Richard Flax, Chief Investment Officer at Moneyfarm

When we plan for the future, there are always myriad factors to keep in mind. In this market update, we’ll explore a few of them, to give you a better understanding of how our asset management team makes decisions and the impact they might have on portfolios in the coming months.

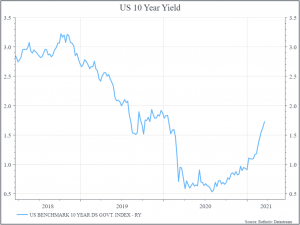

Sometimes only one number seems to matter for financial markets. This week, that number is the interest rate on the US 10-year government bond. The 10-year yield has risen sharply this year, driving down bond prices quite broadly. Market participants are asking if the US Federal Reserve will intervene more directly to manage this, but the Fed so far appears relaxed.

The impact on the equity market has been a bit more nuanced. We’d argue that bond yields have risen, at least in part, because of expectations for stronger economic growth. That should bode well for company profits and perhaps equities more generally. Certainly equity markets so far this year have performed better than bonds.

Within equity markets, we’ve seen signs of rotation. If 2020 was the year of so-called “growth” stocks – many in the technology space – then 2021 has so far seen a shift to “value”. These are lowly-rated, out-of-favour businesses, whose prospects might improve faster in a strong economy. As an example, in 2020, a popular index of US growth stocks returned around 38.5% (in dollars). Its value equivalent returned 2.8%. So far in 2021, the growth index is down around 1%, while the value index has risen 10.5%.

How should we think about all this?

In the short term, say the next six months, you could say that the question is one of interpretation. How will financial markets react to the likely scenario of a stronger recovery and some increase, perhaps temporary, in inflation. We think that this will be a fairly positive environment for equities and continue to favour a tilt towards so-called value stocks in our riskier portfolios. That partly reflects our view that neither inflation nor government bond yields will rise dramatically from here.

Beyond that, we’d say the question is more about the sustainability of the recovery. Yes, we’ll see strong growth numbers in 2021, but will those translate into a more sustained economic recovery in 2022 and beyond? We should think about the sustainability of the recovery in broad terms: in terms of headline economic growth, but more importantly, in terms of an improved labour market, the alleviation of poverty and the transition from very high levels of government support for the economy towards a more ‘normal’ level of private sector activity.

After the Financial Crisis of 2008/2009, Developed Market economies initially bounced back quite strongly. But the pace of the recovery from there was fairly slow, at least by historical standards. A long slow recovery proved positive for financial assets, but maybe didn’t do quite so much for overall standards of living. With so much more government support during 2020 than was the case 10-12 years ago, we might see a faster recovery this time around, but it’s still unclear whether all the stimulus we’ve seen will provide a basis for long-term growth or just an important short-term boost.

As for inflation, we continue to believe that it’s an important consideration. We’d expect to see a pick-up in inflation rates in 2021, but that should moderate going forward. That should make life easier for Central Banks as they try to plot a course towards sustainable growth and relatively stable prices.

We should also consider the current healthcare situation. Financial markets appear confident (at least to us) that there’s a clear path towards some measure of ‘normality’. We’d argue that their collective faith in the ability of science to solve the challenges of COVID 19 has so far been well-placed. And that underpins our assumptions of a robust recovery in 2021.

But the data from Europe and Brazil, in particular, mean we shouldn’t be too confident. Will new variants emerge? Will Covid-19 become a seasonal event, requiring bi-annual vaccinations? What impact could that have on economic activity and financial markets?

Where does all this get us?

We’re cautiously optimistic about the outlook for risky assets like equities this year – even if we see some areas where valuations and expectations are already quite high. But for all the talk of 2021, we think that the real story is for next year and beyond. Will 2021 prove sustainable? We think you’ll need four things: a healthy recovery in the labour market, fairly benign inflation, some adroit policy-making (both from governments and central banks), and successful long-term management of Covid-19. The early signs are good, but there’ll likely be some challenges along the way.

What does it mean for our portfolios?

As we consider our next rebalance, there are a few decisions to make. First, can equities continue to perform relatively well? We think the answer there is yes. Second, will bond yields continue to rise? We think after the move we’ve seen, bond yields will stay in a range over the next few months. We think that’s a fairly constructive environment.

In terms of risks, we think that progress on vaccination and the path of economic recovery will be critical. More specifically, as we see more signs of recovery in the next few months, we think the focus of attention will shift to 2022 – will we see the rebound of 2021 translate into a sustainable economic recovery in 2022 and beyond. The early signs are hopeful, but we’ll continue to monitor economic data and policy decisions.