk.

A stocks and shares ISA can offer a higher interest rate, but it’s dependent on the ups and downs of the stock markets, and there is no guarantee that you will recoup your investment in full when your policy matures. You can, however, opt for different risk options; high, low, or medium and the thing that helps to facilitate these options is the ISA bond element. In theory, the more bonds included, the less the risk.

The more diversified your investment portfolio, the less risky it could be. It’s one reason why many people are now looking at ETFs (Exchange Traded Funds), particularly bond ETFs and ETF ISAs.

Seeking professional help when making a choice

Is a bond the same as an ISA? Having read through this blog, you will now appreciate the difference between a bond and an ISA, and the choice you make will depend on your individual circumstances and personal savings goals. You will also have an understanding of the ISA bond element and its impact.

Many factors should be taken into account when evaluating the advantages and disadvantages of investment bonds and ISAs to make an informed decision. You may also want to consider opening a general investment account.

FAQ

It depends on several factors, such as an investor’s risk tolerance, ready access to savings and investments, and financial goals.

No, but the value can diminish with inflation.

Yes, if you are risk-averse, especially if you have a lot of money, because the more bonds you buy, the bigger your chance of winning a prize.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.