For self-employed people with a business to run, setting up and managing a private pension can be low down the list of priorities. Less than a third of self-employed people are actively paying into a pension, making it one of the key drawbacks of working for yourself.

The often irregular income and lack of an HR department that comes with running your own business can make saving an arduous, daunting task. It needn’t be, though, and everyone who is earning should be putting whatever they can away for a secure future.

This guide will run through the rules for pension contributions, as well as the options available to any self-employed people looking to get started.

| As a self-employed, will I have access to a state pension? | Yes, but it will be up to £203.85 a week |

| How much should I contribute per month to my pension? | As much as you can without sacrificing your current standard of life |

| Can I go down the DIY route? | Yes, but if you are not very experienced, a professional advisor might save you time and money |

| Most difficult thing to do | Getting started with a solid plan |

Why you should have a private pension

One of the most difficult steps in planning for retirement is getting started. With self-employed people managing every area of their businesses, regular saving can be a difficult habit to get into. After all, no one is there to do it for you and there’s always something more pressing to be getting on with.

Building a private pension pot, however, can be the difference between simply surviving in retirement and making the most of your best years. Of course, self-employed people are eligible for the State Pension just like anyone else, but with this coming to a maximum of £175.20 a week, people are increasingly turning to invest in private pension accounts to bolster their retirement incomes.

Getting started early and contributing regularly are the best ways to build a healthy retirement fund over time, with plenty of schemes in place to help you do this. For more information on your options, check out Moneyfarm’s Private Pension Plan and our Pension Transfer service and get a pension that works as hard as you do.

What you’re able to contribute

There are limits to the amount any individual can pay into a private pension account every year. The maximum you’re able to contribute each financial year (6th April to 5th April) is currently £60,000 pre-tax or gross. To access this limit, your relevant earnings within the same tax year need to be at least £60,000 for personal contributions.

Therefore, if you’re earning less than £60,000, then you’re only able to contribute that amount. So, anyone who earns £32,500 a year gross will be able to put £32,500 into their pension that year.

If you’re looking at claiming tax relief on these contributions, you’ll also need to take this into consideration when calculating what you put in each year. At Moneyfarm, we add tax relief at source for the basic rate (25% uplift). So, if you contribute £48,000, this will be automatically uplifted to £60,000. The tax relief will count towards your contributions as well. The higher and additional rate band tax relief needs to be claimed in the tax return.

Something else to note is that the tax relief on pensions is 25% on the way in but 20% on the way out. What this means is that, to reflect the 20% basic tax rate, contributions to pension accounts are uplifted by 25%. An £8,000 deposit is uplifted to £10,000 by the government, for example. The £2,000 uplift represents 25% of the initial deposit, but 20% of the total amount.

For employer contributions, you do not necessarily need to have the relevant earnings to reach the limit, but you will not be getting tax relief for this style of contribution. The FCA regulation for employer pension contributions is that they should be ‘wholly and exclusively’ to your relevant earnings.

Pension contributions as a limited company

As the director of a company, you’re able to invest into your pension as both an employer and an employee. In this instance, it is up to you which way you choose to invest into your pension and both have their benefits.

Employer contributions allow companies to contribute either the full £60,000 or part of it each financial year. One benefit of the employer contributions are that they may be considered as an allowable business expense and could potentially offset your company’s corporation tax. However, because this funding comes pre-tax, you don’t receive the same tax relief but they are not liable for employer national insurance.

Employee contributions up to the £60,000 limit allow the investor to claim back any income tax they paid on the contribution. By doing this, Moneyfarm applies the basic rate tax back at source, meaning you get an additional 25% free on any applicable contribution. If you are an additional or higher rate taxpayer, you’ll need to claim back the extra relief from your income tax via the tax return each financial year. This will usually come in the form of an adjusted tax code, so you won’t miss out.

The choice between one or both of the contribution options – employee or employer – is down to the investor’s preference. Often, it is best to seek advice from an accountant or financial advisor.

Pension contributions as a sole trader

As a sole trader, you are the business. At least, this is how the FCA sees you, and your pension contributions are therefore personal and could be eligible for tax relief.

In this instance, you will need to work out how much you earn gross per year to understand how much you are able to contribute. If you earn over £60,000, this will be your upper limit. Most businesses will find themselves over this threshold, but for sole traders, this is the absolute maximum you can contribute, unless you have access to any carry forward allowance.

By understanding this yearly figure and how much of it you take advantage of, you’ll be able to work out if you’re eligible to take back any unused allowance from the previous three years (if you had an active pension during that time). We’ll go into more detail about how you can take advantage of any unused allowance in the next section; however, if you are interested in learning about how your lifetime allowance works, you can find more information here.

Unused Allowance & carry forward

It’s important to remember that unused pension allowance can be carried forward. This is a powerful tool which anyone saving for their future should be aware of, allowing people to add large sums of cash into their pension accounts if they have unused allowances from the previous three tax years.

Pension contributions are always based on relevant earnings, but if you’ve had an active pension (SIPP or workplace pension) for the previous three years, you can access any unused allowances throughout this period, to bolster your allowance for the current tax year.

In essence, you potentially have access to a maximum allowance of £160,000 for any given tax year. To work out how much you could put in, you need to review your checklist:

- Relevant earnings in current financial year (6th April to 5th April)

- Total contributions including tax relief and employer contributions in all pensions

- Does the tapered annual allowance apply?

- Does the money purchase annual allowance apply?

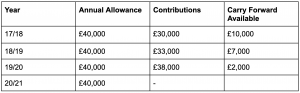

It’s important to note that your pension contributions can never exceed your relevant earnings, even when carrying forward your allowance. Below, is an example of an investor with a single pension. Across the last three years, this individual has consistently contributed less than the £60,000 annual allowance. The available amount to carry forward for each year is labelled in the table.

In the current tax year (2020/21), this individual has relevant earnings of £55,000 which they could therefore contribute the full £60,000 to their pension. Looking back at their contributions over the previous years, the investor could claw back an additional £15,000 in unused past allowances to match their relevant earnings.

With relevant earnings of £55,000, this is the maximum the individual can contribute to their pension for the current tax year. This means that, of the cumulative £19,000 in carried forward allowance, they can only access £15,000.

What are ‘relevant earnings’?

Relevant earnings for the majority of investors will include all taxable income under income tax, so wages, bonus, overtime or commission. The big ones to look out for are dividends and investment income, which do not count.

It is important to state that Moneyfarm is not offering financial advice nor tax advice, rather explaining what people are able to do, based on the tax year 2020/21.

FAQ

What is the best pension for a self-employed person?

There is no best pension for a self-employed person. Instead, you have to choose the right pension for you based on several factors, including flexibility, investment choices, charges, convenience, and so on.

Can you get a pension if you are self-employed?

Yes, you can get a pension if you are self-employed. There are several types of pensions for self-employed people; they include private pensions, SIPPs, Nest, and LISAs.

How much can self-employed put in pension?

How much a self-employed person contributes to their pension depends on how much they can afford and how much they want their pension pot to be at retirement. But, there is no limit to how much a self-employed person can contribute to a pension. However, there is an annual and lifetime pension allowance limit to benefit from tax relief.

For more information on the specifics of the income please follow the government guidelines:

https://www.gov.uk/hmrc-internal-manuals/pensions-tax-manual/ptm044100#IDAN30KF

To work out your tapered annual allowance please follow the government guidelines:

https://www.gov.uk/guidance/pension-schemes-work-out-your-tapered-annual-allowance

To find out the rules of the money purchase annual allowance please follow the government guidelines:

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.