Pension income is taxable in the UK. Whether it is your State Pension, a workplace scheme or a private pension, the income you receive counts towards your annual taxable income.

At a Glance

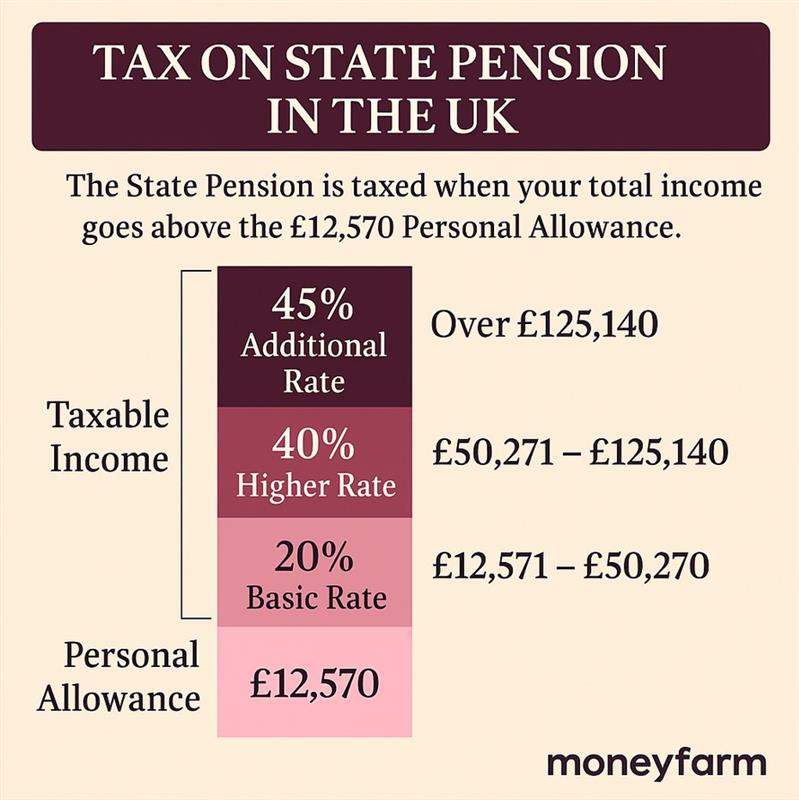

- Pension income in the UK is taxable once your total income exceeds the personal allowance (£12,570 in 2025/26).

- The State Pension is included in your taxable income, even though tax is not deducted at source.

- You can usually take up to 25% of your pension pot tax-free from age 55 (rising to 57 by 2028).

- Tax relief is available on pension contributions, but the process depends on the type of scheme.

- Different pension types (state, defined benefit, defined contribution) have different rules and tax implications.

| What is the personal allowance for pension income tax in the UK? | £12,570 for the 2022/23 tax year |

| What is the tax rate of pension income in the UK? | The basic taxpayer rate is 20%, the higher taxpayer rate is 40%, and the additional taxpayer rate is 45% |

| How much tax do I have to pay? | The tax paid depends on the amount of pension income received, your personal allowance and your tax code |

| Is pension contribution taxable? | No, pension contributions are not taxed |

Will you pay income tax on your state pension?

The State Pension is taxable income, although tax is not deducted at source. You usually receive the full gross amount, and if your total income for the year exceeds the personal allowance (£12,570 in 2025/26), you may have to pay income tax on it.

Any income above this threshold is taxed at your marginal rate (20%, 40% or 45%) according to the UK income tax bands: 20% basic rate applies from £12,571 to £50,270, 40% higher rate from £50,271 to £125,140, and 45% additional rate on income above £125,140.

For any given tax year, your taxable income includes the following:

- Your state pension

- Other pension payments you receive

- Any earnings from self-employment

- Any receivables from rentals

- Any interest from banks and building societies

- Receivables from investments

How Much of Your Pension Is Tax-Free?

Pensions are not fully tax-free in the UK. From age 55 (rising to 57 in 2028), you can normally take up to 25% of your pension pot as tax-free cash. The remainder is treated as taxable income and will be taxed according to your income tax band when withdrawn.

This tax-free amount can usually be taken either as a single lump sum or in stages, depending on your pension scheme rules. Any further withdrawals are subject to income tax.

Are other types of pension taxed as income?

Income tax is not deducted from your state pension. However, the full new state pension forms part of your total receivables, which is £9.339.20 per annum.

It means that from your personal tax allowance of £12,570, your full state pension (if you receive a full new pension) of £11,502.40 (updated 2025/2026) must be deducted, which leaves you with a balance of £1,067.60.

If you have other pensions that will use up this balance and exceed it, you will pay income tax on the excess pension income at the usual rates because the rates don’t change in retirement.

National Insurance Contributions Explained

You must pay National Insurance contributions during your working life, whether you are employed or self-employed. It starts from the age of 16 and remains a requirement until State Pension Age.

Employees pay Class 1 contributions, deducted automatically from earnings.

Self-employed workers usually pay Class 2 contributions at a flat weekly rate and Class 4 contributions based on annual taxable profits.

The Other Types of Pensions in the UK and Their Tax Treatment

Aside from your state pension, the other pensions generally fall into one of two categories – defined benefits pensions and defined contribution pensions.

Defined benefit (DB) pension schemes

A defined benefit pension (DB) scheme pays you a retirement income based on your salary plus how long you worked for your employer. These are also referred to as “final salary” and “career average” pension schemes.

You only generally encounter these in older workplace pension schemes or as pension schemes in the public sector. But either type can fall into the bracket of a pension taxed as income if it pushes your annual income over your personal tax allowance.

Defined contribution (DC) pension schemes

Defined contribution (DC) pension schemes, sometimes called “money purchase” pension scheme, are usually personal or stakeholder pensions. They might be:

- Workplace pensions organised by your employer

- Private pension schemes set up by you

The money paid into these types of schemes is put into investments like stocks and shares by your pension provider. The value of pension pots can appreciate or depreciate depending on how the products they are invested in perform.

As you approach retirement (currently age 66), providers may gradually shift your pot into lower-risk investments, though this is not automatic in all cases. You can also hold a Self-Invested Personal Pension (SIPP) alongside a workplace pension if you wish.

From age 55 (rising to 57 in 2028), you can usually take 25% of your pot tax-free, while the remainder is taxed as income when withdrawn.

OPEN A PRIVATE PENSION WITH MONEYFARM

Taxes on Pensions UK: State Pension vs Defined Benefit vs Defined Contribution

|

Pension / Account |

Tax treatment |

Tax-free element |

Access age |

|

State Pension |

Taxable as income (not deducted at source) |

None |

State Pension age (currently 66) |

|

Defined Benefit (DB) |

Taxable as income |

Up to 25% lump sum (commutation factor applies) |

Scheme-specific, often 60–65 |

|

Defined Contribution (DC) |

Taxable as income |

Up to 25% of pot tax-free from age 55 (57 from 2028) |

55 (57 from 2028) |

Pension lump sums and taxation

Since the 2015 pension freedoms, individuals aged 55 and over (rising to 57 from 2028) can access savings from defined contribution pensions more flexibly. You are no longer required to buy an annuity or enter a drawdown plan. Instead, you can withdraw some or all of your pension pot.

Access to part of your pot will cause the remaining investments to appreciate, but a pension drawdown is required.

Most people now take advantage of the 25% lump sum tax-free rule instituted in 2006, taking 25% of their pot without paying any income tax. However, the remaining 75% will be taxed as income under the annual tax threshold rules.

The position with defined benefit schemes is a little more complex. Whereas you still have the option to withdraw 25% as a tax-free lump sum, what happens with a defined benefit scheme is that something called the “commutation factor” comes into play. It is a factor that calculates the amount of income you will receive in retirement after taking a tax-free lump sum upfront.

Pension contributions and tax relief

You get tax relief on the contributions you make to your pension, but the way you claim it depends on the type of pension scheme in question.

The net pay system

Some workplace pensions use the net pay system, and you don’t need to do anything to ensure you get full tax relief. That’s because your pension contributions are deducted from your salary before income tax is paid, and your pension scheme provider automatically claims back the tax relief at the appropriate rate. You do not need to take any further action.

The relief at source system

This system is applied to all types of personal pensions and some workplace pensions. In other words, you should take note if you have a private pension via an insurance company or a SIPP (Self Invested Personal Pension).

If your contributions are made via your employer, they will take 80% of your contributions from your salary. It is referred to as “net of basic rate tax relief.”

Your pension scheme provider then issues a request to HMRC, resulting in an additional 20% tax relief being paid into your Pension. However, with tax relief at source systems, higher or additional rate taxpayers have to fill out a self-assessment tax return form to receive the extra tax relief they are entitled to.

In some cases pension contributions reduce your taxable income, but you will have to claim any tax relief over and above the basic rate by yourself.

Tax-Free lump sums

From age 55 (rising to 57 in 2028), you can usually take up to 25% of each pension pot as tax-free cash. The remainder is treated as taxable income when withdrawn. If you have multiple pensions, each may offer its own 25% tax-free entitlement.

Scottish Tax Relief

The income tax bands in Scotland are slightly different from those in the UK. You can claim additional tax relief on:

- 20% up to the amount of any income on which you paid 40% tax

- 25% up to the amount of any income on which you paid 45% tax

As regards claiming additional tax relief on private pension contributions, you can claim:

- 1% up to the amount of any income on which you paid 21% tax

- 21% up to the amount of any income on which you paid 41% tax

- 26% up to the amount of any income on which you paid 46% tax

Withdrawals from private pensions are taxable, though there are strategies to reduce the overall tax burden.

Do I have to pay income tax on my pension if it is an ISA?

Individual Savings Accounts (ISAs) are not pensions but tax-efficient investment wrappers. Money held in an ISA grows free from both Capital Gains Tax and Income Tax, and withdrawals are also tax-free. This means that unlike pension income, which is taxable beyond your personal allowance, you do not pay income tax on money you take from an ISA. You also do not need to declare ISA holdings or withdrawals on your self-assessment tax return.

However, contributions to ISAs do not benefit from tax relief in the way that pension contributions do. For example, payments into a Self-Invested Personal Pension (SIPP) attract tax relief, while ISA contributions are made from post-tax income (read more on how to invest in a SIPP and SIPP vs ISA).

There are several types of ISA that can support long-term saving. A Stocks and Shares ISA allows investments in funds, equities and bonds to grow in a tax-efficient way, while a Lifetime ISA (LISA) can be used to save for a first home or retirement, with a government bonus on contributions up to £4,000 per year.

ISAs therefore complement, rather than replace, traditional pensions:

- pensions usually offer more powerful tax advantages for retirement planning;

- ISAs provide greater flexibility, as savings can be withdrawn at any time without additional tax charges.

Many people choose to combine the two, using pensions for long-term income in retirement and ISAs for accessible, tax-free savings.

Key Takeaways

- Pension income in the UK is taxable once your total income exceeds the personal allowance (£12,570 in 2025/26).

- The State Pension counts as taxable income, but tax is not deducted at source.

- You can normally take 25% of your pension pot as tax-free cash from age 55 (rising to 57 in 2028).

- Pension contributions receive tax relief, though the process differs between the Net Pay and Relief at Source systems.

- National Insurance is not payable on pension income and stops at State Pension age.

FAQ

You have to pay pension income tax in the UK if your pension income (plus other incomes) exceeds your personal allowance.

You can take lump sums from your pension, but this may be subject to income tax. You can only take 25% of your pension as a lump sum without paying income tax. Any amount above the tax-free threshold will be subject to income tax.

Yes, the state pension is a taxable income in the UK. The income tax you will pay on your state pension depends on your total income (other private pensions, work pensions, earnings or investment income). But tax is t deducted after you have been paid and not at the source.

No. National Insurance contributions stop once you reach State Pension age, even if you continue working. Pension income itself is not subject to National Insurance, only income tax.

Yes, with careful planning. Spreading withdrawals across several tax years, using your personal allowance and taking advantage of the 25% tax-free cash can help reduce the tax you pay. Combining pensions with ISAs or other tax-efficient savings may also help manage your retirement income more effectively.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.