A £1 million pension pot is a milestone many UK savers aspire to, offering the potential for long-term financial security in retirement. Understanding how much income this could provide, and what it takes to build such a pot, can help you plan confidently for later life.

At a glance

- £1 million can support a moderate to comfortable retirement, depending on withdrawals, longevity and market conditions.

- Modern planning uses the PLSA Retirement Living Standards rather than income-replacement ratios.

- A £1 million pot can last 15–40 years depending on annual withdrawals.

- Starting early significantly reduces the monthly amount needed to reach £1 million.

This Moneyfarm guide will examine how much you need to live a comfortable life after work, why people strive to reach the £1 million mark, and what it takes to reach it.

How much do I need for retirement?

You might be decades away from seriously thinking about your retirement, or you may be thinking about retiring early at 55 early, but getting a picture of how much you want to save by the time you do leave work can be useful. Even at a young age, having an idea of how much you want to spend in your retirement can make all the difference.

The Moneyfarm Pension Calculator takes basic information like your current financial situation, your age and your desired pension income to lay out how much you need to be saving to keep on track. The general rule is that you’ll need between half and two-thirds of your final salary to enjoy a comfortable standard of living during retirement.

Research from the Pensions and Lifetime Savings Association found that retired individuals living a comfortable retirement require £31,300 each year. For a luxurious retirement, they spent £43,000 each year. This increases to £43,100 and £59,000 for couples, respectively.

Annual spending levels for a single person, 2026

|

Lifestyle |

Outside London |

London |

|

Basic |

£13,400 |

£15,800 |

|

Moderate |

£31,700 |

£33,000 |

|

Comfortable |

£43,900 |

£45,700 |

Example: a professional in Manchester targeting a moderate lifestyle would need around £31,700 per year. If they expect the full State Pension (currently £11,502 in 2025/26), the remaining £20,000 must come from personal pensions and ISAs.

The current lifetime pension allowance is £1,073,100 but a £1 million pension pot can support a moderate to comfortable lifestyle depending on:

- the withdrawals you take

- how long you expect to be retired

- how your investments perform.

How much does a £1 million pension give you per year?

Let’s say, for argument’s sake, you want a pension pot of £1 million by the time you retire. Depending on how much you want to take out every year, this sizable pot can last for anywhere between 40 and 15 years, depending on when you retire.

You could, for example, take a £250,000 lump sum at 68 and then take a yearly annual income of £36,000 until the age of 93. That’s an annual income above the national average and, remember, you only need between half and two-thirds of your final salary to be comfortable.

Example: a 61-year-old retiring early with a £1 million pot might prefer not to take the full tax-free lump sum at once. By taking only £100,000 tax-free and leaving the rest invested, they reduce the risk of drawing too heavily in the early years. They then withdraw £28,000 per year, adjusting withdrawals during weaker market periods to preserve longevity.

Annuity vs. drawdown

- An annuity converts your pot into guaranteed lifetime income, secure but inflexible and often poor value for money.

- Drawdown instead keeps your money invested, allowing flexible withdrawals and potential growth, but carries market risk and requires active management.

Most retirees now choose drawdown for flexibility, though annuities suit those prioritizing certainty.

Alternatively, you can spread the £1 million out over the course of your retirement. Here’s how long £1 million will last with a range of drawdown amounts.

£50,000 – 33 years

£60,000 – 25 years

£70,000 – 19 years

While withdrawing £50,000, £60,000 or £70,000 annually may seem sufficient today, inflation steadily erodes what that money can buy.

At a historical UK inflation rate of 2.5% annually, your purchasing power halves roughly every 28 years. This means a £50,000 withdrawal today would need to rise to £64,000 in 10 years, or £82,000 in 20 years, to maintain the same lifestyle. Without adjusting for inflation, your initial drawdown loses significant value over time.

To combat this, keep a portion invested in growth-oriented assets during retirement, increase withdrawals annually to match inflation, and consider inflation-protected securities. Failing to plan for inflation can transform comfortable early retirement into financial struggle later.

How to build a £1 million pension pot

Building a £1 million pension pot typically comes from a combination of regular contributions, disciplined long-term investing and staying invested through market cycles. Lump sums can help, but the core driver is consistent saving aligned with your risk level, time horizon and long-term financial plan. What matters most is starting early and staying invested.

Reaching £1 million requires steady contributions and a portfolio aligned with your risk level. The amount you need to set aside each month depends on when you start and the long-term returns your investments achieve. Returns are never guaranteed, but disciplined saving and a diversified portfolio improve your chances of reaching this target over time.

Example: by starting at age 25 you might set aside £300 per month initially. As your salary increases, you can raise contributions to 12 percent of earnings in your early 30s. Small annual increases, combined with employer contributions and market growth, can close the gap to a £1 million target without relying on large lump sums.

For the purposes of the example above, we’ve assumed a 6% rate of return on a SIPP – a reasonable return for our higher risk level accounts. As you can see, the amount you need to invest monthly to target a pot of £1 million can differ hugely depending on when you get started.

Anyone who seriously begins investing for their retirement at 20 years old will need to save £359.42 per month. Compare that with the £1,427.86 it takes monthly to reach £1 million when you start saving at 40. This showcases the benefit of starting to invest early.

Naturally, you should increase your personal pension contributions as your salary improves throughout the course of your career. Or, indeed, you may find yourself with a lump sum of cash that can help you on your way. These are all things to consider, but having a broad idea of how much it takes to reach a £1 million pension pot can be helpful in your planning. Again, try using our tool to assess your own financial situation and see what you need to do to reach your goals.

When saving for the future, there’s no time like the present

As with all investing for the future, the key is to start saving as early as possible. Make sure you’ve cleared any existing debts, have some money put aside for a rainy day, and have chosen the investment product that best suits your goals. Once all that’s taken care of, the best time to start investing is right now.

The earlier you start investing, the more you’ll take advantage of compound interest. Compounding means your investment returns can themselves generate further returns over time. The longer you stay invested, the more pronounced this effect becomes.

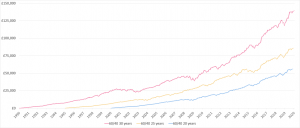

The chart above maps the performance of three hypothetical investment accounts over a 30-year period. One (pink) is invested for the full 30 years, another (yellow) is invested for 25 years, and the other (blue) is invested for just 20 years. The difference in the eventual returns on the three accounts is stark. Couple this with regular top-ups generating their own returns, and you can see why starting early is in your best interest.

To get started with a Moneyfarm SIPP, or to see how a Moneyfarm ISA could support you in saving for the future, take a look at our full pension page, our pension transfer service or read our guide. We’ll match you with an investment portfolio that suits your goals and your timeframe, meaning you can get back to focusing on what really matters now.

Key Takeaways

- A £1 million pension pot can support a moderate to comfortable retirement depending on longevity, withdrawals and market returns.

- Current planning is based on PLSA Retirement Living Standards rather than outdated income-replacement rules.

- Starting early significantly reduces the monthly contributions required to reach £1 million.

- Contribution levels must rise over time as income grows and retirement goals become clearer.

- Sustainable withdrawals vary, but 3–4 percent is commonly used as a planning benchmark, not a guarantee.

- The combination of pensions, ISAs and diversified investments improves long-term resilience.

- Regular reviews help ensure savings remain aligned with inflation, risk level and retirement age.

FAQ

What will a £1 million pound pension pot give me?

It depends on how you access your pension, your withdrawal rate, investment returns in retirement and how long you need the money to last. A sustainable withdrawal rate is often estimated between 3% and 4%, but the right level depends on market conditions and personal circumstances. This would equate to roughly £30,000–£40,000 per year before tax, but it is not guaranteed.

How long could £1 million last in retirement?

There is no fixed answer. Longevity, inflation, investment performance and withdrawal habits all influence how long a pension pot can support you. Planning tools can model different scenarios, but real outcomes vary.

How much income will 1 million generate in the UK?

With a million-pound pension pot, a £250,000 lump sum at 68 with a yearly annual income of £36,000 will last till the age of 93. A £50,000 drawdown will last 33 years, a £60,000 drawdown will last 25 years, while a £70,000 drawdown will last 19 years.

Can I retire at 55 with 1m?

Yes, you can retire at 55 with £1 million. However, your desired retirement lifestyle and the UK life expectancy will determine your annual income amount. For instance, to retire comfortably at 55, you will require a pension pot between £400K-£700 and £ 700 K, while a more luxurious retirement requires a pension pot above £750K.

It depends on how you access your pension, your withdrawal rate, investment returns in retirement and how long you need the money to last. A sustainable withdrawal rate is often estimated between 3% and 4%, but the right level depends on market conditions and personal circumstances. This would equate to roughly £30,000–£40,000 per year before tax, but it is not guaranteed.

How long could £1 million last in retirement?

There is no fixed answer. Longevity, inflation, investment performance and withdrawal habits all influence how long a pension pot can support you. Planning tools can model different scenarios, but real outcomes vary.

With a million-pound pension pot, a £250,000 lump sum at 68 with a yearly annual income of £36,000 will last till the age of 93. A £50,000 drawdown will last 33 years, a £60,000 drawdown will last 25 years, while a £70,000 drawdown will last 19 years.

Yes, you can retire at 55 with £1 million. However, your desired retirement lifestyle and the UK life expectancy will determine your annual income amount. For instance, to retire comfortably at 55, you will require a pension pot between £400K-£700 and £ 700K, while a more luxurious retirement requires a pension pot above £750K.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.