As we head into the summer holidays, we think it’s a great time to take a step back and reflect on what’s been a wonderful year for us here at Moneyfarm. Not only have we become B Corp-certified, won a host of awards and launched our Find, Check & Transfer pension service and much more besides, but the latest data from ARC has shown strong performance versus our peers.

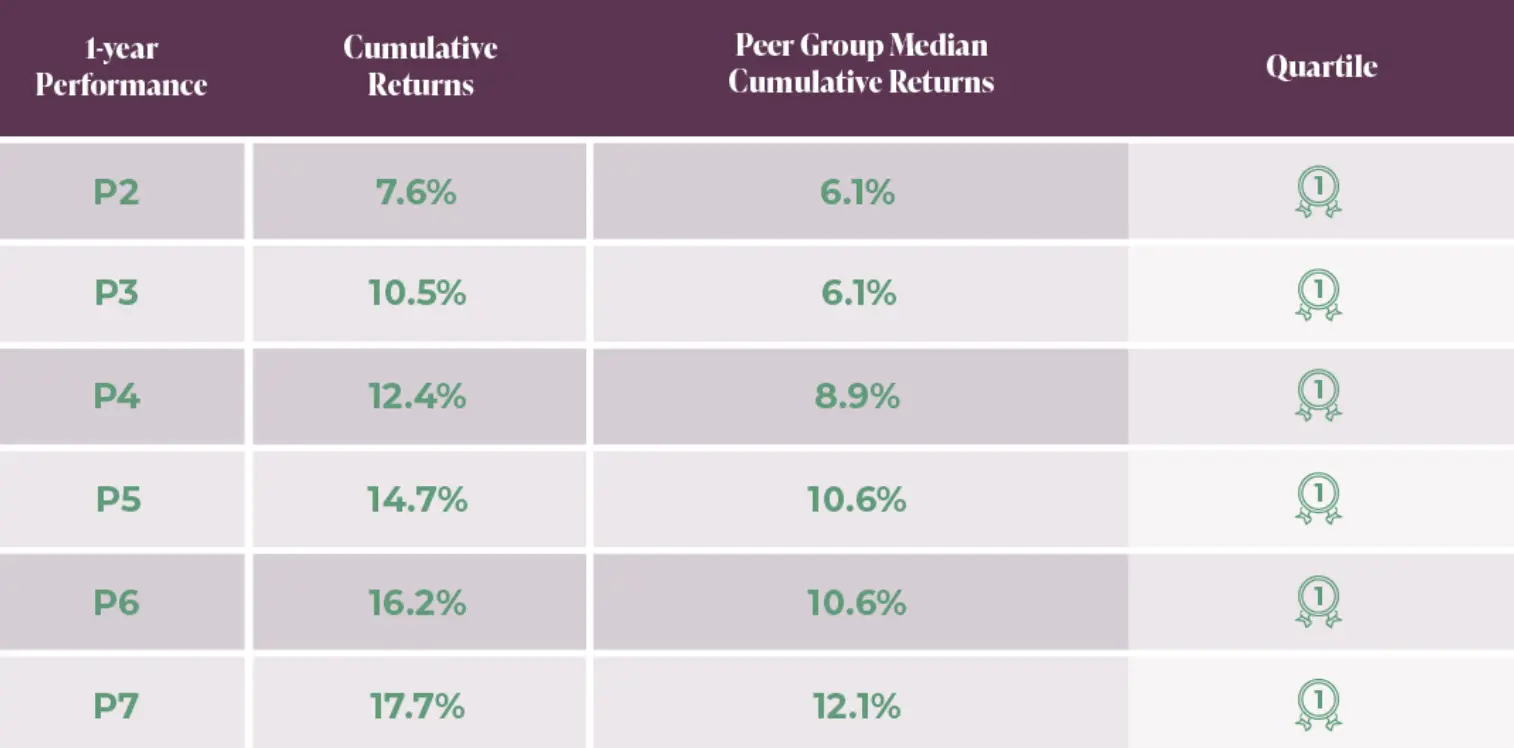

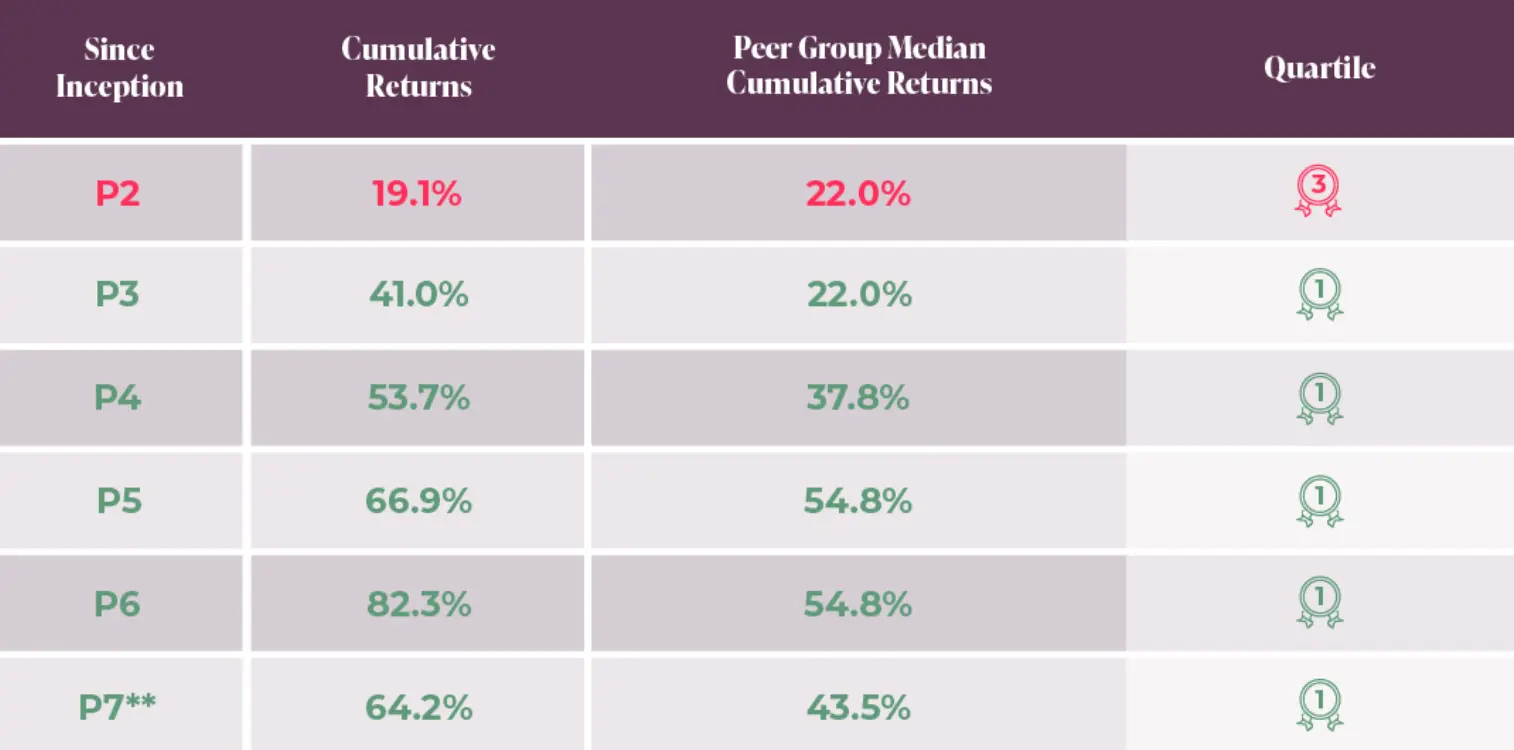

So what does the latest portfolio performance data look like? And what does it mean for your savings and investments? You can find your portfolio’s relative performance data listed below.

Strong track record of performance

We’d like to share the latest data from ARC with you to give an overview of portfolio performance. We believe the latest figures demonstrate our ability to navigate challenging market conditions effectively on behalf of our pension holders, as well as the benefits of maintaining a well-diversified approach when investing. Although, it should be noted that past performances are not an indication of future performance and returns and the value of investments can fall as well as rise.

What is ARC?

Asset Risk Consultants (ARC) specialises in performance analysis of investment portfolios. They provide independent, unbiased data and insights that help us evaluate our performance. This impartiality is invaluable, as it allows us to rely on unbiased information to assess performance.

What is the ARC relative benchmark?

The ARC benchmark is a standardised set of performance data and metrics used by ARC, which serves as a reference point against which the performance of various investment portfolios can be compared.

By comparing the metrics of a specific investment portfolio to those of the ARC benchmark, we gain insights into how well a portfolio has performed in relation to a broadly accepted industry standard.

Our latest figures from ARC

*These figures are calculated by ARC using anonymised customer performance data. All data submitted are net of costs and have been invested in the same model continually for the period under consideration. Please note that performance data included is for our classic portfolios only – ESG lines are not included in ARC data. The returns are net of underlying fund costs and market spread. 1-year performance should never be used as the basis of investment decisions – it is a short time period. Past performance is not an indicator of future performance. Data as of 30/06/2024. For our full performance, please refer to our website.

**The returns here are simulated using an assumed balance of £250,000, and the average management fee from our pricing model of 0.46% from 01/01/2016 to 31/10/2017 and 0.55% from 01/11/2017 to 31/12/19. The returns are net of underlying fund costs and market spread. The returns are the total returns, so include all dividends. (Data Source: Bloomberg/xignite). As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Simulated past performance is not a reliable indicator of future performance. This information is for educational purposes only and should not be considered as personalised investment advice.

***Performance period starts from 01/05/2016 and ends on 30/06/2024. The P7 only became available to clients on 16/05/2019. P1 data is not available from ARC as it doesn’t reach the risk level required for ARC relative performance comparison.

As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. This information is for educational purposes only and should not be considered as personalised investment advice.

We’re now a certified B Corp!

We were founded with the mission of making finance simple and accessible, with the aim of protecting and growing your wealth to give you greater control over the life you want to lead.

As a digital wealth manager, we recognise our role in shaping a better future for all. That is why, two years ago, we embarked on our journey to becoming a B Corp and last month we became a B-Corp certified firm. You can read more about this milestone achievement here.

This dedication to our clients has also been recognised by a number of industry bodies who’ve awarded us these prestigious awards based on our levels of service and product offerings in the last 12 months alone:

- Boring Money – Best Buy Pension 2024

- YourMoney.com Best investment ISA 2024 – Medium portfolio

- Boring Money – Best Buy ISA 2024

- Boring Money – Best For Low-cost pension 2023

- Moneyfacts – Digital wealth management provider of the year – 2023

We’re proud of our achievements so far but we recognise that it’s a journey rather than a destination, which is why we remain committed to continuous improvement and maintaining the highest possible standards.

Ready to take control of your retirement planning?

When you’re planning for life after work, it’s vital to choose an investment partner that you can trust, so you can have peace of mind when you retire. At Moneyfarm, we’re dedicated to helping you try to grow your savings so you can enjoy the retirement you deserve.

How we can help you save for the life after work you deserve

No matter what stage of your retirement planning journey you’re on, you can enjoy a range of benefits to help you make the most of your money, including:

- Tax efficiency – Get a 25% boost to your pension, without making a claim to HMRC. You may be entitled to more or less than this amount, subject to your tax status. Please note the tax treatment depends on your individual circumstances and may be subject to change in the future.

- Flexi-access drawdown – With a flexi-access drawdown pension, you can take any level of income you choose, or you can choose not to take any income at all after having taken your pension commencement lump sum [PCLS – the 25% tax-free lump sum]. You can increase or reduce the amount of income being drawn or ask for an extra one-off flexi-access drawdown pension payment. You can choose for it to be paid on a monthly, quarterly, semi-annual or annual basis. If you wish to change the amount of flexi-access drawdown pension being drawn from your plan you should instruct us in writing

- Targeted savings to suit your retirement plans – We manage your portfolio around your target retirement date and will update your pension portfolio risk recommendations as the date approaches.

- Expert guidance – Our team of pension and savings experts are always on hand to help you make the best financial decisions possible. And best of all, all our consultancy services are completely free and only a phone call away.

Personalised service and support every step of the way

The relationship we have with each and every one of our clients is always our top priority. We believe that investing is best done together.

Whether you’re looking for some guidance on your investment journey, need a little tech help in setting up your Moneyfarm app or anything else, our team is always here to help.

Close to you

Over the last 12 months alone, our team has worked round the clock to be there for you whenever you need guidance or support.

- We spent 599,768 minutes (or almost 10,000 hours) talking to our clients on the phone during this period,

- With our consultants making and receiving 52,662 individual calls in that time – that’s almost 40 calls each and every day,

- While across all our customer support teams, we’ve managed to handle 69,803 client cases this year.

(Source: Moneyfarm data. Collected during the 14/8/23 – 14/8/24 period)

This level of service is why we believe over 130,000 clients trust us to help make their wealth grow together in partnership.

If you’d like more information on your Moneyfarm pension or would like to open a pension with us, why not book an appointment with one of our team of consultants? You can do so via this link or call us on 0800 433 4574. You can also email hello@moneyfarm.com or start an online chat session and we’ll be happy to help.

As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. It is important to consider your risk tolerance and investment objectives before proceeding. A pension may not be right for everyone. Tax treatment depends on your individual circumstances and may be subject to change in the future. If you are unsure if a pension is right for you, please seek financial advice.

*As with all investing, financial instruments involve inherent risks, including loss of capital, market fluctuations and liquidity risk. Past performance is no guarantee of future results. It is important to consider your risk tolerance and investment objectives before proceeding.